E-filing Income Tax in India

With the technological development and centralisation of data in India, E-filing Income tax has become an effortless process, as long as you have the relevant documents that support your claim for ITR returns. The ITR form can be filled online and the refund directed to your bank account.

Table of Content

Many have heard of the terms — income tax e-filing and income tax returns, but very few know what they are and what documents are required to do income tax e-filing. Before we look into the e-filing process, let us first understand what income tax is.

What is Income Tax?

Every Indian individual who is employed or self-employed is liable to pay tax on their annual income if it is above the minimum threshold. This tax either gets deducted at the source (TDS), or it gets deducted monthly from the salary.

An individual can decrease the total amount of tax that they pay every month by making some investments and/or deposits in the tax-free schemes as notified by the income tax department. Such individuals, who have made investments, can later file for returns on their income tax deducted by the income tax department.

What is income tax returns or income tax e-filing for returns?

Income tax e-filing is a term used for filing income tax returns online. In the income tax returns form, the taxpayer has to fill information about their income earned in the given financial year, the tax-saving investments made by the individual, and the resultant tax applicable in that year, and submit it to the Income Tax (IT) department. The IT department will then analyse your form and initiate the necessary returns. The IT department has issued seven different forms viz ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6, ITR 7, to encompass each category of taxpayer. Each taxpayer should do income tax India e-filing before the last date of ITR filing for returns. The features and requirements of each ITR form are different based on the taxpayer’s source of income, the total amount of income earned annually and the taxpayer’s category. A taxpayer can fall into one of the three categories:

- Individual

- HUF (Hindu Undivided Family)

- Company

When should the taxpayer do income tax e-filing?

If the taxpayer falls under any one or more of the below-mentioned criteria, then they should do an income tax India e-filing to gain income tax returns:

- If the gross annual income of the taxpayer is greater than 2.5 lakhs INR and is below 60 years of age, or if it is greater than 3 lakhs INR for an individual who is above 60 years of age but below 80 years, or if it greater than 5 lakhs INR for an individual who is above 80 years

- If the taxpayer has multiple income sources, like capital gains, house rent, investments, etc.

- If the taxpayer wants to claim refunds on the income tax paid to the government

- If the taxpayer wishes to apply for loan or visa

- If the taxpayer has invested in or earned from foreign assets in the current financial year

- If a taxpayer is a firm or a company, irrespective of loss or profit

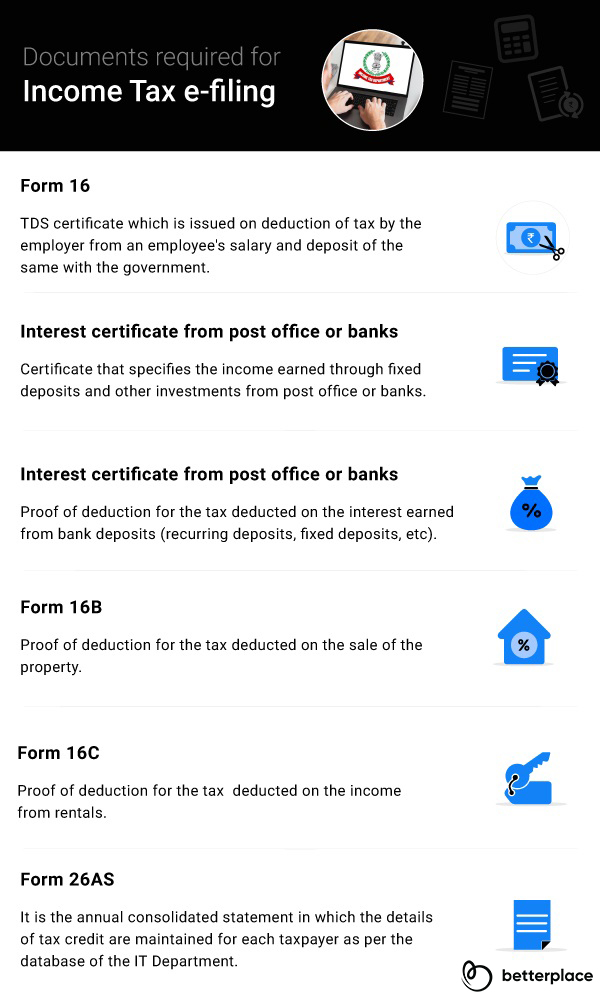

Documents required for Income tax e-filing

Before embarking on the income tax e-filing process, make sure that you have all the documents required to fill the ITR form online. Salaried individuals usually fill the ITR 1 form for income tax e-filing. If the individual annual income is greater than 50 lakhs INR, then they should use ITR 2. So, let us check out the documents required to file an income tax filing form.

Form 16

Form 16 is the most vital document required to file ITR filing for income tax returns. The employer issues this form to the employee. It is a TDS certificate which details the annual salary and all the tax deducted from the salary.

The ITR 1 form is the same as or similar to your Form 16, so almost all the details required to file ITR 1 will be available in Form 16. Just make sure that it has the correct PAN number mentioned.

Interest certificate from post office or banks

The individual should also specify their income earned through interests from bank and post office deposits. Interest certificate is proof of the income earned. The bank or post office where you have your deposits will issue this certificate.

Form 16A/Form 16B/Form 16C

If the individual has additional sources of earnings and the tax has been deducted at source on such earnings, then the individual is required to furnish the relevant forms as proof of tax deduction for ITR returns. These include:

- If tax is deducted on the interest earned from bank deposits(such as recurring deposits, fixed deposits, etc), then the bank will provide Form 16A as proof of the deduction.

- If the tax is deducted on the sale of the property, then the buyer will provide Form 16B as proof for the tax deduction.

- If tax is deducted on the income from rentals, then the tenant will issue Form 16C as proof of a tax deduction.

Form 26AS

Form 26AS is the consolidated yearly tax statement of the individual. This statement has information on all the tax deductions under your PAN, such as:

- Tax deduction by the employer

- Tax deduction by banks

- Tax deduction by additional income sources

- Advance tax deposited during the previous financial year

- Any self-assessment tax

Form 26AS for ITR e-filing can be downloaded from the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website.

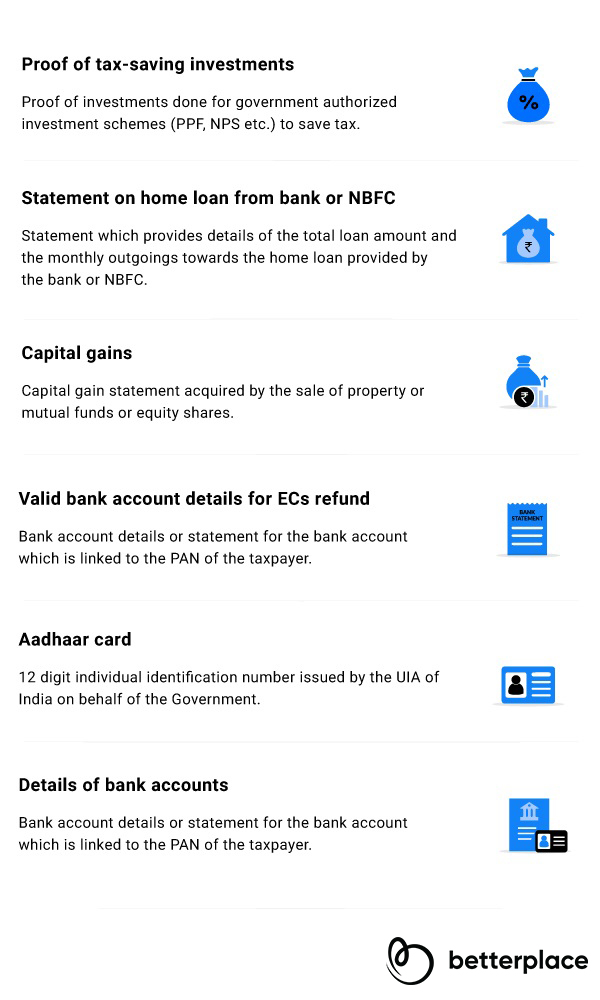

Proof of tax-saving investments

The individual should furnish proof of all the investments done in government authorised investment vehicles to save taxes. This investment helps to lower the tax liability. You can make a claim of a maximum of 1.5 lakhs INR as tax benefits under this section. The various investment vehicles qualified for income tax returns include:

- Paid Life insurance premiums

- Public Provident Fund

- Employee Provident Fund

- National Pension System

- Investments in Equity Linked Savings Scheme

Statement on home loan from bank or NBFC

If the individual has taken a home loan, then they should furnish the home loan statement from the respective bank or NBFC to claim income tax returns. This statement will provide the details of the total loan amount and the monthly outgoings towards the home loan.

Capital gains

If the individual has gained capital by the sale of property or mutual funds or equity shares, then they should report these gains while doing ITR e-filing. Non-disclosure of such information will invite penalty.

Valid bank account details for ECs refund

From 1st March 2019, the income tax department issues only e-refunds. So, while doing income tax returns filing, you need to provide details of a valid bank account linked to your PAN to initiate a successful refund.

Aadhaar card

The individual should provide proper Aadhaar card details for a successful income tax returns filing of ITR 1 form.

Details of bank accounts

The individual should provide the details of all bank accounts under their name while e-filing income tax.

With the technological development and centralisation of data in India, E-filing Income tax has become an effortless process, as long as you have the relevant documents that support your claim for ITR returns. The ITR form can be filled online, and the refund will be initiated directly to your bank account.

Due Date for Efiling Income Tax

To ensure that taxpayers meet the deadlines for all tax-related matters, the IT department has released the ‘’File-it-Yourself’’ calendar for 2020. The calendar not only helps taxpayers map their ITR filing journey, but also lists all the services and information provided by the IT department that can help make the process of filing taxes extremely convenient for all taxpayers.

As for the due dates, here’s what the calendar has to say:

| Deadline/Due Date/Last Date | For | |

| January 15, 30, 31 | TDS and TCS deposits for the quarter ending on December 31, 2019. | |

| March 15 | 4th and final installment (payment) of advance tax (2020-21). | |

| March 31 | For AY 2019-20 with incomplete assessment, filing revised or belated return of income. | |

| May 15 | Submission of TCS statement for Q4 (FY 2019-20). | |

| May 31 | Quarterly statement (TDS deposited in the previous quarter). | |

| June 15 | For AY 2021-22, advance tax (first installment) payment. | |

| July 31 | Filing of ITR for individuals. | |

| September 15 | The second installment (payment) of advance tax. | |

| September 30 | Filing of ITR for corporates and to-be-audited accounts. | |

| December 15 | The third installment (payment) of advance tax. | |

The Pros of Efiling ITR

With the introduction of ITR efiling, taxpayers can breathe a sigh of relief as they no longer have to opt for the cumbersome process of paper filing. Apart from this pro, ITR efiling has several other benefits, such as:

- ITR filing is accurate as the process is automated.

- Processing, payment, refund credits speeds are quick.

- Taxpayers can file their returns much before the due date on the portal. Doing this will ensure that you do not face any issues on the portal which can run slow or crash as a result of increased user traffic and congestion. Advance payment of taxes on the portal also ensures that no interest or penalties are levied for missing the deadlines.

- With the efiling method all transactions with the IT department are recorded for future references. Such records can be leveraged if any business opportunity emerges in the future which require proof of dealings with the IT department

Income Tax e-Filing FAQs

- Which ITR form should be filed by a salaried individual?For a salaried individual, to efile ITR the relevant form is ITR-1 (SAHAJ). However, you might be required to file a different case depending on the income you receive, other than your salary, or your investments. For example, for a salaried individual with capital gains, ITR-2 is relevant.

- Is ITR filing necessary if TDS deductions have been made?According to the Income Tax Act, you will have to file ITR even if you have paid TDS on your salary. TDS on salary is proof of your income exceeding the tax exemption threshold.

- Can ITR for previous years be filed in the current year?No, revised or old ITRs cannot be filed for the current assessment year. Simply put, for AY 2020-21, only FY 2019-20 is considered. However, if you have received notices for any of the previous ITRs, you can file them.

- Are any documents required when filing ITR?Documents need not be attached when filing ITR. But always keep your documents ready at all time as the tax authorities might ask you to produce any as proof.

- What are the various ITR forms that can be used by taxpayers to file returns?The different ITR forms are ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, ITR-7, ITR-V.

- Who is the ‘Assessment Officer’?Assessment officer will be an employee of the Income-tax Department who will be given the jurisdiction over a specific geographical area or group of people. You can get more information about the administering officer for your locality from the Income Tax Department official website.

- How to link Aadhaar with PAN?Aadhaar and PAN can be easily linked via the e filing portal only if the date of birth of the taxpayer is identical in both the documents. Taxpayers should login on e-Filing portal using his registered username and password. ‘Link Aadhaar’ option is listed under ‘Profile Settings’ on the user dashboard.

- What is gross total income?Income of the taxpayer can be classified to five heads according to the Income Tax Department. They are — Salaries, Income from house property, Capital gains, Profits and gains of business or profession, and Income from other sources. Gross total income is the sum of all the above mentioned income heads.

- Should senior citizens pay advance tax?If an individual of the age 60 or above and is not having any income from business or profession, should not pay the advance tax. The senior citizen should be a resident mandatorily.

- Is pension taxed as salary income?Yes. Pension is taxed as the salary income of the taxpayer. However, the pension received from UNO (United Nations Organization) is exempt from tax.

Offline Tax Filing Now a Breeze: IT Department Scraps Java & Excel-Based Utility

In an effort to ease the IT filing process, the IT Department has replaced the excel and java-based utility with a JSON-based utility for the Assessment Year (AY) 2021-2022. With the new utility taxpayers can bow import and edit pre-filled data before filing ITR. Here are some things you should know about the new JSON-based utility.

- PAN (Permanent Account Number) cannot be altered. Taxpayers first need to edit the information online on the e-filing portal and then download the prefilled forms via the utility.

- Pre-filled data can be downloaded from the IT e-filing portal after which taxpayers can enter other basic details such as address etc.

- The JSON-based utility can be currently used to file ITR 1 to ITR 4. The Income Tax department has released a step-by-step guide on how to use the utility.

- ITR filing on the e-filing portal is still diabled. All taxpayers can do currently is export the JSON file fill and save the utility.

New Income Tax Rule Changes 2021 – A Quick Glance

Finance Minister Nirmala Sitharaman has announced a set of changes in the Income Tax rules in the Union Budget 2021. The changes proposed will come into effect from 01 April, 2021. We are listing the major changes here.

- EPF Tax rules: Interest on employee contributions to EPF over Rs 2.5 lakhs will be taxed from 1, April 2021. Earlier the entire contribution was exempt from tax.

- TDS: The budget has proposed the addition of new Sections 206AB and 206CCA in the Income Tax Act as a specific provision for the deduction of higher rates of TDS and TCS, for people who are exempt from filing ITR.

- Tax exemption: Senior citizens who are above the age of 75 years are exempt from filing income tax returns (ITR). The exemption will be valid to only those who have no other income apart from monthly pension and interest gained from the bank holding the pension account.

- The Income Tax Return filing forms will be prefilled for every user to avoid confusions and to ease the process of ITR filing.

- The Budget 2021 proposes to provide tax exemption to allowance for Leave Travel Concession (LTC), which was taxed earlier. This is in accordance with Covid-related travelling restrictions.

Latest News on Income Tax e-Filing

Re-Register Your Digital Signature on the New Income Tax Portal: IT Department

The Income Tax Department informed all taxpayers via email that they must re-register their Digital Signature Certificate (DSC) on the new website. At exactly 8:45 p.m. on June 7, 2021, the old IT portal (http://incometaxindiaefiling.gov.in) was given a newer look and URL (https://www.incometax.gov.in/).

While the website migration was completed successfully, the DSCs couldn;t be moved due to technical and security reasons fro the old portal to the new. Therefore, DSCs must be re-registered. The IT department has also asked Indian taxpayers to update other details, such as phone numbers and email IDs.

Budget 2021: No ITR Filing Required for Senior Citizens if They Fulfil These Conditions

February 09, 2021: As per the new Union Budget, senior citizens above the age of 75, who only have pension and interest as a source income will be completely exempted from filing the ITR.

“For senior citizens who only have pension and interest income, I propose exemption from filing their income tax returns. The paying bank will deduct the necessary tax on their income,” said Finance Minister Nirmala Sitharaman, while presenting the budget.

The conditions provided for this complete tax exemption are as follows;

(i) The senior citizen should be an Indian national and of the age of 75 years or more during the previous fiscal year.

(ii) The person shouldn’t have any other income other than the pension. Yet, the taxpayer may have interest from the same bank where he or she is receiving the pension. Banks will be specified by the central government in a later notification.

(iii) The Taxpayer has to furnish a declaration statement to the designated bank.

ITR Filing Deadline Extended To January 10

January 08, 2021: The finance ministry has extended the deadline to file an income tax return (ITR) for individuals by ten days to January 10, 2021. The deadline for filing ITR for businesses also has been extended till February 15.

The deadline for ITR filing has been extended three times this financial year. The normal deadline for ITR filing is July 31. It was extended due to the pandemic emergency. It was then extended to November 31, 2020 and now January 10.

The deadline for Vivad Se Vishwas scheme to resolve direct tax dispute has been extended by a month till January 31, 2021. Also the date for filing the GST annual return for 2019-20 fiscal has been extended till February 28, 2021.

The extension of the deadline till January 10 is for filing the income tax returns for 2019-20 fiscal year (2020-21 assessment year) and is only applicable for those individuals whose accounts are not expected to be audited and usually file their income tax return using ITR-1 or ITR-4 forms.

ITR Filing FY 2019-20 – Deadline Extended Till December 31

November 16, 2020: The government has extended the deadline for filing income tax returns by individual taxpayers for the financial year 2019-20 to December 31, as a relief to taxpayers hit hard by the global pandemic. The last date for providing ITR for those who are required to get their accounts audited has been extended to January 31, 2021.

Ever since Covid-19 restrictions and lockdowns transpired, the government has been receiving requests from the public for the extension of date for filing annual returns (FORM GSTR-9) and reconciliation statements (FORM GSTR-9C) for FY 2018-19 .

The due date for filing returns for the taxpayers who are required to furnish statements related to international/specified domestic financial transactions has also been extended to January 31, 2021.

ITR Filing FY 2018-19: Deadline Further Extended Due To COVID

October 7, 2020: The Income Tax Department has extended the deadline for filing returns for FY 2018-19 (AY 2019-20) from September 30, 2020 to November 30, 2020. The extension of the deadline is subject to the current pandemic situation. This is the fourth time the department is extending the deadline for filing original and revised ITR for the fiscal year 2018-19.

The IT department notified the same on their Twitter profile on 30th September: “On further consideration of genuine difficulties being faced by taxpayers due to the Covid-19 situation, CBDT further extends the due date for furnishing of belated & revised ITRs for Assessment Year 2019-20 from 30th September, 2020 to 30th November, 2020.”

The government is emphasizing on providing tax-related services without any hassles to every taxpayer of the country. The Income Tax Department recently tweeted that they have already issued refunds worth over Rs 1.18 lakh crore to more than 33 lakh taxpayers within the last 6 months.

Tax Evasion In India – Government States That Only 1% of India Pays Tax

September 24, 2020: Recent reports from the tax department shows that only 1% of the Indian populace pays income tax and declares profit over the non-taxable salary. Just 5.78 crore annual tax returns were documented by individuals taxpayers for the budgetary year 2018-19 till February 2020. Out of this, solitary 1.46 crore individual taxpayers filed returns declaring income above Rs 5 lakh, Anurag Singh Thakur, MoS, Ministry of Finance, replied to an inquiry in Lok Sabha. Taxpayers with salary up to Rs 5 lakh are not required to pay any personal tax from Assessment Year 2020-21 onwards. It should be noted that tax evasion is at the centre of the low tax base in the nation.

The government has implemented multiple steps such as surveys, searches, income assessments, penalties and prosecution etc. as the measures to avoid tax evasion. Tax evasion is considered as a crime and the prosecution will be done in the criminal courts. The income tax department has come up with multiple tax evasion detection techniques such as Computer Assisted Scrutiny Selection (CASS), Income Tax Business Application (ITBA), and Non-filers Monitoring System (NMS).

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space

Comments