Everything You Need to Know About Form 26AS

Everybody pays taxes. But the process of figuring out payable taxes and how to file them often creates confusion. Luckily, the Income Tax Department provides help in the form of online tools and forms that help calculate and file taxes. Form 26AS is one such aid provided by them.

26AS – Table of Content

What exactly is Form 26AS?

Form 26AS is one of the most important documents required to file an income tax return.

In simple terms, it is a consolidated tax statement which provides information on deducted taxes from the income earned. It also shows details about the self-assessment tax payments or advance tax paid during a relevant financial year.

This form is simply available on the official income tax website for the users who have a permanent account number (PAN) card and contains additional information such as:

- Income tax refunds received during the financial year

- High-value transactions such as mutual funds, shares, fixed deposits etc.

- Tax Deduction and Collection Account Number (TAN) information and consolidated details of deductors and collectors

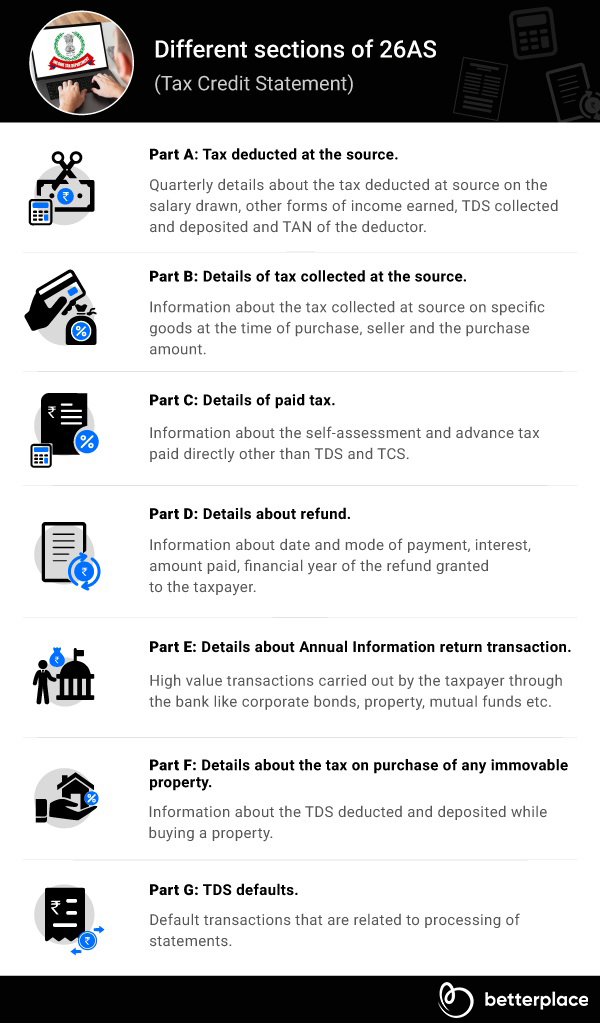

Different parts of form 26AS

Form 26AS is composed of 7 parts. These are:

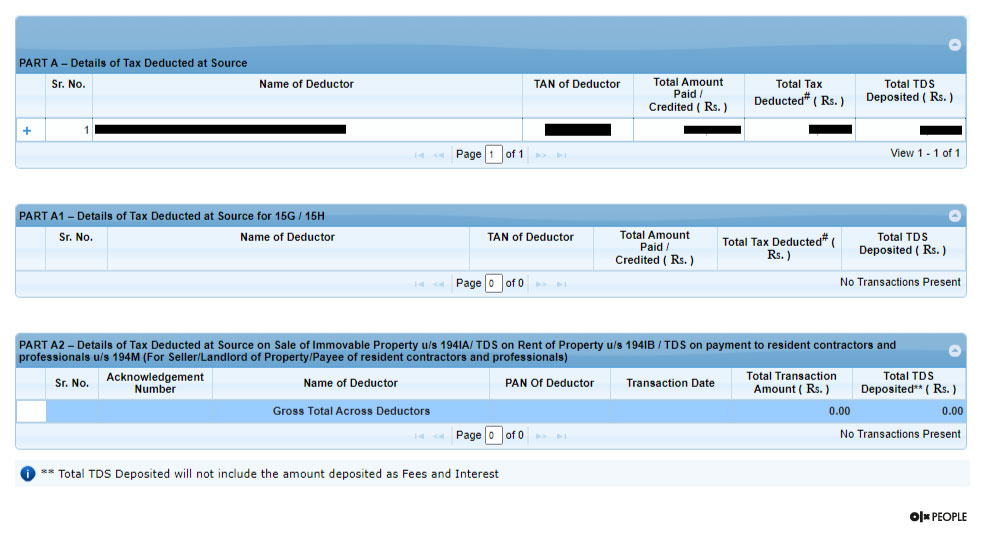

Part A: Tax deducted at the source

This part of the form provides quarterly information about the tax deducted at source on the salary drawn, income earned on interest, salary, pension income etc. It also contains the TDS collected and deposited along with the TAN of the deductor. Part A is further made up of:

Part A1: TDS information for Form 15G/ Form 15H

This part contains information about the income where TDS is not subtracted as Form 15G/15H has been submitted. It also allows the verification of the TDS status if the form has been submitted. And displays the ‘No transactions present’ status in case the form isn’t presented.

Part A2: TDS information on the sale of (seller’s) immovable property u/s 194(IA)

Applicable only in the case of the sale of a property in the year and TDs being deducted from the receipt.

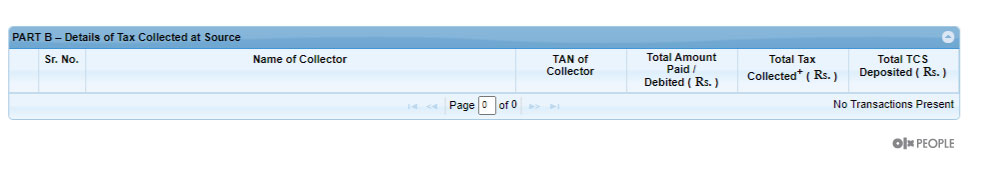

Part B: Details of tax collected at the source

This section is all about the tax collected at source on specific goods at the time of purchase. It will also include the information about the seller and amount.

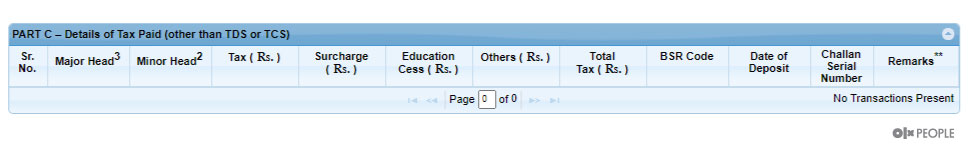

Part C: Details of paid tax (other than TCS or TDS)

This section of form 26As will display information about the (self-assessment and advance) tax paid directly. It will reflect the challan details used to deposit tax.

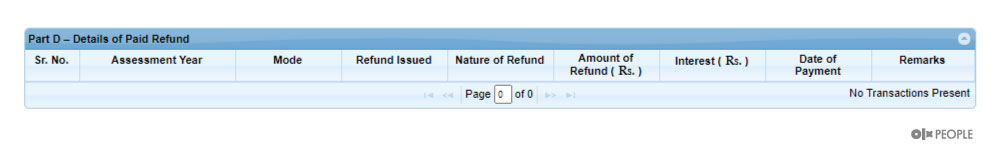

Part D: Details about refund

This section of the form will contain information about the refund granted to the taxpayer. It includes details like the date of payment, mode of payment, interest paid, the amount paid, and the financial year to which this refund belongs.

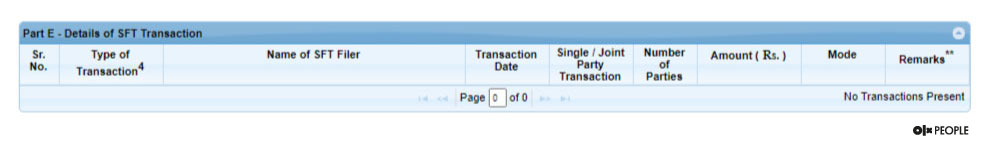

Part E: Details about Annual Information return transaction

This will include information about the transactions that are high in value and is carried out by the taxpayer through the bank. It might include purchases of high value like corporate bonds, property, or even mutual funds.

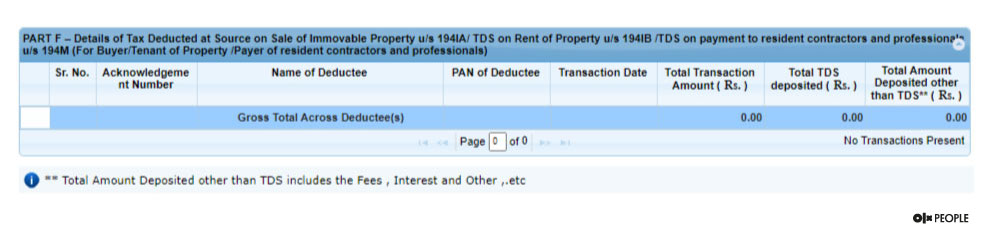

Part F: Details about the tax applied and deducted on purchase of any immovable property (for buyers)

This part offers information on the TDS deducted and deposited while buying a property. TDS deduction is mandatory before any sort of payment is made towards the seller.

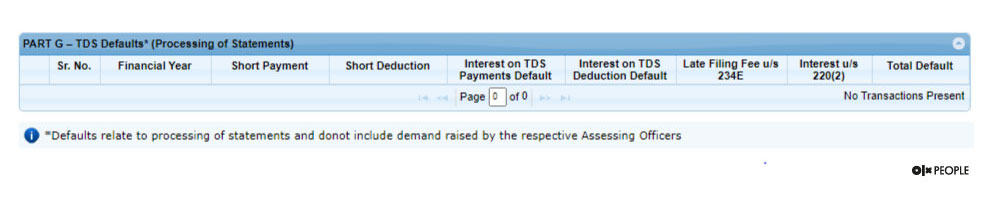

Part G: TDS defaults

Contained in this section are defaults that are related to the processing of any statements, and will not include the demands raised by an assessing officer.

With the due date for filing ITR, fast-approaching it’s important that you understand the value of Form 26AS. However, always be mindful of the information being submitted. Never furnish inaccurate information and always review all entries before the final submission.

Obtaining Form 26AS

This form can easily be downloaded from the online website of the income tax department. In order to get your form 26As, all you have to do is to log into the account that you used to file the income tax. You can also use the net baking option that is provided by some banks that are authorized. After you have logged into your income tax account, you will find an option named View form 26AS. This option will be present in the quick link tabs or in the “My Account” menu. After you have reached here, all you have to do is to choose the correct year of assessment. You need to select the year that you need to get the details of. You can now easily download the form and have a look at it.

One of the most important things that you need to keep in mind is always to verify the details that are mentioned in your form, 26As. You need to immediately point out the mistakes to the concerned authority if you find one. This will be helpful in making the required corrections.

How to View and Download Form 26AS ?

You can easily download Form 26AS by logging on to your Income Tax Filing profile in the Income Tax Official website.

- Visit ‘e-Filing’ portal

- Log in to your tax-paying profile

- Go to ‘My Account’

- Click ‘View Form 26AS (Tax credit)’

- Read the given disclaimer

- Click ‘Confirm’

- The TDS-CPC portal will open up

- Click ‘Proceed’

- Click ‘View Tax Credit (Form 26AS)’

- Select the Assessment Year

- Select the view type (HTML, Text and PDF file types are available)

- Click ‘View/Download’

Availability of Form 26AS

Form 26AS can be easily downloaded from the Income Tax filing profile as mentioned above. Other than this, you can also avail Form 26AS through the following means.

Through TDS portal

- Register at the TDS Reconciliation Analysis and Correction Enabling System (TRACES) by the Income Tax Department

- Login to your account

- Click on the tab ‘Form 26AS’

- Click ‘Download’

- The file will be password protected. The password will be your Date of Birth in DDMMYYYY format.

Net banking

- You can obtain your Tax Credit Statement (Form 26AS) via net banking if your PAN card is linked with the bank. You can log in to your online banking profile to download the Form 26AS for free.

How Form 26AS helps in filing the return?

The Form 26AS is a yearly merged tax proclamation that can be gotten to from the annual tax site by all taxpayers utilizing their Permanent Account Number (PAN). In the event that you have paid taxes on your income or tax has been deducted from your salary, the Income tax department will have all these information recorded in their database. Taxpayers can refer to Form 26AS for the information on the salary (on which taxes have been deducted) just as the taxes that have been paid by the deductor. Furthermore, Form 26AS additionally contains information of your deductors, for example, the name of the deductor and Tax Deduction Account Number (TAN).

Information of taxes paid by you and refunds

Form 26AS encompasses all the relevant financial transactions of the taxpayer. This includes any tax refunds the taxpayer received for the financial year.

TDS marked for the sale of immovable property

If someone buys an immovable property, the buyer should deduct the tax at source from the amount paid to the property seller. The details of the sale of property during a fiscal year along with tax details will show up in the Form 26AS.

TDS on property rent

Indian citizens receiving a monthly rental income of Rs. 50,000 per month from an individual, are obliged to deduct tax at source before making the payment. The information of the deducted tax will be reflected in the Form 26AS.

TCS on car sale

For every car purchase, the buyer should pay the seller a tax amount of 1% on the purchase price if the price of the car exceeds Rs.10 Lakhs. This amount will be deposited by the seller with the treasury. The information on the tax collected on your behalf will be shown in Form 26AS.

High valued transactions

The high-value transactions performed through your account or financial institutions will be summarised in the Form 26AS. This will be based on the Annual Information Return (‘AIR’) filed by the respective organization (bank) or institution. The purchase of mutual funds, corporate bonds, stocks, immovable property etc which are highly valued will be shown here.

Advance tax and self assessment tax paid by the taxpayer

In the event that the taxpayer has covered any advance tax or self assessment tax during the year, the equivalent will likewise get reflected in the Form 26AS.

Document showing all the tax paid by you

The Form 26AS records all taxes paid by the respective taxpayer in a fiscal year. It captures all tax-related information – direct paid tax or deducted on your behalf, making the process of crediting the taxes easier while filing the Income Tax Returns. The Form 26AS is updated every quarter. All the tax credits reflecting in the form are eligible for claiming the returns.

Verify details in Form 26AS

Introduction of Form 26AS has precluded the requirement to submit the TDS certificates (Form 16 / 16A) by the taxpayer with the tax return. It is important to verify the details in Form 26AS and inform the authorities in case of any discrepancy. Under or overreporting of income might cause a lot of hassles to the taxpayer in the long run. Tax mismatch in Form 26AS will later result in inquiry from the respective authorities. Every taxpayer should ensure that the taxes claimed in the return are in line with tax information listed in the Form 26AS.

How does Form 26AS help in filing income tax returns?

Ever since the government shifted to online transactions, filing income tax returns has become easier than ever. Although the process might seem simple, it is always advised to focus on details to prevent errors from happening. To calculate the tax outgo correctly and to declare all the information needed, it is mandatory to have the essential documents while filing. Form 26AS will have all your financial movements recorded for the existing or recently passed financial year.

Form 26AS helps you to cross-check Form16 to check the deductions and its alignment with advance taxes paid during the financial year and tax deposited as per the department records. It eases up the filing process like this.

TDS deductions for FDs, pension funds and similar investments will reflect in the ITR form. But not all the relevant details would show up on this. Hence comparing Form 26AS with ITR will help you assess the right numbers. You can also make a clear note of income that is reflected in Form 26AS but not matching with the received income or vice versa.

Cross-checking and Verifying Form 26AS with Form 16 (TDS)

Cross-checking Form 26AS with TDS certificate (Form 16) is mandatory since it will verify whether the TDS deducted amount was deposited properly. Other relevant information to verify are:

- Full name, PAN, Deductor’s TAN, Refund amount received, TDS amount on Form 26AS

- TDS data on your payslips

- TDS mentioned in Form 16/16A

For any discrepancy for any of the mentioned details or any other error in Form 16 one should consult with the employer or tax deductor immediately and correct as soon as possible.

How to get errors in Form 26AS corrected?

Taxpayers must get the error in Form 26AS before filing the Income Tax Returns. The easiest way to do this is by reaching out to the deductor or consulting authority for the correction. If your deductor is a Bank and there is a discrepancy in the TDS certificate issued, you need to request the bank to rectify the error and ask them to upload the revised TDS return. Although the deductee doesn’t have the authority to force the deductor to make corrections for the mismatches in filed returns, the only possible way to make such corrections is by consulting with them.

The Form 26AS has a valid format decided by the government. According to the Circulars of the Central Board of Direct Taxes, all the bankers and deductors should generate and download the Form 26AS from the TRACES portal. This is the only valid format of the form. Make sure you are getting the form from an authentic provider to avoid confusions and errors related to the format.

Once an error is rectified on the TDS, the deductor should file the revised TDS and the Form will get automatically updated after a while. It generally takes 1 to 2 weeks to update the 26AS after filing of TDS Return. For the revised TDS, it might take a slightly longer time.

Form 26AS FAQs

- How many days does it take to reflect transactions in Form 26as?

A self-assessed tax paid and will reflect in your Form 26AS within two to three days of the transaction. - What to do if discrepancies appear in actual TDS and TDS credit as per Form 26AS due to deductor?

For deductor side discrepancies, he/she may file TDS/TCS correction statements to correct the error. - How can I claim the excess tax paid?

It can be claimed as a refund by filing your ITR. If you file the return and if your claim is accepted by the tax department, the refund amount will be credited back to your account as Electronic Clearance Service (ECS) transfer. - Does Professional tax get reflected in 26AS?

No. Professional tax is not reflected in form 26AS. - Is the Gratuity amount reflected in 26AS?

Gratuity amount upto 10 lakh is tax free. Any aggregate amount above this value will be reflected in 26AS although it won’t be shown separately. The Form 16 will also show this tax component.

Latest News

New Updated Form 26AS – FY 2019-20

The updated Form 26AS is designed to benefit honest taxpayers with detailed information on financial transactions. However, the new structure may desist individuals or taxpayers who are trying to conceal any transactions in the returns.

The Form 26AS is updated and its scope is enlarged by Finance Act 2020. It’s been notified by Rule 114-I. The form is extensively advanced to provide more relevant information to the taxpayer. It includes 2 parts — Part A and Part B.

Part A provides the basic information of the assessee such as PAN, Aadhaar, and contact information. While Part B depicts TDS, SFT, other tax information, demands, refunds, pending and completed proceedings. It also provides information gained from any authority/body conducting any functions under Section 90/90A or information which fits in the interest of revenue or other transactions.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space