How Can I Check The Status of My Income Tax Returns?

To offer convenience to all the taxpayers, the Income Tax Department has utilised technological resources in providing them access to all services related to taxation online. Taxpayers can now submit their income tax returns form online and also verify the ITR status online on the e-filing website.

Table of Contents

You can now check your ITR status online by simply login into the e-filing portal. Considering the number of services provided by the portal, you may find yourself confused about where to go and what to do.

We have created this step-by-step guide that helps you navigate the portal and check your ITR status online. Before we proceed, let us first understand what ITR status is.

What is the income tax return status?

After an individual has filed and verified their income tax returns (ITR) for the given year, they need to know the current level at which the processing of the ITR by the Income Tax Department stands. This is known as the ITR status and the act of verifying it is called the ITR status check. One can check their ITR status online.

It is essential for an individual to check their ITR filing status to ensure that their income tax returns form was accepted and is under processing with the Income Tax Department. Once your ITR application gets accepted and duly processed, you will receive confirmation about the same from the Income Tax Department website. Also, if the individual’s ITR application is liable for any refunds, then it will get processed once the assessment of their ITR Form is completed. Usually, it takes approximately 15 days to complete the assessment thoroughly. Thus, if an individual is expecting some kind of refund post the assessment, then they should check the official portal routinely to stay updated about the status of their income tax returns.

What are the ways to check ITR status?

To make it convenient for the taxpayers, the Income Tax Department has utilised technological resources in providing them access to all services related to taxation online. Hence, an individual can submit their income tax returns form online and also verify the ITR status online on the e-filing website.

Checking your ITR status online is quite simple. You can either do this yourself by following the steps that are mentioned below in this article. Or you can take the help of your registered CA to check the status of your ITR.

Check ITR status online

The process of checking ITR status online is an easy process which can be done by following either of the two simple methods:

- Method #1 — An individual can check the income tax returns status online with the help of the acknowledgement number, which they would have received while filing for the income tax returns, using their PAN number.

- Method #2 — The individual has to log in to the Income Tax Department’s e-filing website with the help of the password and login ID, and then, check the status of their income tax returns applications.

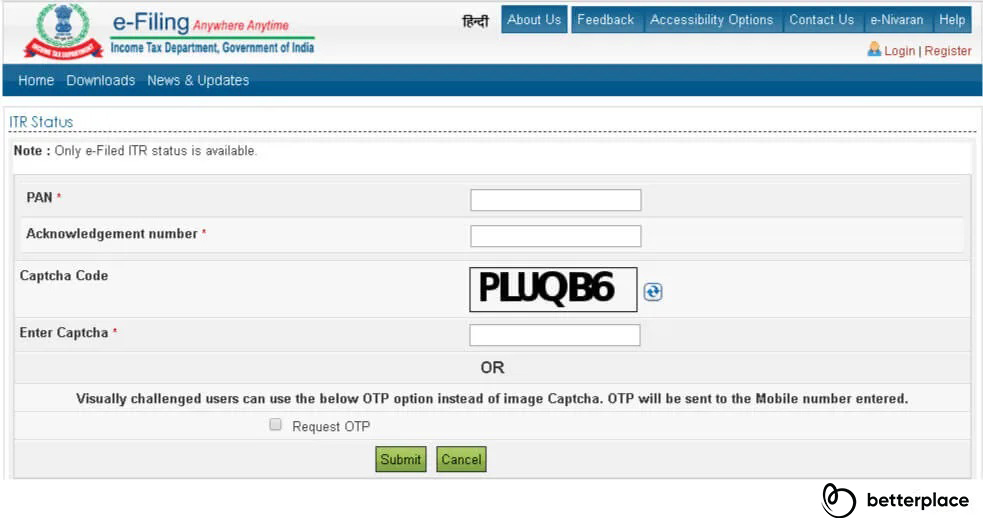

With PAN number and Acknowledgement number

The steps to check the ITR status with the help of the acknowledgement number and PAN number are as follows:

Step 1: Visit the e-filing website of the Income Tax Department of India. On the left side of the page, under “Quick Links”, you will find “ITR Status”. Click on this option.

Step 2: This will lead you to another page, wherein you will be asked to enter the PAN number and Acknowledgement number, followed by the Captcha code for verification. Users, who are visually challenged, can make use of OTP instead of the Captcha. The user will receive an OTP in their registered mobile number.

Step 3: After filling the details as required, click on “Submit”. After you click on the “Submit” button, a new page will open, which will show the status of the income tax returns form.

What are the different types of Income Tax refund status?

- Undetermined – This indicates that your ITR has not yet been completed.

- Refund received – The Revenue Administration has mailed your reimbursement through the form of a check or a straight debit to your bank account number that you supplied when you filed your claim.

- Evaluation Period is not reflected in Reimbursement / Appeal Status – You have failed to submit the report.

- No Claim, No Return – You might well have requested reimbursement in your ITR, but the Department may determine that you aren’t eligible for compensation based on their calculations.

- Refund Unpaid- This signifies that the Department has issued you a reimbursement, but your location is inaccurate or the financial details you gave are incorrect.

- ITR completed reimbursement calculated and forwarded to Refund Lender – This indicates that the Department has reviewed your returns and a payment attempt has been created. The information is given to the return banker for verification.

- Demand determined – This signifies that the IRS has denied your rebate claim and rather issued an ongoing demand for taxes owed.

- Consult the Judicial Assessment Officer – This indicates that the IT administration needs clarity or details on your ITR.

How is the Payment of Income Tax Refund done?

ITRs are issued either immediately via NECS/RTGS or via check. Make absolutely sure to include all of the bank information, including your account number, the IFSC code, and your contact location. It will make it simple to send income tax returns straight to your account.

How to Request for Refund Reissue?

Access the ‘e-Filing’ Website at https://www.incometax.gov.in/iec/foportal/. Navigate to ‘Your Profile’ > > Select ‘Maintenance Demand’ > Select ‘See Application’ as the ‘Demand Type,’ and ‘Reimbursement Remake’ as the ‘Demand Type.’ Click the ‘Submit’ button.

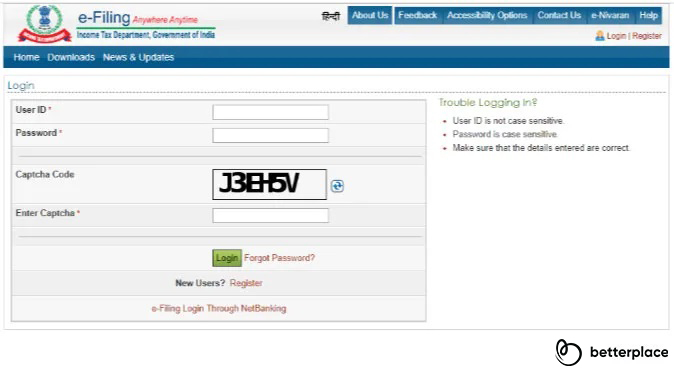

Logging in into the website

An individual can check the income tax return status by logging into the e-filing website of the Income Tax Department, by following the steps as mentioned below:

Step 1: Go to the e-filing website of the Income Tax Department.

Step 2: Sign in to the website with the help of your “User ID”, “Password” and “Captcha”. After you enter the details, click on the “Login” button. If the individual doesn’t have an account, then they can create one by clicking on the “Register” button.

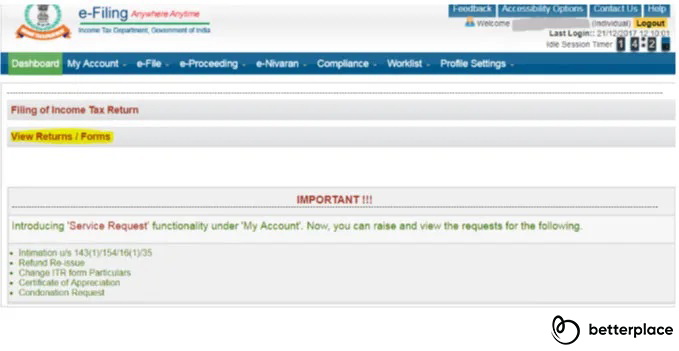

Step 3: After logging in, you will be directed to the dashboard, where you will find the option of “View Returns/Forms”. Click on this option.

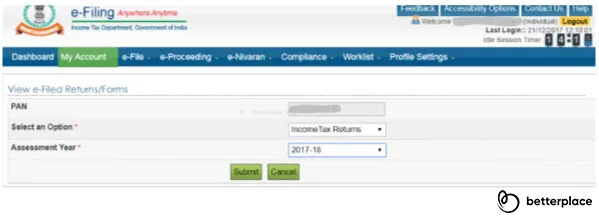

Step 4: A new page will appear on your screen. From the dropdown menu, “Select an option”, choose “Income tax returns”. From the dropdown of “Assessment Year”, select the right year to check income tax returns status. Then, click on the “Submit” button.

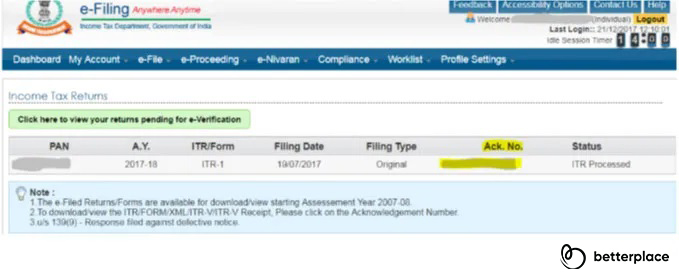

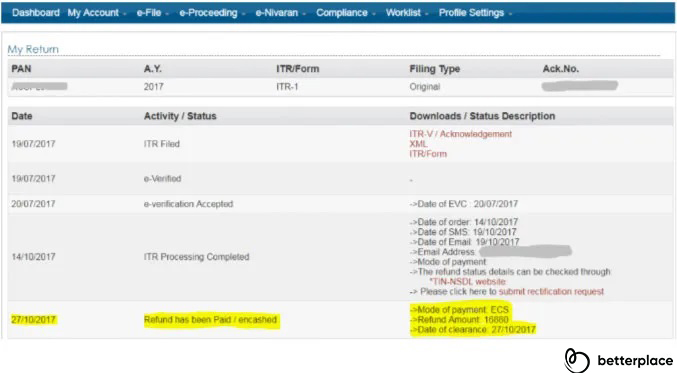

Step 5: Once you select the assessment year and hit the “Submit” button, the relevant acknowledgement number will appear on the screen. Click on the acknowledgement number.

Upon clicking on the acknowledgement number, a new page will open on your screen which will highlight the income tax returns status, as shown in the screenshot below.

Similarly, different kinds of status messages may appear on the screen with regards to your ITR status:

- If the status reads as “Submitted and pending for verification”, it means that the individual has filed their ITR returns but has not yet verified it.

- If the status reads as “Verified or Successfully verified”, it means that the individual has submitted as well as verified the income tax returns form. However, the ITR Form has not yet been processed. In this case, the individual has to wait for a few more days for their ITR form to get processed.

- If the status reads as “Processed”, it means that the Income Tax Department has successfully processed the ITR Form of the individual. It also means that refunds, if any, can be initiated and the refund amount will get credited into the bank account of the individual.

- Sometimes, you can also see the status as “Transferred to Assessing Officer” or “Defective”. In this case, the individual has to follow with their designated Assessing Officer in their relevant zone.

With the help of these simple steps, you can check the status of the income tax returns form online. Plus, you can also verify the income tax refund status 2018-19 by entering the correct assessment year.

Check Related Articles

Latest news

Income Tax Dept Issues Refunds Worth Rs 1.01 Lakh Crore

September 14, 2020: The Income Tax Department has given refunds of about Rs 1.01 lakh crore to 27.55 lakh taxpayers within April 1 to September 8, 2020. The information was shared to the public via the official twitter handle of the CBDT. The administration has accentuated on giving tax-related services to taxpayers without any hassles amid the COVID-19 pandemic, and in like manner has been clearing up forthcoming tax refunds.

The refund includes personal income tax (PIT) refunds up to Rs 30,768 crore issued to 25.83 lakh members and corporate tax refunds amounting to Rs 70,540 crore issued to over 1.71 lakh organizations.

“CBDT issues refunds of over Rs 1,01,308 crore to more than 27.55 lakh taxpayers between 1st April,2020 to 08th September,2020. Income tax refunds of Rs. 30,768 crore have been issued in 25,83,507 cases & corporate tax refunds of Rs.70,540 crore have been issued in 1,71,155 cases,” stated the Central Board of Direct Taxes (CBDT) in a recent tweet.

FAQs on Income Tax Refund Status

Why is it taking a long time for my reimbursement status to be updated?

If you haven’t received your refund within three weeks, the tax return may need to be reviewed again. This might occur if your statement was partial or wrong. If you requested the Additional Child Tax Credit, you could also face difficulties.

How long will it take for the refund to be approved?

IRS is waiting more than 3 weeks to provide reimbursements for a few 2020 tax returns which need to be reviewed, such as those with improper Recovery Reimbursement Allowance amounts or those that utilized 2019 revenue to calculate the (EITC) and (ACTC).

Why can’t I find Where’s My Reimbursement?

A tax deduction can be postponed for a variety of reasons, including an inadequate return, an erroneous return, a revised return, tax evasion, trying to claim tax incentives, owing to definite debts whereby the government could take your refund, and having to transfer your reimbursement to the false bank because of the erroneous routing number.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space