Everything You Need to Know About Linking Aadhaar Card with Income Tax Returns

Under the IT Act, it is mandatory for Indian taxpayers to link Aadhaar card with income tax returns and PAN card. The process of linking IT with Aadhaar and PAN have been simplified. The former involves just two steps, and one of them doesn’t even require registration on the e-filing portal.

The Income Tax Department of the Government of India has made it mandatory for Indian taxpayers to link Aadhaar card with income tax returns and PAN card. The process has been made very simple by the Income Tax Department to ensure that every individual links their Aadhaar card to their PAN number while filing for income tax returns. The process to link Aadhaar card with income tax returns involves just two simple steps, and one of them doesn’t even need you to register with the e-filing portal. Any individual can use this online portal to link PAN with Aadhaar.

One can also link mobile number to Aadhaar card online. However, in order to pursue your Aadhaar card link with mobile number, you must understand the following processes.

Why should you link the Aadhaar card with income tax returns?

Prior to 5th August 2017, an individual could e-file income tax returns without needing to link Aadhaar to ITR. However, after this date, it had become mandatory to link PAN with Aadhaar. The deadline for this was first 31st August 2017. This deadline has been extended many times, and the final deadline was 31st March 2019. As of today, it is mandatory to link Aadhaar card with income tax returns and PAN card.

The individual can still be able to file income tax returns without connecting the PAN card and Aadhaar card. However, the Income Tax Department would not process any returns until the Aadhaar card and PAN number are linked. The individual needs to go to the official portal of the income tax authority to link both the details.

You can link your Aadhaar number to your PAN number in one of the two ways:

Without logging into the account

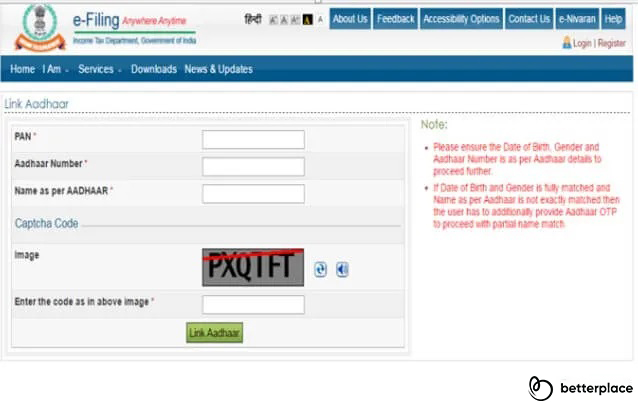

Step1: Go to the e-filing website. On the left side of the page, you will find the option “Link Aadhar”. Click on this option.

Step 2: Input the details as displayed on the screen:

- PAN

- AADHAR number

- Name as mentioned in the Aadhaar card

Then, enter the Captcha or verification details as mentioned on your screen. Then, hit “Submit”.

If the name entered is incorrect, then you will have to reverify with the help of OTP, which will be sent to your mobile number linked with the Aadhaar number. Further, if the name in Aadhaar is different from the name on the PAN, then the process of linking Aadhaar with PAN will fail. In this case, you should correct this detail in either the Aadhaar card or PAN card such that names in both documents are the same. Also, ensure that the gender and birth date is the same in both your Aadhaar card and PAN card.

Logging into the account

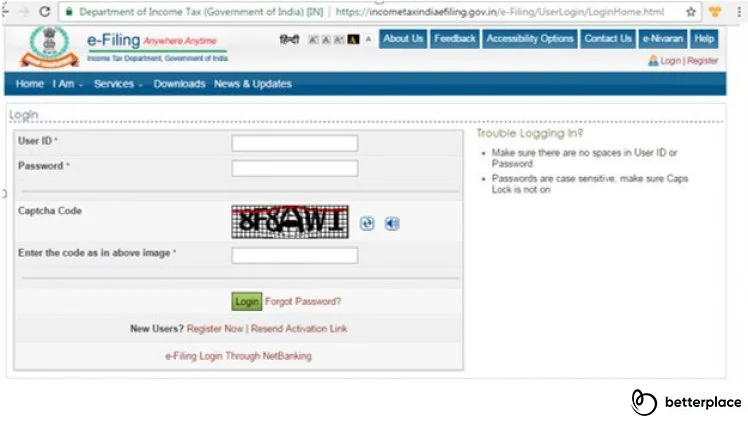

Step 1: First, you need to register at the e-filing website of the IT department, if you have not registered yet.

Step 2: Sign in to the portal and enter the Login ID, Password and Date of Birth.

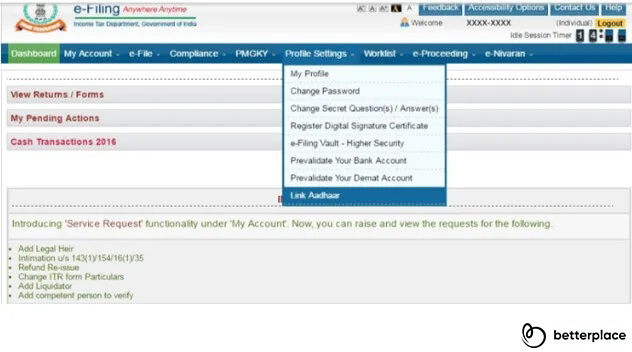

Step 3: Next, you will find a pop-up appear on your screen, asking the user to link their Aadhaar number with the PAN number. If you do not see any pop-up, then go to “Profile Settings” present on the blue coloured tab on the topmost bar. From there, select the option “Link Aadhaar”.

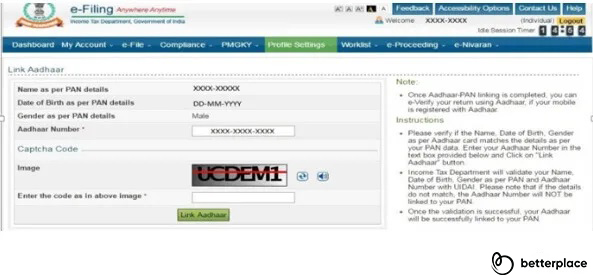

Step 4: In this new window, details like gender, birth date and name will be already mentioned, as you had entered them while registering on the official portal. Check the details mentioned on your screen with those on the Aadhaar card and correct any discrepancies.

Step 5: Enter the Aadhaar number followed by the verification code, and hit “Link Now”.

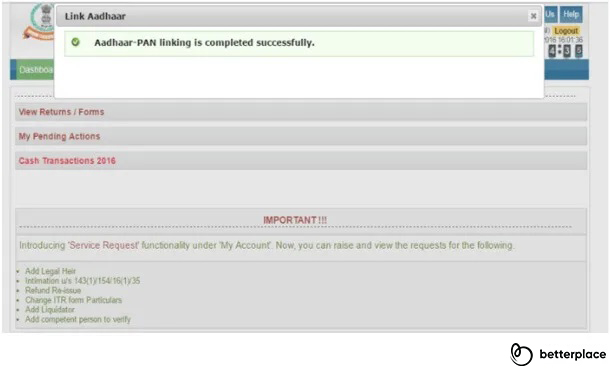

Step 6: You will see a pop-up appear on your screen informing that the Aadhaar number is linked successfully to the PAN number.

PAN Aadhaar Link Status

After submitting the request for a PAN card link to Aadhaar card, you can verify its status by following the steps as mentioned below:

- Go to the “Link Aadhaar” page, as mentioned in step 5. Then, hit “Click here” to proceed.

- Next, you will be asked to enter a few details:

- PAN

- Aadhar number

- Once you enter these, hit “View Aadhaar Link Status”.

- The results will appear on the screen, which will show your link request status.

In these simple ways, you can link your Aadhaar card with income tax returns. Since this is now a mandatory requirement, follow the aforementioned steps to successfully complete this process.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space