File Your Income Tax Returns Online With Ease

As a taxpayer, it’s your duty to file income tax returns; it’s a great way to save money on taxes. The online method of filing income tax returns is the easiest way to do so. If ITR isn’t filed, under the Income Tax Act, you will be liable to pay penalties.

Table of Content

File your income tax returns online

Documents required for income tax filing online

You want to file an income tax return online for a salaried employee. But don’t know how to do so? We have outlined for you detailed steps that will clear any doubts you have on how to file income tax return online.

The entire method of filing income tax returns is known as income tax e-filing, as it can be done online on the Income Tax Department portal. So, let us discuss the different steps on how to file income tax returns online.

How to file your income tax returns online

The Income Tax Department has established an online software to fill all the ITR forms. Only the forms ITR 1 and ITR 4 can be filed online without having to download the application in Java or Excel. You need to gather all the relevant documents to file the ITR form online. Your income tax return filing online can be done in the following steps, as mentioned below:

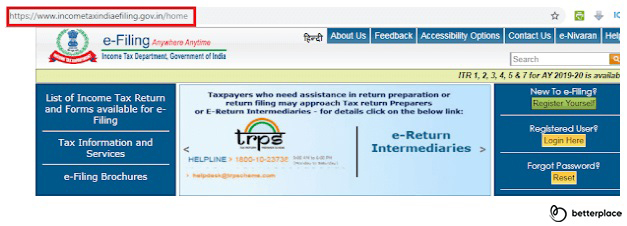

Step 1: Go to the income tax e-filing portal. First-time users need to register themselves with their PAN number.

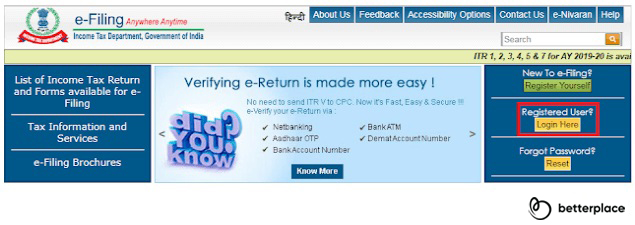

Step 2: If you have registered before, then login into your account by entering the User ID (PAN number), Password and the Captcha.

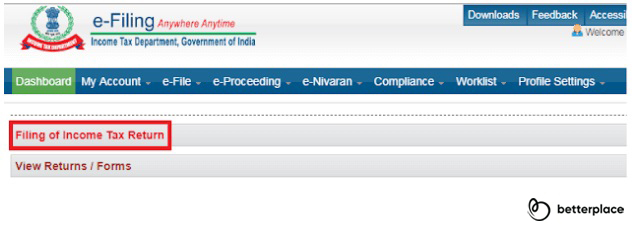

Step 3: Now, select the option “Filing of Income Tax Return” for income tax return filing online.

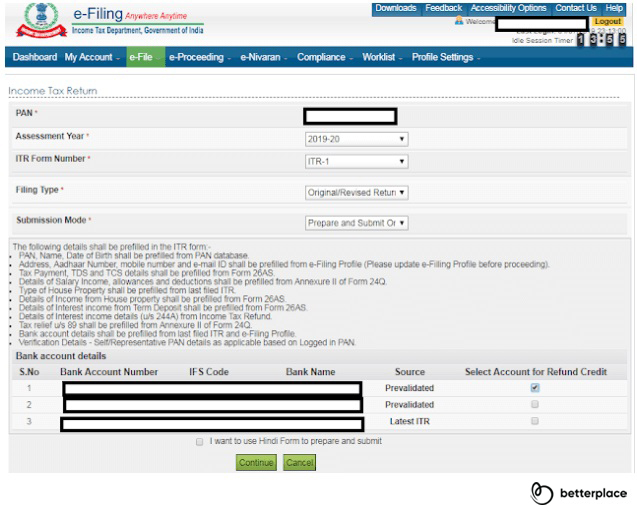

Step 4: A new webpage will appear.

- Select the relevant “Assessment Year”,

- ITR Form Number: ITR 1

- Filing Type: Original/Revised Return

- Submission Mode: Prepare and Submit online

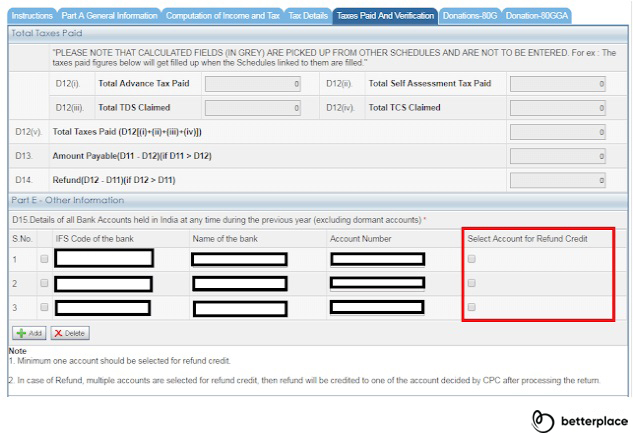

- Select the right bank account to get refund credit. If your bank account details are prevalidated, then pre-validated will be mentioned under the “Source” column. If not, then “Latest ITR” will be written. It is better to select only prevalidated bank accounts for refund purposes.

After filling all the details, click on “Continue”.

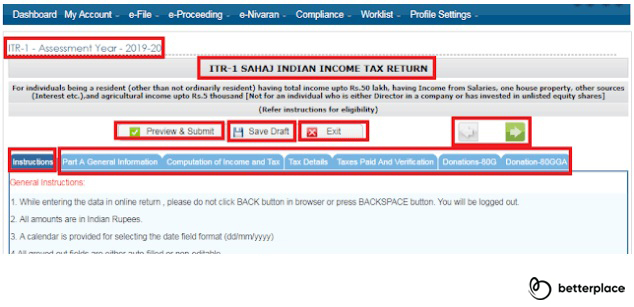

The new webpage for ITR 1 Form will appear on your screen. The 1st Tab is “Instructions”. You must go read the instructions thoroughly before you begin the process of filling and filing your ITR-1.

The webpage also contains 3 command buttons:

- Preview and Submit: To preview the data you have filled before the submission.

- Save Data: To save the data that you have filled to use in the future.

- Exit: To Exit from this ITR 1 Form webpage.

Plus, this webpage also contains 6 additional Tabs:

- Part-A General information: It has the personal information about the individual. The data is mostly prefilled in this tab. The individual must verify the pre-filled data and make the essential corrections. Plus, the individual should fill all empty data fields.

- Computation of Income and Tax: It contains relevant details of the individual’s income and calculates their “Total Income”. The resultant tax liability, with rebates if any, gets auto calculated.

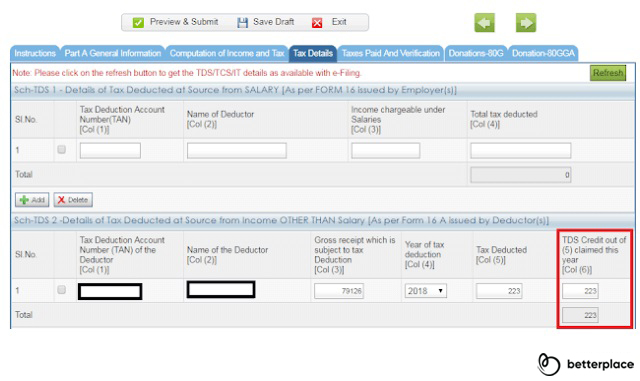

- Tax Details: It contains the TDS details deducted by all deductors, including the employer, Advance Taxes, paid Self-assessment taxes if any and TCS if any. This data is usually pre filled. But, if the given data is wrong or the data fields are empty, then the individual should fill the right data.

- Taxes Paid and Verification: It contains details of the total taxes paid, tax payable and/or refundables if any. This tab contains ITR form verification section by the individual along with the options for verification.

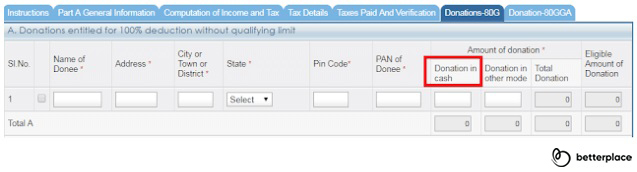

- Donation 80G: This tab has the details of any donations done by the individual during the given financial year. Only donations that qualify for deduction as per Section 80G will be reflected under this tab.

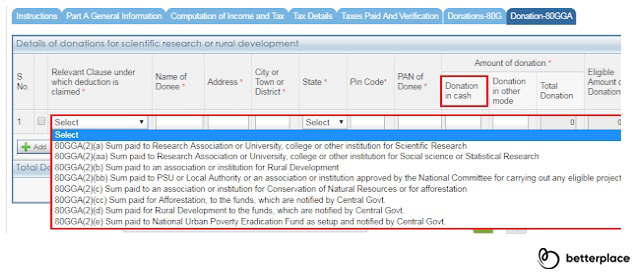

- Donation 80GGA: This tab contains the details about the donations made by the individual during the given financial year. Only donations that qualify for deduction as per Section 80G will be reflected under this tab.

Step 5: “Part A General Information” is divided into 2 parts.

Part 1: It contains personal information that is already pre-filled. Apart from “Last Name” and “PAN” all the other fields are editable. The individual can edit the data fields if there is any correction that needs to be made. If the individual changes their postal address, email and mobile number, they should also make these changes on the main profile page. But, remember to save the changes on this tab before going to your “My Profile” to make the necessary changes.

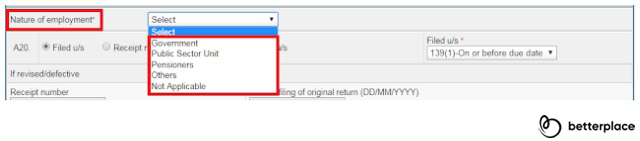

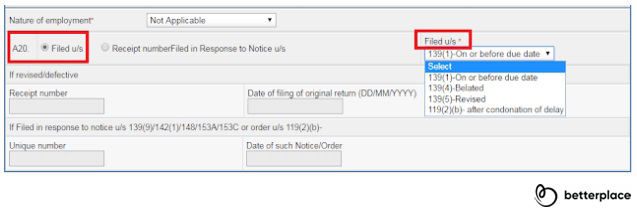

Part 2: The individual has to fill the following details:

- Nature of Employment: the individual must mention the correct nature of employment from the drop down. If the individual is filing ITR 1 Form only for rental income or interest income and doesn’t have any salary income, they must select “Not Applicable”.

- Filing status: In column A20, choose the “Filed u/s” option as the individual is filing the ITR on their own. In the 2nd column “Filed u/s” select the applicable option from the drop down. And save the data by clicking on “Save Data”.

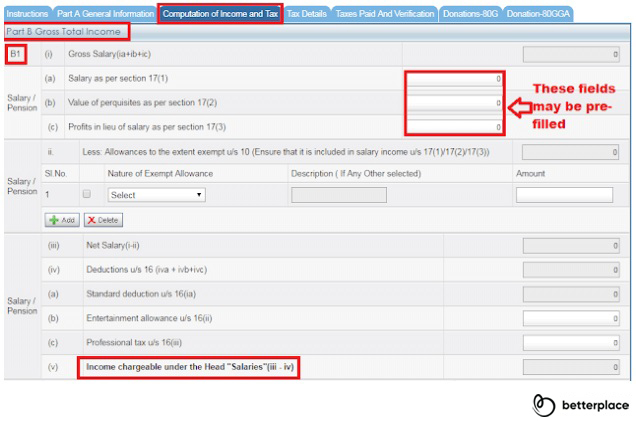

Step 6: After filling the options, the individual can go to the next tab option, i.e., Computation of Income and Tax, by clicking on the tab header or the green right arrow.

This tab consists of 3 parts:

- Part B: Gross Total Income

- Part C : Deductions and Taxable Total Income

- Part D: Computation of Tax Payable

- Block B1 is about Salary income. Some data fields may be pre-filled. If not, the individual can fill the data fields by referring to Part B of their Form 16.

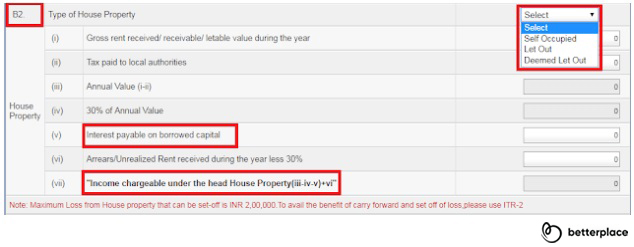

- Block B2 refers to the earnings from one house property. If the individual owns more than 1 house, then they cannot file ITR 1. According to the options in the drop down, the individual has to select the relevant options.

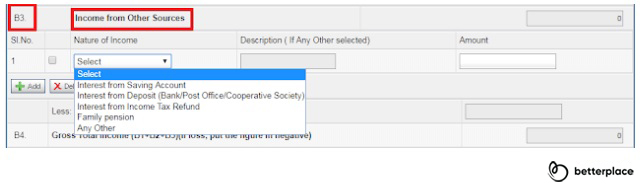

- Block B3 refers to “Income from Other Sources”.

In 2019, ITR 1 Form has been changed to include Income from Other Sources, such as:

- Interest from Savings Account: Deduction upto Rs 10,000 is allowed under section 80 TTA.

- Interest from Deposits: This includes earnings from recurring deposits, fixed deposits, debentures, bonds, etc. This income gets reflected in Form 26AS if tax has been deducted or if Form 15H or Form 15G is filed.

- Interest from Income Tax Refund: This is pre-filled if any earnings are reflected during the preceding financial year.

- Family pension: Pension if any received by a member for the family of the deceased employee.

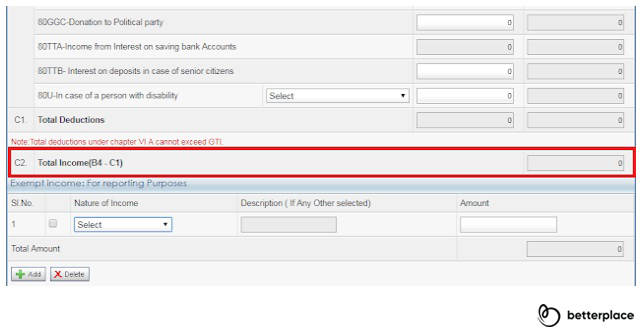

- Part C: Deductions and Total Taxable Income

This part refers to the deductions provided to the individual as per Chapter VI-A of the Income Tax Act,1961, that covers section 80C to 80U. The individual can fill this information from Part B of their Form 16. To claim deductions under section 80G or 80GGA, separate tabs are provided which the individual can fill to claim relevant deductions.

Note: Cash donations need to be mentioned separately in the data field. If the cash donation is more than Rs 2000, then the cash amount is not eligible for deductions.

Deductions under section 80GGA is the newest tab inserted in ITR 1 Form. This section provides deductions for donations towards rural development or scientific research. The individual should claim these deductions as per the appropriate clauses.

After the individual fills all the relevant deductions, the system auto calculates the individual’s Total Income.

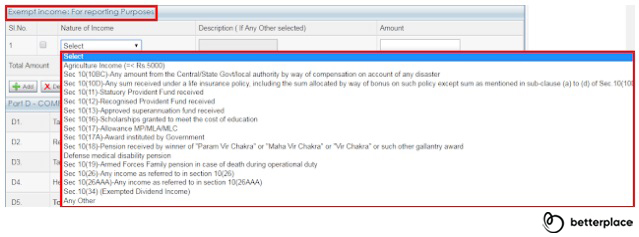

Next, the individual should report their Exempt Income. It is not a part of Total Income. However, it is highly advisable that individuals should report their Exempt Income.

Types of Exempt Income which a salaried individual usually earns are:

- Interest on EPF

- Interest on PPF

- Empet proceeds from Life Insurance

- Interest earned from bonds that are Tax-free

- Part D refers to Computation of Tax Liability and Taxes. This part gets entirely auto calculated.

- No external intervention is allowed in this field.

- Then, click on “Save Draft” to save your Form.

Step 7: Now, move to the “TAX Details” tab. This tab contains details of the TDS deducted by employer or by banks, self assessment tax and advance tax details, and TCS. These data fields are usually prefilled. If the individual finds any missing data, then they can fill it annually. The Sch TDS 2 must be filled as mentioned in the image below.

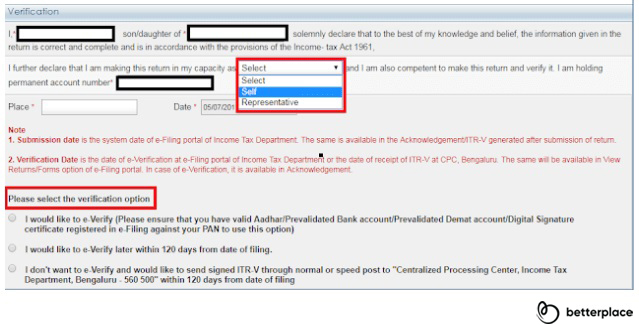

Step 8: Taxes Paid and Verification: This tab contains the aggregate values of TCS and TDS claimed and the paid Self-assessment tax and Advance tax. The tab will show whether the individual is liable to pay more taxes or is eligible to get refunds on excess tax paid.

In the “Verification” tab the PAN details of the individual, including the name and the father’s name will be pre-filled. The individual must fill the “Place” and capacity as “Self”.

The individual should choose appropriate verification options as per their convenience. After which, then can proceed to filing their income tax returns.

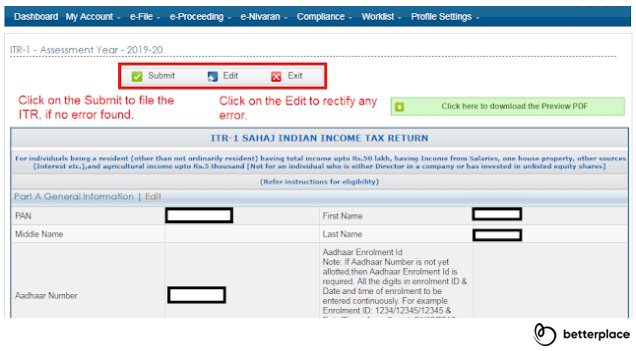

After the ITR-1 Form is completely filled, click on “Preview and Submit”. The “Preview” of the ITR Form appears on the screen. If any mistake is detected, then select the “Edit” option to make the changes. If no errors are detected, then click on “Submit”.

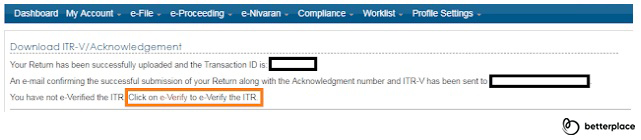

A confirmation message with the Transaction ID will reflect on the screen. The copy of the Acknowledgment or ITR-V is emailed to the individual’s registered email address.

- Returns can be verified electronically with the help of Electronic Verification Code (EVC).

- Another method of verifying the returns is the offline method.

- Here, the individual has to take the printout of the verification — the ITR-V — sign it and send it physically through mail, within 120 days from the date of income tax return e-filing, to the CPC (Central Processing Centre) in Bengaluru.

- Once the verification gets uploaded successfully, you will receive an ITR-V or acknowledgement on the registered email address.

Note: This acknowledgement can also be found in your ITR account in the income tax filing portal. You can also download the acknowledgement when required.

After the individual verifies the ITR, the Income Tax Department will process the information and notify the individual regarding the status through an SMS on the registered mobile under or on the registered email address.

Documents required for income tax filing online

- Bank statement

- PAN card

- Form 16 (for salaried people)

- Proof of any tax-saving investments

- Interest certificates from post offices or banks

- TDS certificate

- Salary slip

- Form 26AS

- Form 16A/16B/16C

As an Indian citizen, you must file income tax returns. The online method of filing income tax returns is the easiest way to do so. If you do not file your income tax returns, then you will be liable for penalties under the Income Tax Act. Further, income tax returns are a great way to save money on taxes. So, with the easy steps outlined above, never skip filing your income tax return online.

How to Download Income Tax Return Forms Online

Taxpayers can easily download ITR forms from the official Income Tax Filing portal. It’s important to choose the applicable ITR form from as per your financial transactions and assessment year.

Follow these steps to download ITR forms from the official portal.

- Go to the ITR portal.

- Click on ‘Forms/Downloads’ on the main menu’.

- Select ‘Income tax returns’ from the drop down.

- You can download the right form by clicking the corresponding ‘pdf’ button.

Advantages of Filing Income Tax Return Online

The Income Tax Return can be filed either online or offline. Online process; e-filing is much easier and prompt than the offline process. The offline filing of Income Tax Returns used to be tiring and troublesome. Introduction of e-filing is such a relief for taxpayers. Here are some of the major advantages of filing your tax returns online.

Seamless processing: Acknowledgement of e-filing is quicker than the offline procedure. The tax refund processing is also much quicker.

Convenience: E-filing facility is available 24/7. You can file your tax returns from anywhere, anytime. Payment can be made by bank transfer and other online payment methods.

Proof of income: The e-filing portal helps you document all your financial transactions at one place. It is more secure and flexible. You can use the e-filing record as the proof of income for any banking or related usages.

Latest News

Income Tax Filing 2020-21: File by March 31 or Face a Penalty

March 26, 2021: An alert has been issued by the Department of Income Tax, Government for those who haven’t filed their taxes for Assessment Year 2020-21. As per the alert, IT return has to be filed by March 31, 2021 failing which a penalty in the form of a late fee (as per the IT act) will be imposed.

“If you have filed your audit report but not filed your Income Tax Return (ITR) yet, please do so at the earliest. Last date to file ITR for AY 2020-21 is March 31, 2021,” read the IT Department’s tweet.

For those who are unaware, income tax returns can be filed on the e-filing portal (incometaxindiaefiling.gov.in). In the event of any queries or issues on the portal while filing returns, the taxpayers can call 18001030025.

The Finance Department also issued a clarification regarding ‘maximum tax liability’ in ‘cash’ for GST dues.

“Unconfirmed reports have appeared in certain sections of the media that some GST officers are using unauthorised communication means such as phone calls, WhatsApp and messages asking taxpayers to discharge ‘maximum tax liability’ in ‘cash’ in order to ensure that targets for revenue collection from GST for the financial year are met,” said the The Ministry of Finance.

“It is to clarify that neither the Government nor the Central Board of Indirect Taxes and Customs (CBIC) have issued any such instructions to their field formations. As such, taxpayers are free to utilise the Input Tax Credit available in their credit ledger, as permissible in law, to discharge their GST dues for the month of March, 2021 – the last month of this financial year,” it added.

Income Tax Assessment 2020 – Taxmen To Compute All The Tax Demands By August 31

August 03, 2020: With mild collections ending up being a hurdle in achieving tax revenue goals, CBDT Chairman P C Mody has set monthly targets for field formations for clearing requests and requested them to compute complete taxes for all assesses by August 31.

The chairman also conveyed that a lot of taxpayers are waiting to file applications under ‘Vivad Se Vishwas’ scheme, but are also waiting for the right call to be implied to them. The CBDT clarified that the monthly target for clearing pending appeals and proposals will be disposed of by sending direct communication to the taxpayer via the e-filing portal or emails.

“… board desires that all the work … of cleaning up of the tax demand and calculating the tax payable or refundable in respect of all eligible assessees under Vivad Se Vishwas scheme is taken up on priority,” said Mody in the letter to Principal Chief Commissioners of Income Tax.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space

Comments