EPF – Table of Contents

- EPF applicability

- How to login to EPFO Portal?

- EPF passbook

- Check the EPF Balance

- Claim a Dormant EPF Account

- Check EPF claim status

- EPF scheme enrollment process

- EPF Contribution

- EPFO FAQs

If you are a salaried employee in India, you already know about the portion of your salary that you do not get in hand. You typically contribute this portion of your salary towards your Employee Provident Fund or EPF account.

Latest updates on EPF

E-nomination Important for Online Payment of PF, EDLI, and Pension

All Employees’ Provident Fund Organisation (EPFO) subscribers should note that e-nomination is necessary for the online payment of PF and to ensure that their nominees receive pension and EDLI scheme upto Rs. 7 lakh.

E-nomination can be completed by logging into the PF portal. However, one must remember that e-nomination is only necessary after marriage. Furthermore, documentation or approval from the employer isn’t needed; a self-declaration is sufficient for e-nomination.

Here’s a step by step guide for you to understand all about EPF

What is EPF?

Employee Provident Fund (EPF) is a fund wherein the employee and the employer have to contribute an equal pre-decided amount of money which can later be leveraged by the employee. It is managed by the Employee Provident Fund Organisation of India (EPFO).

Objectives of the EPFO:

EPFO envisions repositioning itself to be the World’s Best Social Security Organization that provides the best facility to

- Decrease the amount of time it takes to resolve disputes from a month to 72 hours.

- Provide subscribers with no trouble service through EPFO offices.

- Confirm that all eligible facilities are in compliance with the needs of the mentioned statute

- Encourage and foster voluntary conformity.

- Member Accounts are updated on a regular basis.

- Access to the Member Account is available online.

EPF Benefits:

The following are the benefits of EPF:

- A worker’s investment in his PF fund is regarded as qualified for exemptions under the Indian Income Tax Act. Furthermore, earnings produced under EPF systems are tax-free. This exemption is available to a maximum restraint of Rs. 1.5 Lakhs.

- It aids in long-term financial savings.

- There isn’t any need to produce a single, large investment.

- Subtractions are made monthly and help the worker save money.

- It could provide financial assistance to a worker in the case of emergencies.

- It aids in the preservation of money for pension and the maintenance of a comfortable lifestyle.

EPF Interest Rate

The CBT is led by the Labor Minister. EPFO provided an 8.5% interest rate to all its members on their cumulative EPF contributions year 2020-21. Their rate of interest in 2019-20 remained unchanged at 8.5 per cent, an eight-year low.

EPF Eligibility

Any paid worker with a paycheck significantly lower than 15,000 INR is required to join the EPF. Employees having a monthly salary far beyond INR 15,000 are qualified to participate in the EPF if they receive clearance from the Regional PF Commissioner along with their employer.

Types of EPF Forms

The business provides several sorts of PF Forms for various claim methods. Some required forms are as follows:

- Form 19: To be completed after a member has completed the final payout of their PF account.

- Form 10C: For obtaining the Workers’ Pension Fund ’95 Scheme Credential Reward.

- Form 10D is used to file pension applications.

- Form 20: Used to collect PF following the passing away of a person’s lawful heir/nominee.

- Form 5IF: must be completed by the lawful heir/nominee of the participant in order to receive an assured benefit under the Workers’ Deposit Linked Financial Services act of 1976.

- Form 31: To request an advance/temporary pullout under Workers’ Provident Plan ’52.

- Form 13: To move PF/pension funds across accounts.

- Form 14: To use the PF account to finance a policy of life insurance.

EPF withdrawal without employer signature

Many individuals believe that it’s impossible to obtain cash from EPF without the approval of your prior employer. One must recognize that the funds in the EPF are not within the authority of your boss. Every employer reimburses a portion of your monthly pay as EPF. Essentially, it is your own EPF payment. This amount is subsequently put into your EPF Balance profile with the Employees ’ provident fund. Once the cash is invested in that bank, you have complete ownership of it.

EPF applicability

Let’s understand the conditions around which EPF is applicable –

EPF applicability for employers

- Any company that has 20 or more employees in total is required by law to deduct EPF.

- Subject to certain conditions even organisations with less than 20 employees are applicable.

EPF applicability for employees

- Any salaried employee with a monthly income of less than 15,000 INR needs to compulsorily be a member of the EPF.

- An employee with a monthly income higher than INR 15,000 (the current prescribed limit) is eligible to become a member of the EPF if he/she gets approval from the Assistant PF Commissioner and employer.

- An employee can also choose to opt out of EPF if his/her salary is higher than INR 15,000 and if they have never made any contribution to EPF. This can be done by filling Form 11, which is a self-declaration form provided by the EPFO.

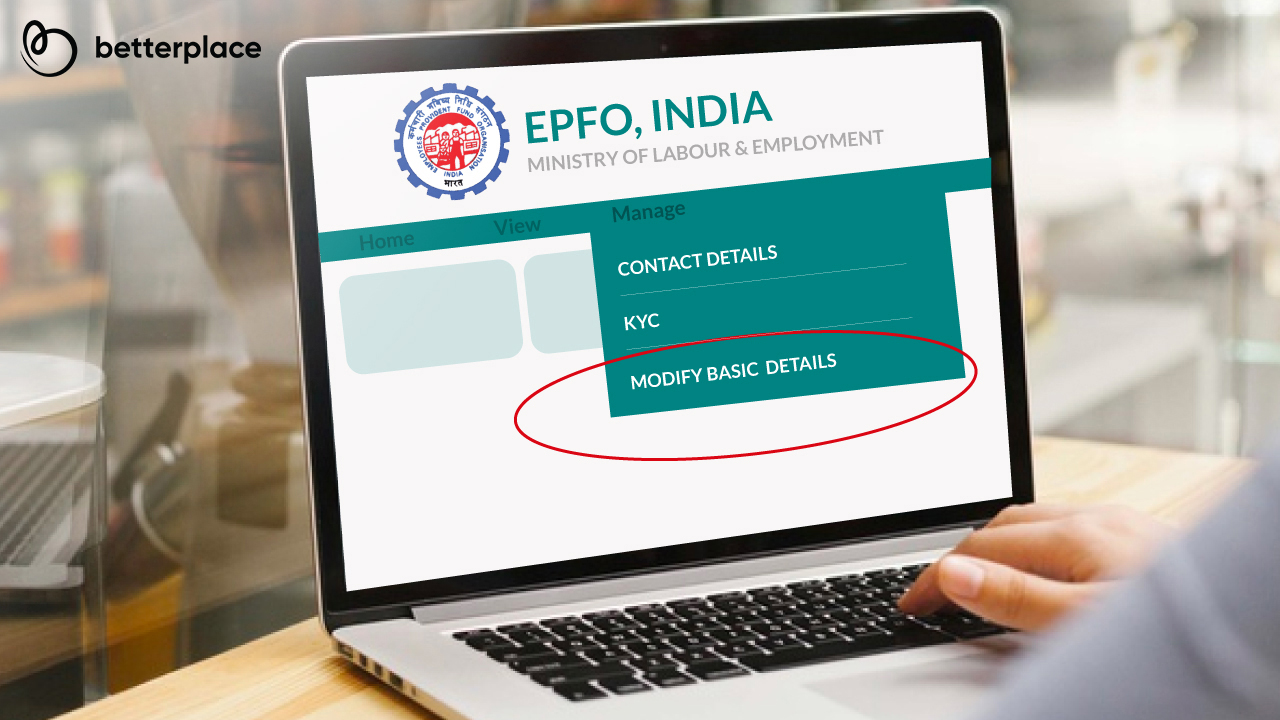

How to login to EPFO Portal?

Most of the services provided by the EPFO can be easily availed online through the EPFO member e-Sewa portal. These services include EPF passbook — viewing and downloading, withdrawing funds, PF account transfers etc.

You can easily avail these services by registering and logging in to the EPFO portal. Login portal for the employee and employer are the same.

Most of the services provided by the EPFO can be easily availed online through the EPFO member e-Sewa portal. These services include EPF passbook — viewing and downloading, withdrawing funds, PF account transfers etc.

You can easily avail these services by registering and logging in to the EPFO portal. UAN is mandatory for EPFO login. If you still haven’t generated nor activated UAN, refer this article for assistance. Follow the steps below to login to your account.

- Visit https://unifiedportal-mem.epfindia.gov.in/memberinterface/

- Enter you UAN number, password and captcha code

- Click ‘Sign in’

Check your account statement with EPF passbook

EPF passbook or the UAN passbook is similar to a bank passbook where you can find your account details and statements. You can easily download or print your EPF passbook through EPFO member portal. Follow these easy steps to download or view your EPF passbook.

- Go to EPF site index

- Click on ‘e-Passbook’

- In the opened tab enter your UAN, password, captcha and click ‘Login’

- In the succeeding page, you can select the member ID (in case of multiple IDs)

- The direct links for Viewing, Downloading the EPF passbook and Viewing claiming status will be available in the page

How to check the EPF Balance?

You can easily check the EPFO balance by viewing or downloading the EPFO passbook as mentioned above. If your number is registered with UAN, here are the other two ways to check the EPFO balance.

- SMS method

You can easily get your account balance via SMS by sending an SMS to 7738299899 from your registered mobile number. The SMS format is:

EPFOHO UAN ENG

Here ENG represents the language preference of the message. UAN notifications are available in 10 languages. English (Default), Hindi, Kannada, Telugu, Tamil, Malayalam, Punjabi, Gujarati, Marathi, and Bengali. You can change the language by providing the first three letters of the preferred language. For eg. If you want to get notifications in Hindi, send SMS as; EPFHO UAN HIN

- Missed call method

If you want to know your account balance and other details, you can easily give a missed call to 011-22901406 from your registered mobile number.

For both these methods, UAN should be linked with KYC such as bank account number, Aadhar number and PAN.

PF withdrawal procedures

PF amount can be withdrawn easily by submitting an online or physical application. For withdrawing the PF amount online, one needs to make sure that the KYC is linked with UAN. This ensures smoother processing and easy withdrawing. You can check both processes in detail here.

How to Claim a Dormant EPF Account?

- Go to www.epfindia.com

- Click on ‘Inoperative A/c Helpdesk’. under ‘For Employees’ section

- On the opened webpage click on the link ‘(a) First Time User Click Here to Proceed’

- In the next section, describe your problem in the ‘Problem Description’ section

- On the next page you need to provide relevant details like EPF no, company name etc. Once this is updated, click ‘Next’

- Enter your KYC data in the next page

- Afterwards, click ‘Generate PIN’

- PIN will be sent to your mobile number

- Verify PIN and click ‘Submit’

Once you submit this, you will receive an SMS with your reference ID. You can log on to the Helpdesk login by entering this reference number and your mobile number. Your request status will be visible on your log in page. A field officer will get in touch with you directly to assist you on the further steps.

How to Withdraw from an Unclaimed EPF Account?

Once you identify your account, withdrawing funds from your unclaimed EPF account is quite simple. Follow these steps to withdraw funds from an unclaimed account

- Go to EPFO official portal

- Fill up ‘EPF claims form’

- Submit this form in person or via post to the nearest EPFO office

How to check EPF claim status

Once you raise a claim request, you can easily track your request status through the membership portal. Follow these steps to check your EPF claim status online.

- Go to EPFO portal

- Hover over ‘Our services’ and click on ‘For employee’s’ tab

- Click on ‘Know your claim status’

- In the next page enter your UAN

- In the opened web page enter your state, select the EPF office from the drop-down menu, enter your establishment code and account number

- Click ‘Submit’

- The claim status will be sent via SMS on your UAN registered mobile number

EPF scheme enrollment process for employers

One can easily enrol an organization to EPF scheme by following the below 4 step process.

Step 1 – Registering the organization

Visit the EPFO unified portal and click on ‘Establishment registration’.

Step 2 – Understanding the user manual

Once you complete the first step, you will see the option to download the ‘Instruction manual’. Download it and read it carefully.

Step 3 – Registering the Digital Signature Certificate

DSC registration is a prerequisite to submitting a fresh application. You will find all the details regarding this on the Instruction manual. The registered employers can log in with the Universal Account Number [UAN] and password.

Step 4 – Fill up the employer details

Fill up all the necessary details such as Name, Username, Employer PAN etc as the following step and click ‘Register’. The system will ask you to verify the mobile PIN and activate the verification link afterwards.

EPF contribution

The employee and the employer both have to contribute equally towards the employee provident fund. But what is the amount and how is it calculated? Let us know!

Pointers-

- EPF is calculated on the salary, where salary = Basic + DA (Dearness Allowance)

- In private organisations, salary = Basic

- The EPF contribution is either 1800 INR per month or 12% of the salary

- That means, 12% of your salary goes into your PF account

- Your employer needs to contribute 12% too. This 12%, however, is divided into two accounts-

1. Employee Provident Fund – 3.67%

2. Employee Pension Scheme – 8.33% - Apart from this, the employer needs to pay 1% extra charges –

1. EDLI, Employee Deposit Linked Insurance (insurance of your EPF and EPS) – 0.5%

2. EPF administration charges – 0.5%

There are three scenarios on which EPF contribution depends.

Scenario 1 – Employee’s salary is less than 15000INR

Let’s assume the salary is S1, so –

- The employee will contribute 12 % of S1.

- Whereas, the employer will contribute –

– 3.67% of S1 to EPF

– 8.33% of S1 to EPS

– 0.5% of S1 to EDLI

– 0.5% of S1 to EPF Admin charges

Scenario 2 – Employee’s salary is more than 15000INR

In case the employer opts for Minimum EPF, then the calculation is not done on the employee’s current salary, rather on the minimum salary – that is – 15000INR.

- The employee will contribute 12 % of 15000 = (1800 INR).

- Whereas, the employer will contribute –

– 3.67% of 15000 to EPF

– 8.33% of 15000 to EPS

– 0.5% of 15000 to EDLI

– 0.5% of 15000 to EPF Admin charges

Scenario 3 – Employee’s salary is more than 15000 INR

If the employer opts for Full EPF, and let’s assume the current salary is 30000 INR

- The employee will contribute 12% of 30000.

- Whereas, the employer has two choices –

A. The employer can contribute his share total of 12% on the minimum salary of 15000INR.

OR

B. The employer can contribute his share total of 12% on the employee’s current salary (here, 30,000INR). In this case, the contribution to the EPS will remain 8.33% of 15,000 and the balance above that goes into the EPF.

Now that we know who contributes what into your PF account, let us know about the major benefits you receive –

- High Interest – You get an interest rate of 8-9% on your EPF balance. Currently, the interest rate in India is 8.65%. This high rate of interest facilitates your retirement planning.

- Exemption from Tax – Your EPF falls under the EEE (Exempt Exempt Exempt) category. That is, the money you invest in EPF, the interest you earn, and the money you withdraw – are all exempted from income tax.

Note – If you withdraw money in case of emergencies (we’ll talk about it) before a specified period of 5 years then, in that case, you won’t be exempted from tax. - Low Risk – EPF is an extremely low-risk investment. So, it gives you a safe option to invest your money with the added advantage of government backing.

- Life Insurance– EPF also acts as life insurance. In case of death of the employee, the corpus goes to the family of the deceased.

- Hassle-free– Owing to the UAN (a 12-digit unique number that is given to all PF members), you need to open an EPF account only once and then it can be transferred to your subsequent employers. Accessing an EPF account is absolutely hassle-free.

So many benefits, but what if you want to enjoy your EPF money right now? Well, let’s get into that –

First things first, your EPF balance is meant to be utilized at the time of your retirement and should not be withdrawn casually.

To serve this purpose, there are certain rules attached to withdrawal-

- You can withdraw 100% money in case you’ve chosen self-employment or have remained unemployed for more than 2 months. The latter needs to be certified by a gazetted officer.

- You can withdraw 75% of your EPF after one month of unemployment.

- You can withdraw 100% money from the EPF and EPS account at the time of retirement (58 years of age).

- 90% can be withdrawn at the age of 57 years.

- Other than that the amount can be withdrawn only in the case of emergencies such as –

Medical emergency

House loan repayment

Renovation of house

Purchase of land or house

Marriage or education (Marriage of self/siblings/children)

*All of the above emergency withdrawals are accessible after 5 years (or more) of service wherein you can withdraw up to a certain percentage of your EPF balance.

The EPFO loyalty-cum-life bonus

EPF members who have contributed towards the scheme for more than 20 years, might not be aware of another benefit offered by the EPFO. Known as the loyalty-cum-life bonus, long-standing contributors receive an additional INR 50,000 bonus at the time of retirement.

Furthermore, permanently disabled members who have contributed for less than 20 years are also eligible for this bonus. In other words, members who have contributed for less than 20 years towards the EDLI scheme, but their total contributing years falls short of 20 years due to permanent disability are entitled to the bonus. Here are the details of this bonus:

| Basic | Loyalty-cum-life benefit |

| More than INR 10,000 | INR 50,000 |

| Between INR 5,001-10,000 | INR 40,000 |

| Up to INR 5,000 | INR 30,000 |

Benefits of updating KYC documents on the EPFO portal

Although updating your KYC on EPFO portal is not mandatory, all members can avail certain benefits through this. Here are some of the benefits all the members will get by updating their KYC details.

- EPF account fund transfer will be faster and easier

- You can claim withdrawals online

- SMS updates on PF activation and similar activities

- If a member withdraws fund before 5 years, a TDS charge of to 34.608% will be levied against the amount. This can be reduced to 10% if the PAN is updated

Concluding notes – Although EPF deprives you of the ‘high’ in-hand salary, its benefits outpower the ‘so-called con’. It is a beneficial low-risk investment that should only be accessed in case of dire emergencies.

EPFO FAQs

- How to withdraw EPF for Covid19 emergencies?

You need to ensure that your KYC is linked with your UAN before applying.- Visit Member e-Sewa portal

- Login to your account

- Click on ‘Online services’ and select claim (Form -31, 19,10C and 10D)

- Check the details on the next page and enter the last 4 digits of your account number

- Click ‘Proceed for online claim’

- From the drop-down, select the ‘PF advance (Form 31)

- Choose the purpose of withdrawal as ‘Outbreak of pandemic (COVID-19)’

- Enter the amount required, address and upload the scanned copy of the cheque

- An OTP will be sent to your registered number verify the OTP to claim your request

- What is the EPF rate for the year 2019-20?

The EPF interest rate is evaluated every year (financial year) by EPFO board after consulting with the Ministry of finance. The interest rate for 2019-20 is 8.50%. - What are the different types of EPF forms?

Form Name Purpose 19 EPF Withdrawal 10C Pension withdrawal 13 EPF Transfer 31 Advances/ Withdrawal 14 LIC Policy 10D Pension Application after Retirement 51F Insurance Claim after Death of a member 20 EPF Withdrawal in case of Death of a member - Do I need to create an account for filing transfer claims?

Yes, you need to register to the member portal for filing the transfer claim. - Who will receive the retirement benefits in case of a member’s death?

In case of death of the registered member his/her spouse and children (utmost 2) will receive the benefits. - What is the employee’s contribution to EPF?

Both the employer and employee should contribute 12% of employee’s salary for EPF. 8.33% of the contributed amount is deducted toward pension scheme. - Do I need to create a new EPF account if I change my job?

No, in case of job change you can apply for account transfer online by submitting Form 13(R). - Can I pay more than 12% share towards EPF?

Yes, you can contribute more than 12% share towards EPF but the total contribution shouldn’t exceed 15,000 per month. - Can an employer reduce the wages of the employee on account of payment to the EPF?

No. This is considered as an illegal practice and it is barred under the section 12 of EPF & MP Act 1952. - Is there a restriction in the period of membership for EPF members?

There is no restriction of period for the membership for the EPF members. A person can continue to contribute to his/her EPF account even after leaving the job. However, if there’s no contribution to the account for 3 consecutive years, the lump sum may stop gaining interest.

EPF – Latest Feature

Employer’s Intervention Not Required: EPFO Subscribers Can Now Update Their Exit Dates Online

EPFO subscribers can now breathe a sigh of relief. Seeing that subscribers would often complain about their ex-employers for not cooperating or taking excessive time to update their exit dates, the retirement fund body has introduced a new feature online wherein subscribers can update exit dates on their own without the employer’s help.

Updating exit dates is mandated by the EPFO, especially to transfer a PF account from the previous to the current employer, but more importantly, to withdraw PF funds — without the updated date of exit, subscribers cannot withdraw their PF funds.

Here’s how you can update your Date of Exit on the EPFO portal:

Step 1: Log into the EPFO portal (epfindia.gov.in) with your Universal Account Number (UAN) and password.

Step 2: Navigate to ‘Manage’ and Click on ‘Mark Exit‘. Then choose the PF account number from the ‘Select Employment‘ dropdown.

Step 3: Enter the date of exit and the reason for exit.

Step 4: Click on ‘Request OTP’ and enter the OTP sent on your registered mobile number (the number must be active and linked to your Aadhaar). Then select the checkbox.

Step 5: Click ‘Update’ hit ‘Ok’.

After clicking on ‘Ok’, the date of exit will be automatically updated. EPFO subscribers must note that the date of exit can only be updated after 2 months has lapsed from the actual date of exit.

Related Articles on EPF