Income Tax Login And Registration Guide

If you have been a tax-paying salaried person in India, then you will know that you can easily file your income tax returns (ITR) from the income tax portal. The income tax e-filing portal also enables taxpayers to learn of deduction details, check refund status, and e-verify returns.

Table of Content

If you have been a tax-paying salaried person in India, then you will know that you can easily file your income tax returns (ITR) from the income tax portal. The income tax e-filing portal also enables taxpayers to learn of deduction details, check refund status, and e-verify returns. However, all this is made simple only and only if you have certain pre-requisites. You will find them listed below –

- A valid email ID

- An active Indian mobile number

- Permanent Account Number (PAN)

- Residential address proof (Passport, Utility bills, etc)

As an individual taxpayer, if you have all of these requisites, registering, and logging in to the income tax department portal is very easy.

Registering with the Income Tax Department (ITD) portal

Once you have the required information as listed above, you can go ahead and begin the registration process. Here’s a step-by-step guide on how to go about doing it –

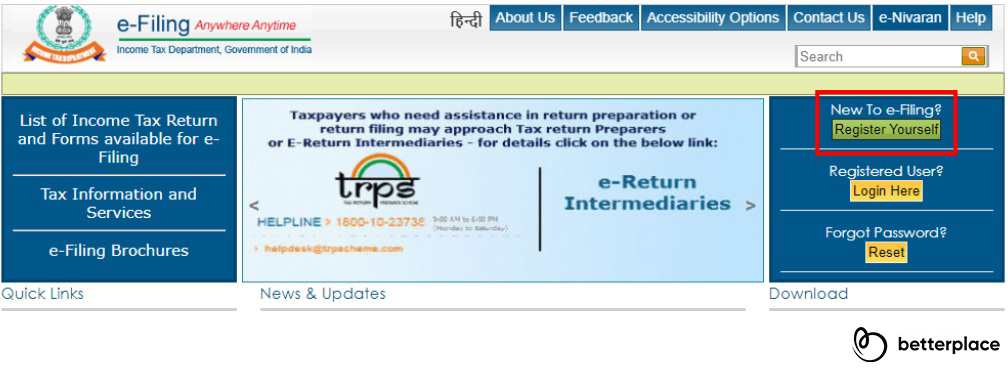

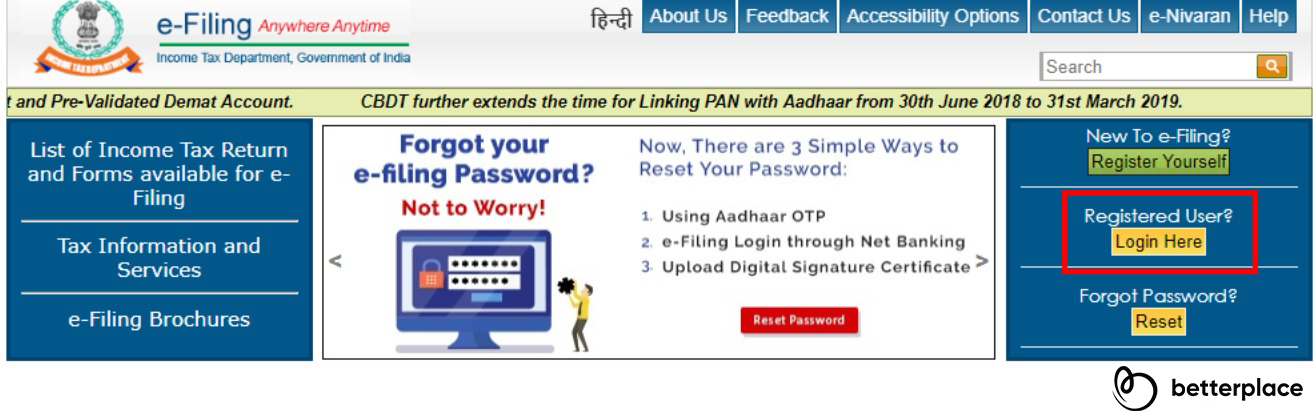

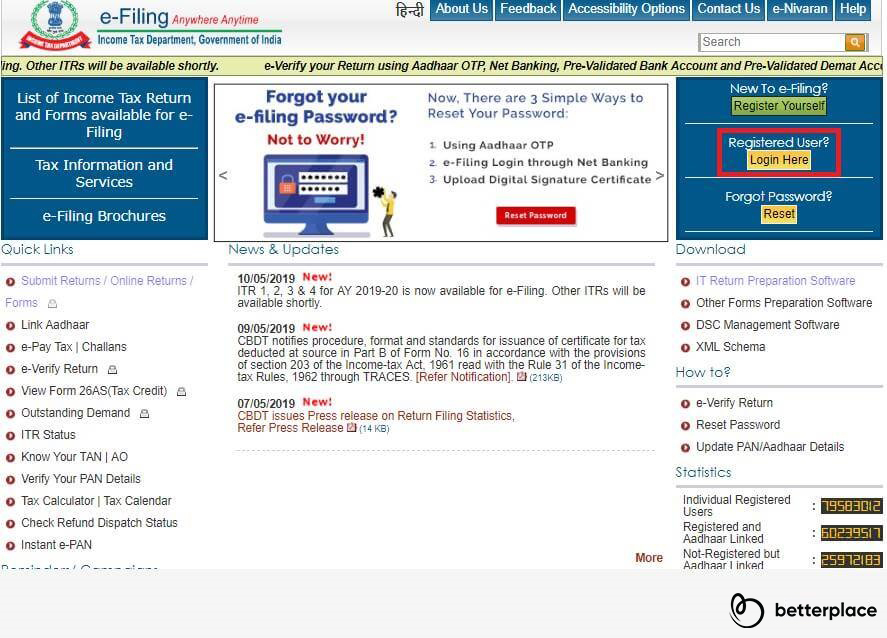

Step 1: Navigate to the income tax department portal and click on “Register Yourself”. It should be located on the right side of the main page of the website

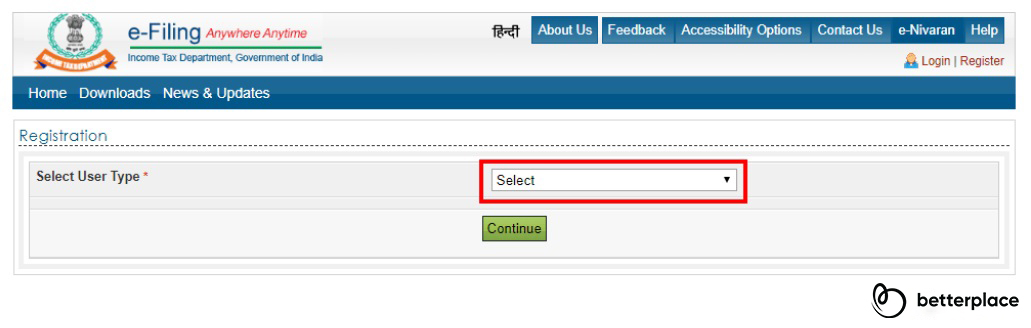

Step 2: Once you click on it, the website will prompt you to select any one of the following –

- Hindu Undivided Family (HUF)

- Individual

- Other than individual

- External Agency

- Chartered Accountants

- Collector

- Third-Party Software Utility Developer

You would be selecting “Individual” as you’re registering yourself on the income tax department portal and will use the same for filing your income tax return as well.

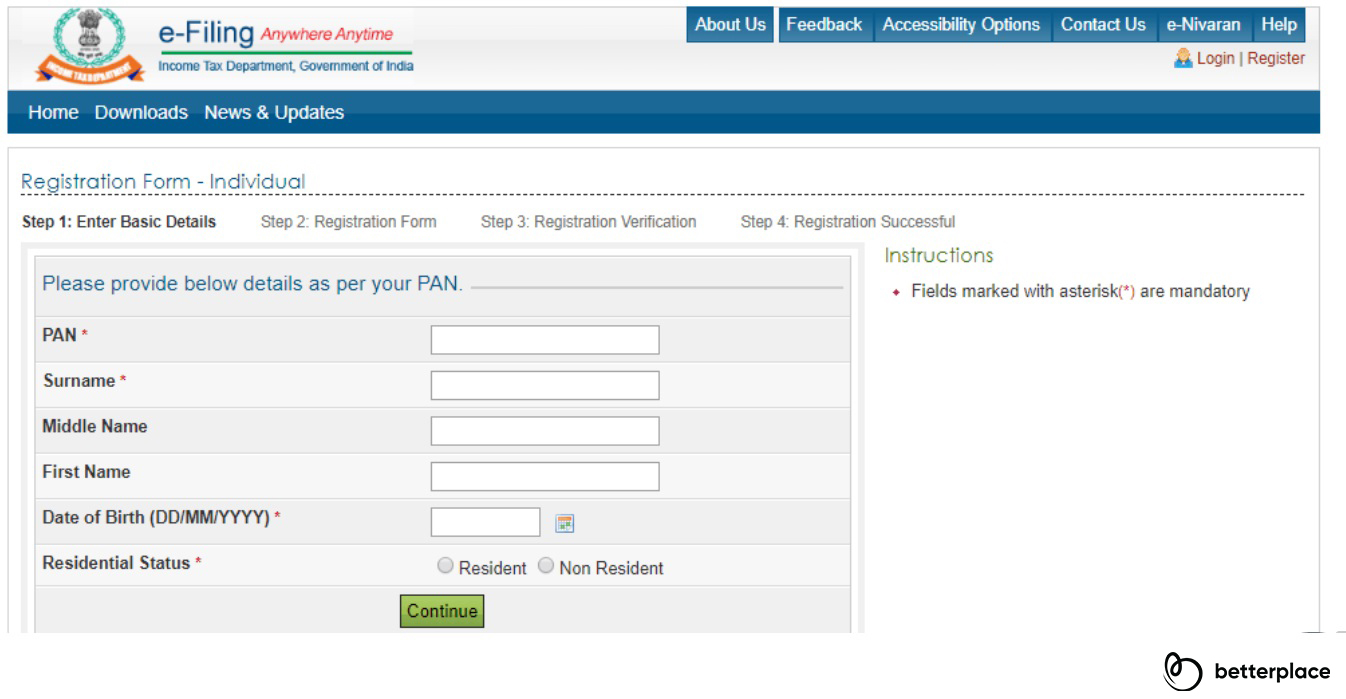

Step 3: After step number two you will be asked to fill in some basic information like your full name, PAN number, Surname, Middle Name, Date of Birth, and Residential Status. Fill everything and then click “Continue”.

Step 4: Post clicking “Continue” you will be redirected to a registration form that will allow you to create a password, username, etc. Click on “Submit” once you’re done.

Step 5: Once you click “Submit” you will receive a six-digit OTP both on your phone and email ID. If however, you had selected “Non-Resident Individual”, you will receive the OTP in your email ID only. Input it before 24 hours as it will then expire and you will have to restart the entire process.

There you go! So go ahead and register on the income tax portal now and complete your income tax registration process officially.

Logging in to the income tax department portal

Now that you have successfully learned how to register yourself on the income tax department portal, let’s look at how to log in –

Step 1: Open the income tax e-filing portal which you visited for registration

Step 2: As you have already registered with the income tax department, you can head directly to the button that says “Login” on the top right corner of the webpage.

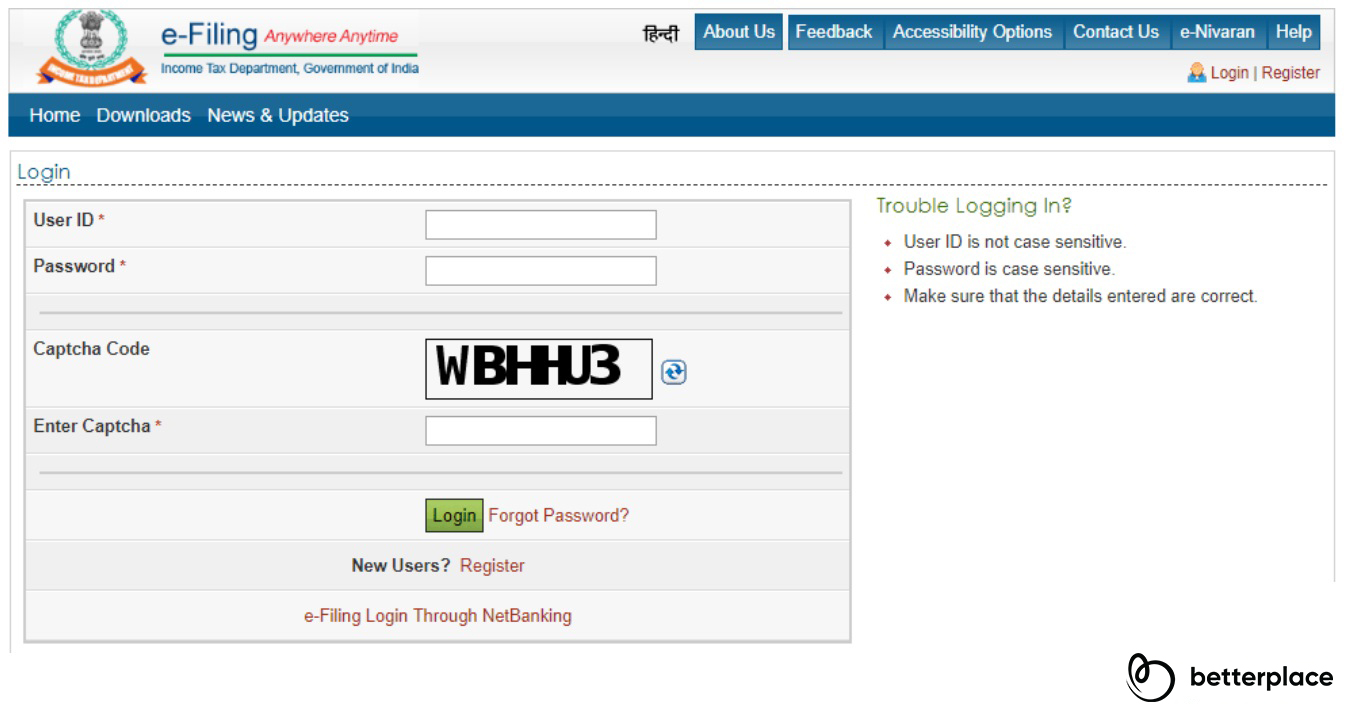

Step 3: Once you have entered the login page you need to input your username and password that you created during registration and just click “Login”

Note: The user ID will be different for different user types. If you had selected Individuals/HUF/Other than Individuals then the user ID will be your PAN number

Step 4: After you click “Login” there will be a small window that will ask you to enter a “captcha value” which is nothing but a security check. If you are visually challenged in any way, you can use the OTP option which will send you an OTP to your registered phone number instead of a “captcha value” that you need to enter.

That’s it! You’re logged in! Now go ahead and file your ITR or upload documents according to your requirements. As you can see, the digitisation of the entire process has made things a lot simpler if you don’t understand the tax process completely.

If you are going with online income tax calculators who promise to file your returns as well, be careful when you do your research as there are lots of dubious ones that you would like to avoid.

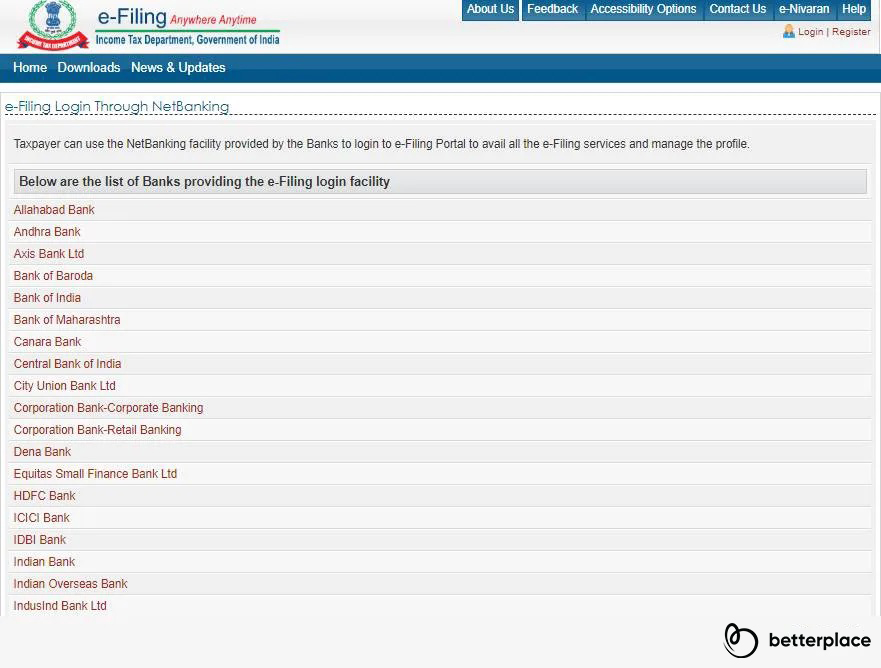

Login to e-filing portal via Internet Banking

E-portal of Income Tax allows individual tax assessee to log on to the e-filing portal through interface of internet banking of major banks in India. Currently, this facility is only available to those who have updated their PAN details with their respective banks.

- Visit eportal through your bank’s net banking page

- This page showcases a list of banks that offer Income Tax login through their net banking platform.

- Click on your Bank’s name to access the netbanking portal

- Log in to your account with your net banking details ie, id and password

Reset the Income Tax E-filing portal password

You can easily recover your eFiling portal password if your mobile number linked with Aadhaar is with you. Other than OTP verification, the IT department provides 3 more ways to reset your password. Follow these steps to retrieve your forgotten or lost password.

- Go to Income Tax Filing portal home page

- In the right hand side you’ll get to see a subsection ‘Forgotten Password’

- Click ‘Reset’

- On the next page enter you portal id viz you PAN number

- Fill up the captcha code and click ‘Continue’

- On the next page select your feasible way to change the password. The options available are;

- Answer secret question (as set at the time of Income Tax e-filing portal registration)

- Upload DSC (Digital Signature Certificate)

- Using e-Filing OTP

- Using Aadhaar OTP

- Once you choose the feasible option, you can either upload documents or enter OTP to change the password.

- Make the new password stronger by adding alphanumerals and symbols.

Frequently asked questions

1) How to link my Aadhaar number to PAN using the e-filing portal?

- Login to the e-filing portal

- Select ‘profile setting’

- Click on ‘Link Aadhaar’

The Aadhaar number of the taxpayer will be linked to the PAN only if the date of birth in both the documents are identical.

2) What should be done if the principal contact is a non-resident who doesn’t have a PAN number?

As per the regulations provided by CBDT, non-residents without PAN are entitled to be an authorized signatory. They can file on behalf of the company/organization without a PAN encrypted DSC. In such cases, the company should send an email to efilinghelpdesk@incometaxindia.gov.in specifying all the information regarding this ie. company name, PAN number, name of the principal contact, and date of birth of the principal contact.

3) What to do if the PAN field is not available while updating Principal Contact details on the profile?

If the principal contact is added as an exceptional case in filing (non-resident, foreigner etc.). To remove this limitation, the taxpayer should send a mail to efilinghelpdesk@incometaxindia.gov.in specifying details such as company name, PAN, Date of Incorporation, name of Principal Contact, PAN of the Principal Contact and date of birth of the Principal Contact. Once completed, the exempted details will be removed and the Principal Contact will be able to record the PAN of the added Principal Contact.

4) If the company has listed a foreigner/non-resident without a PAN as the principal contact, how should the ITR XML be generated?

You can use a dummy PAN to fill up the verification field. It can be used only for verification. A DSC with the dummy PAN will not be accepted by the authorities.

5) Digital Signature Certificate without PAN encryption be used in any cases?

This case is acceptable only if the principal contact of the company/firm is a non-resident or a foreigner. In case if the principal contact does have PAN, DSC with the same PAN should be used for the same.

6) What should be done if the principal contact assigned in the filing portal has changed?

You need to add the new authorized signatory (Principal contact) in e-Filing portal.

- Login to e-filing portal

- Click on ‘profile settings’

- Select ‘Update Principal Contact details’

- Add the PAN and contact details of the new Principal Contact.

- Click ‘Submit’

To update the DSC of new Principal Contact –

- Go to ‘Profile Setting’

- Click on ‘Register Digital Signature Certificate’

7) What to do if I forget the password?

- Go to Income Tax Department e-filing portal

- Click ‘Forgot Password’

- Enter your user ID, fill up the captcha and click on ‘continue’

- There will be 2 options to retrieve the password on the next page. Select any of these and complete the process.

- Answer the secret question

- Upload DSC (Digital Signature Certificate)

- Click submit

- The new password will be sent to the registered email address.

- Login to the e-filing portal with the new password

- On first login, you will be asked to change the password

- Enter the new password of your choice and click ‘Submit’

8) Can a legal heir e-file the returns of a deceased taxpayer/assessee?

The legal heir can file returns, view the status of returns, view status of ITR V acknowledgement and other filing status on behalf of the Income Tax Return of the deceased person for the respective Assessment Year.

Latest News on Income Tax

How are winnings from online gaming taxed?

September 14, 2020: The income earned from online gaming and lucky draws etc falls under section 115BB of the Income Tax Act. It is mentioned under the head ‘Income from other sources’. This head also includes money gained from bets, gambling, card games etc.

Online gaming income is taxed at a flat rate of 30 percent without cess. The net tax rate after cess comes around 31.2%. These winnings don’t benefit from the basic exemption limit. The prize money provider should deduct tax at source before prize distribution. The TDS is calculated based on the TDS provision laid down under section 194B. It is only applicable if the prize money exceeds ₹10,000. No exemptions and deductions are valid for claims against such income.

Gamers should realize that any rewards on which TDS has been deducted will in any case should be unveiled in their income tax returns. The gaming organizations take the gamer’s PAN alongside the ledger subtleties. Be that as it may, the gamer’s duty doesn’t end with giving these subtleties. The recording/reporting of such income earned should be done while filing the tax returns.

Scrutiny of income tax returns lessened to 0.25 pc – FY 2018-19

August 14: According to the latest reports by the Finance Ministry, the level of scrutiny has reduced to 0.25% of returns filed in the assessment year 2018-19. The scrutiny rate is following a decreasing trend and has decreased drastically over the past four years. The scrutiny rates for assessment years 2015-16, 2016-17, and 2017-18, are 0.71%, 0.40%, and 0.55% respectively.

In Delhi, the rate of scrutiny has decreased from 1.12% in 2015-16 to 0.52% in the assessment year 2018-19. During the assessment year 2018-19, around 3.2 million income tax returns were filed in Delhi alone. Maharashtra has over 66.6 million pan cardholders whereas in Delhi there are about 16.6 million. In Maharashtra, the cases selected for scrutiny has reduced to 0.38% of 9.7 million filed IT returns in the assessment year 2018-19.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space