Table of Content

- Who needs to pay the professional tax

- How to make a professional tax e payment

- Making Online Professional Tax Payment

- Professional Tax slabs in different states

- Professional Tax – FAQs

What is Professional Tax?

Professional Tax is a direct tax which is levied monthly by most Indian State Governments on your income from salary, trade, profession or calling.

Under Clause (2) of Article 276 of the Constitution of India,1949, state governments were given the power to come up with slabs for income and the corresponding professional tax amounts. Till date, the maximum Professional Tax amount that can be levied by any state government is INR 2,500.

Who needs to pay the professional tax

Professional tax payment is a revenue source for the government. The maximum amount for professional tax online payment per annum is Rs 2,500 and if salaried, follows the declared pre-determined professional tax slab schedule.

Traders, architects, company secretaries, lawyers, doctors, chartered accountants etc. have to mandatorily make a professional tax payment to the Commercial tax department of the state.

Private company employees also need to pay professional tax payment/e payment. Generally, this deduction is made based on the professional tax slab defined by the government every month. The employer is responsible to remit the professional tax payment amounts collected to the state exchequer using a professional tax online payment method.

In the case of a company, its partners, directors, self-employed professionals, and owners of trading firms the tax may be fixed on the turnover basis or on a fixed amount of Rs 2,500 per annum irrespective of turnover.

Professional tax registration and process

1. The system enables recorded data to be done all at once or in batches.

2. Keep a completed APPT Form on hand in case of emergency. Forms may be found on the webpage, www.apct.gov.in. This will aid in data input speed.

3. Keep visiting www.apct.gov.in – APPT Enrollment Process for the process and documentation to be submitted with the petition.

4. Go to www.apct.gov.in. Select eRegistration or Professional Tax. The system will launch a new browser for mail enrollment and password retrieval.

a. Password may be obtained by clicking here. A new tab will appear.

b. Enter your email address.

c. Verify your email.

d. Put in the authorization number.

e. Press the Submit button. The system delivers the password to your email address. Enter your email and see your password, then return to this website and select “eRegistration” on the page www.apct.gov.in. The system will display the Login Credentials.

f. Enter your email address.

g. Put in the password you got in your email id.

h. Press the Submit button. A new tab will appear.

i. Select “New Registration.” The Complete The registration Option will appear.

Professional Tax slabs in various states

Professional taxes differ from one jurisdiction to the next. As a result, it varies from state to state. Every jurisdiction has its unique set of guidelines that regulate professional taxes in that jurisdiction. To charge occupational tax, all regions use a slab method based on earnings.

Since Professional Tax is a compulsory tax for individuals with an income, most Indian states levy a professional tax. While states like Maharashtra and Karnataka require a professional tax, Haryana and Delhi do not.

Here’s a list of tax slabs in different states:

| Maharashtra | Up to INR 7,500 (men) | NIL |

| Up to INR 10,000 (women) | NIL | |

| INR 7,500 to INR 10,000 (men) | INR 175 | |

| Above INR 10,000 (women) | INR 200 (INR 300/- for the month of February) |

| Tamil Nadu | Up to INR 21,000 | NIL |

| INR 21,001 to INR 30,000 | INR 135 | |

| INR 30,001 to INR 45,000 | INR 315 | |

| INR 45,001 to INR 60,000 | INR 690 | |

| INR 60,001 to INR 75,000 | INR 1025 | |

| Above INR 75,000 | INR 1250 |

| Karnataka | Up to INR 15,000 | NIL |

| Above INR 15,000 | INR 200 |

| Andra Pradesh | Up to INR 15,000 | NIL |

| INR 15,001 to INR 20,000 | INR 150 | |

| Above INR 20,001 | INR 200 |

| Kerala | Up to INR 11,999 | NIL |

| INR 12,000 to INR 17,999 | INR 120 | |

| INR 18,000 to INR 29,999 | INR 180 | |

| INR 30,000 to INR 44,999 | INR 300 | |

| INR 45,000 to INR 59,999 | INR 450 | |

| INR 60,000 to INR 74,999 | INR 600 | |

| INR 75,000 to INR 99,999 | INR 750 | |

| Above 1,25,000 | INR 1250 |

| Telangana | Up to INR 15,000 | NIL |

| INR 15,001 to INR 20,000 | INR 150 | |

| Above INR 20,000 | INR 200 |

| Gujarat | Up to INR 5,999 | NIL |

| INR 6,000 to INR 8,999 | INR 80 | |

| INR 9,000 to INR 11,999 | INR 150 | |

| INR 12,000 and Above | INR 200 |

| Bihar | Up to INR 3,00,000 | NIL |

| INR 3,00,001 to INR 5,00,000 | INR 1000 | |

| INR 5,00,001 to INR 10,00,000 | INR 2000 | |

| Above INR 10,00,001 | INR 2500 |

| Madhya Pradesh | Up to INR 2,25,000 | NIL |

| INR 2,25,001 to INR 3,00,000 | INR 1500 | |

| INR 3,00,001 to INR 4,00,000 | INR 2000 | |

| Above INR 4,00,001 | INR 2500 |

| West Bengal | Up to INR 10,000 | NIL |

| INR 10,001 to INR 15,000 | INR 110 | |

| INR 15,001 to INR 25,000 | INR 130 | |

| INR 25,001 to INR 40,000 | INR 150 | |

| Above INR 40,001 | INR 200 |

| Odisha | Up to INR 1,60,000 | NIL |

| INR 160,001 to INR 3,00,000 | INR 1500 | |

| Above INR 3,00,001 | INR 2500 |

| Sikkim | Up to INR 20,000 | NIL |

| INR 20,001 to INR 30,000 | INR 125 | |

| INR 30,001 to INR 40,000 | INR 150 | |

| Above INR 40,001 | INR 200 |

| Assam | Up to INR 10,000 | NIL |

| INR 10,001 to INR 15,000 | INR 150 | |

| INR 15,001 to INR 24,999 | INR 180 | |

| Above INR 25,000 | INR 208 |

| Meghalaya | Up to INR 50,000 | NIL |

| INR 50,001 to INR 75,000 | INR 200 | |

| INR 75,001 to INR 1,00,000 | INR 300 | |

| INR 1,00,001 to INR 1,50,000 | INR 500 | |

| INR 1,50,001 to INR 2,00,000 | INR 750 | |

| INR 2,00,001 to INR 2,50,000 | INR 1000 | |

| INR 2,50,001 to INR 3,00,000 | INR 1250 | |

| INR 3,00,001 to INR 3,50,000 | INR 1500 | |

| INR 3,50,001 to INR 4,00,000 | INR 1800 | |

| INR 4,00,001 to INR 4,50,000 | INR 2100 | |

| INR 4,50,001 to INR 5,00,000 | INR 2400 | |

| Above 5,00,001 | INR 2500 |

| Tripura | Up to INR 7500 | NIL |

| INR 7,501 to INR 15,000 | INR 1800 (INR 150 per month) | |

| Above INR 15001 | INR 2496 (INR 208 per month) |

| Chhattisgarh | Up to INR 40,000 | NIL |

| INR 40,001 to INR 50,000 | INR 360 (INR 30 per month) | |

| INR 50,001 to INR 60,000 | INR 720 (INR 60 per month) | |

| INR 60,001 to INR 80,000 | INR 1080 (INR 90 per month) | |

| INR 80,001 to INR 1,00,000 | INR 1200 (INR 100 per month) | |

| INR 1,00,001 to INR 1,50,000 | INR 1440 (INR 120 per month) | |

| INR 1,50,001 to INR 2,00,000 | INR 1800 (INR 150 per month) | |

| INR 2,00,001 to INR 2,50,000 | INR 2160 (INR 180 per month) | |

| INR 2,50,001 to INR 3,00,000 | INR 2280 (INR 190 per month) | |

| Above INR 3,00,001 | INR 2400 (INR 200 per month) |

How to make a professional tax e payment:

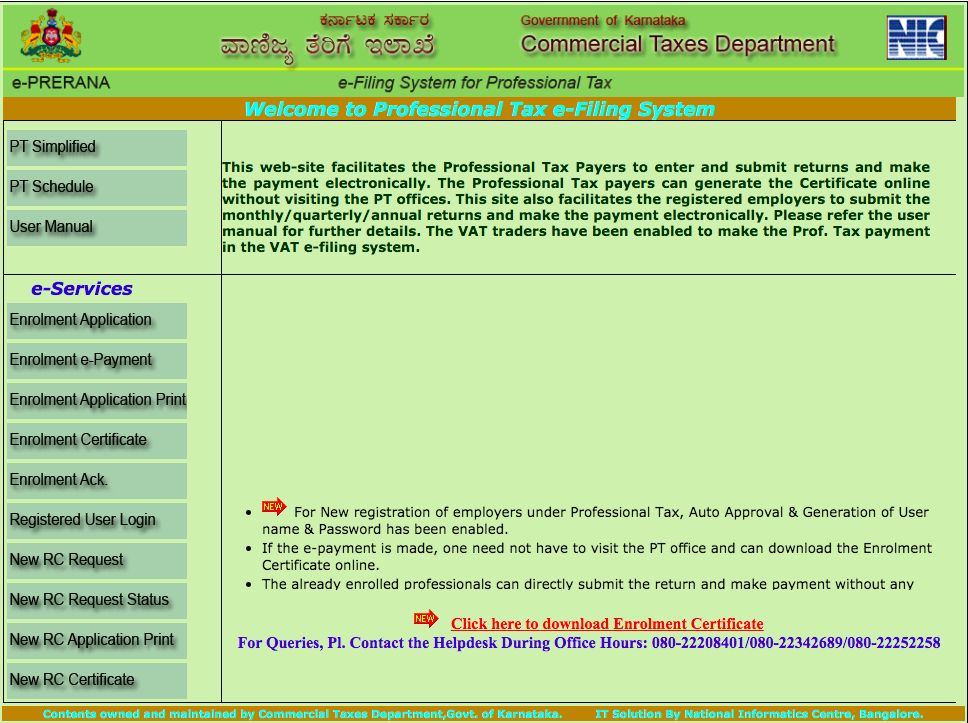

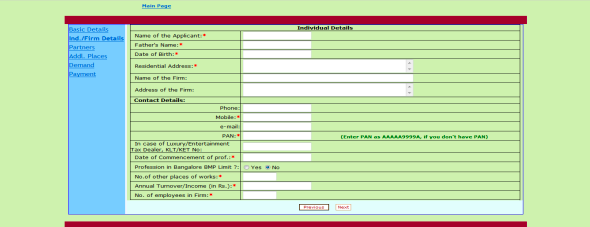

To pay the professional tax payment one has to register with the Commercial Tax Department and obtain a professional tax payment number or Enrollment Certificate (EC).

The payment of professional tax can also be made through a paper professional tax challan at the District Sales Tax Office where you may have to fill in the professional tax challan, have it stamped and sealed and make a cash payment at the counter or by cheque, as directed by the department.

A professional tax e payment can also be made online by using the new EC and RC numbers to make e-payments through a professional tax challan. Making a professional tax online payment or e-payment based on the professional tax slab is advantageous as one does not need to visit the PT office every month or even to download the PT Enrolment Certificate online.

Making Online Professional Tax Payment:

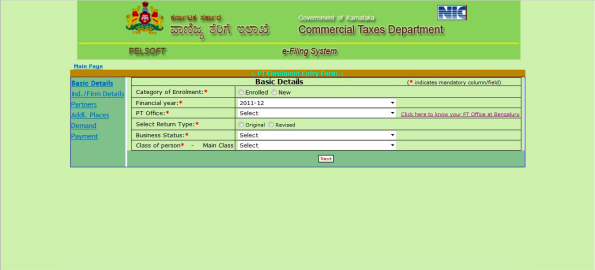

If you have your professional tax payment/enrollment number handy you can pay online use this professional tax online payment step-by-step guide.

- Use only the official state government professional tax website to make a professional tax e payment.

- To find the portal search online with ‘Professional tax payment’ and city name.

- Use the left-side menu bar to click on Karnataka Professional Tax-KTP tab assuming you are in Karnataka.

- The website will direct you to choose between professional tax challan options of a registered employer and self-employed professional.

- Now enter your Professional Tax Payment Registration Number, company name, and details as prompted.

- Then choose the option from monthly or annually, depending on the demands of the department and rules.

- Next, enter the month and year for which you are paying the tax.

- Enter the professional tax payment amount column and the penalty if any is levied.

- Enter the bank details from which you propose to make the payment and your registered mobile number.

- Hit the enter tab and verify your details before you click on the submit tab.

- On the next screen that loads click on the tab that says ‘Click here for payment’.

- It will take you to your bank’s net banking page.

- Sign in and make the payment for the due professional tax payment.

- Save the transaction details and professional tax challan in pdf format for future reference.

The penalty clause:

Paying the online professional tax payment in time is important. Non-compliance is penalized at 10 per cent of the due online p tax payment. A delay in obtaining the registration number is penalized mostly at the rate of Rs 5/- per day from the missed date. To file late returns of the professional tax online payment you are levied a penalty of Rs 1,000/- if you pay within a month of the due date or Rs 2,000/- if it is over a month and later.

Professional Tax slabs in different states

Before we get into the details of the Professional Tax slabs for each State, let’s look at Union Territories and States that do not levy PT.

| States & UTs without PT | States & UTs with PT |

| Andaman and Nicobar Islands | Andhra Pradesh |

| Arunachal Pradesh | Assam |

| Chandigarh | Bihar |

| Chhattisgarh | Gujarat |

| Dadra and Nagar Haveli | Jharkhand |

| Daman and Diu | Karnataka |

| Delhi | Kerala |

| Goa | Madhya Pradesh |

| Haryana | Maharashtra |

| Himachal Pradesh | Manipur |

| Jammu and Kashmir | Meghalaya |

| Ladakh | Mizoram |

| Lakshadweep | Nagaland |

| Rajasthan | Odisha |

| Uttar Pradesh | Puducherry |

| Uttarakhand | Punjab |

| Sikkim | |

| Tamil Nadu | |

| Telangana | |

| Tripura | |

| West Bengal |

Here are the income slabs and corresponding PT amounts for States and Union Territories where Professional Tax is applicable.

| Andhra Pradesh | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 15,000 | 0 |

| 15,001 – 20,000 | 150 |

| Above 20,000 | 200 |

| Assam | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 10,000 | 0 |

| 10,001 – 15,000 | 150 |

| 15,001 – 25,000 | 180 |

| Above 25,000 | 208 |

| Bihar | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 25,000 | 0 |

| 25,001 – 41,666 | 83.33 |

| 41,667 – 83,333 | 166.67 |

| Above 83,334 | 208.33 |

| Gujarat | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 5,999 | 0 |

| 6,000 – 8,999 | 80 |

| 9,000 – 11,999 | 150 |

| Above 12,000 | 200 |

| Jharkhand | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 25,000 | 0 |

| 25,001 – 41,666 | 100 |

| 41,667 – 66,666 | 150 |

| 66,667 – 83,333 | 175 |

| Above 83,334 | 208 (for 11 months); 212 (12th month) |

| Karnataka | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 15,000 | 0 |

| Above 15,001 | 200 |

| Kerala | |

| Salary/Income (INR) half-yearly | Professional Tax Amount (INR) half-yearly |

| Up to 1,999 | 0 |

| 2,000- 2,999 | 20 |

| 3,000 – 4,999 | 30 |

| 5,000 – 7,499 | 50 |

| 7,500 – 9,999 | 75 |

| 10,000 – 12,499 | 100 |

| 12,500 – 16,666 | 125 |

| 16,667- 20, 833 | 166 |

| Above 20,834 | 208 |

| Madhya Pradesh | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 18,750 | 0 |

| 18,751 – 25,000 | 125 |

| 25,001 – 33,333 | 167 |

| Above 33,334 | 208 (for 11 months); 212 (12th month) |

| Maharashtra | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 7,500 | 0 |

| 7,501 – 10,000 | 175 |

| Above 10,001 | 209 (for 11 months); 300 (12th month) |

| Manipur | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 4,250 | 0 |

| 4,251 – 6,250 | 100 |

| 6,251 – 8,333 | 167 |

| 8,334 – 10,416 | 200 |

| Above 10,417 | 208 (for 11 months); 212 (12th month) |

| Meghalaya | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 4,166 | 0 |

| 4,167- 6,250 | 16.50 |

| 6,251 – 8,333 | 25 |

| 8,334 – 12,500 | 41.50 |

| 12,501 – 16,666 | 62.50 |

| 16,667 – 20,833 | 83.33 |

| 20,834 – 25,000 | 104.16 |

| 25,001 – 29,166 | 125 |

| 29,167 – 33,333 | 150 |

| 33,334 – 37,500 | 175 |

| 37,501 – 41,666 | 200 |

| Above 41,667 | 208 |

| Mizoram | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 833 | 0 |

| 834 – 1,250 | 8 |

| 1,251 – 1667 | 12.5 |

| 1668 – 2,083 | 16.6 |

| 2,084 – 2,917 | 20.83 |

| 2,918 – 4,167 | 25 |

| 4,168 – 6,250 | 41.6 |

| 6.251 – 8,333 | 62.5 |

| 8,334 – 12,500 | 83.3 |

| 12,501 – 16,667 | 125 |

| 16,668 – 20,833 | 166.6 |

| Above 20,834 | 208.3 |

| Nagaland | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 4,000 | 0 |

| 4,001- 5,000 | 35 |

| 5,001- 7,000 | 75 |

| 7,001- 9,000 | 110 |

| 9,001- 12,000 | 180 |

| Above 12,001 | 208 |

| Odisha | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 13,304 | 0 |

| 13,305 – 25,000 | 125 |

| Above 25,001 | 200 (for 11 months); 300 (12th month) |

| Puducherry | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 16,666 | 0 |

| 16,667 – 33,333 | 41.66 |

| 33,334 – 50,000 | 83.33 |

| 50,001 – 66,666 | 125 |

| 66,667 – 83,333 | 166.67 |

| Above 83,334 | 208.33 |

| Punjab | |

| Taxable Income (INR) per month | Professional Tax Amount (INR) per month |

| Above 20,833 | 200 |

| Sikkim | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 20,000 | 0 |

| 20,001 – 30,000 | 125 |

| 30,001 – 40,000 | 150 |

| Above 40,001 | 200 |

| Tamil Nadu | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 3,500 | 0 |

| 3,501 – 5,000 | 22.5 |

| 5,001 – 7,500 | 52.5 |

| 7,501 – 10,000 | 115 |

| 10,001 – 12,500 | 171 |

| Above 12,501 | 208 |

| Telangana | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 15,000 | 0 |

| 15,001 – 20,000 | 150 |

| Above 20,001 | 200 |

| Tripura | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 5,000 | 0 |

| 5,001 – 7,000 | 70 |

| 7,001 – 9,000 | 120 |

| 9,001 – 12,000 | 140 |

| 12,001 – 15,000 | 190 |

| Above 15,001 | 208 |

| West Bengal | |

| Salary/Income (INR) per month | Professional Tax Amount (INR) per month |

| Up to 10,000 | 0 |

| 10,001 – 15,000 | 110 |

| 15,001 -25,000 | 130 |

| 25,001 – 40,000 | 150 |

| Above 40,001 | 200 |

Professional Tax – FAQs

1) For a salaried individual, is it mandatory to pay professional tax?

Yes. For individuals who draw income from salary, payment of professional tax is mandatory.

2) Who needs a Certificate of Registration (RC)?

All employers who pay Professional Tax to the State Government on behalf of the employees need Certificate of Registration (RC).

3) What types of Profession Taxpayers exist?

Profession Taxpayers are of two types based on the following criteria:

-

- PTRC or Profession Tax Registration Certificate: Employers who have employed more than 1 worker must obtain the PTRC. Such an employee must draw a salary from the employer which must be more than the prescribed limit for PT to be levied.

- PTEC or Profession Tax Enrollment Certificate: For any individual who is in a profession, calling or trade and is listed under one of the classes mentioned in Schedule I (second column) must obtain PTEC.

4) Is registration and enrolment for PT mandatory for businesses?

Yes. All businesses (except those exempted) must obtain an Enrolment Certificate and a Registration Certificate — for PT — withing 30 days of commencement of business.

5) For delay in PT registration, what is the penalty?

In a case where the Certificate of Enrolment is not obtained by the employer on time, a penalty amounting to INR 1,000 will be levied. Moreover, any pending tax accumulated since the commencement of business must also be paid in full.