For any taxpayer, it is essential to know their income tax jurisdiction. This helps them resolve their tax disputes, as they can address their issues to the right Assessing officer. Now, you must be thinking why is it important to know your income tax jurisdiction when you file your IT returns online. Let us understand this need with a simple example.

Ajay filed his income tax returns form Pune. While assessing his income tax returns claims and Form 26AS, the authorities at the income tax department find out that the total amount mentioned in the IT returns claim is lower than the figure reflecting in the Form 26AS. Thus, the authorities come to know that Ajay has concealed his income, which is unlawful as per the Income Tax Act. Therefore, the authorities decide to send Ajay a show-cause notice.

Now, there are many Ajays in India, who may have filed their IT returns. How will the income tax authorities pinpoint the right Ajay? If they pursue someone only based on their name, the possibility of committing errors increases. As a result, the show-cause notice may reach the wrong Ajay resulting in inconvenience and creating a lot of problems.

To avoid this error, the Income Tax Department issues PAN (Permanent Account Number) to all taxpayers. This unique number helps segregate taxpayers by their jurisdiction, which allows the department to locate the right offender, and also helps in efficient redressal of grievances. That’s why you need to know your jurisdiction when it comes to filing tax.

What is a PAN?

PAN or Permanent Account Number is a ten-digit number, consisting of alphabets as well as numerics, allotted to every taxpayer as per the section 139A of the Income Tax Act. This PAN allows the Income Tax Department to connect every transaction made by the person under their PAN number. These transactions can include payment of taxes, availing TCS/TDS credit, filing income tax returns, and any official exchange with the IT department.

What is income tax jurisdiction?

India has a vast population. A singular central office is not adequate to handle all the taxpayers spread across different regions of India. Thus, to streamline the process of assessment and grievance redressal, the Income Tax Department has divided taxpayers into various jurisdictions, depending on their region. Any tax dispute of the taxpayer would be considered only in the respective jurisdiction. In case there are discrepancies in the filing of the returns and the assessee gets a notice, then they will have to respond to their respective jurisdiction’s assessing officer only.

How to know your jurisdiction?

Now that you have understood what income tax jurisdiction is, its significance and the importance of PAN, you must be wondering how you will know your GST jurisdiction. How will you find your jurisdiction?

There are two ways to know your PAN jurisdiction. Let us check out the steps for each option one by one.

Option 1:

Step 1: Go to the official income tax department website.

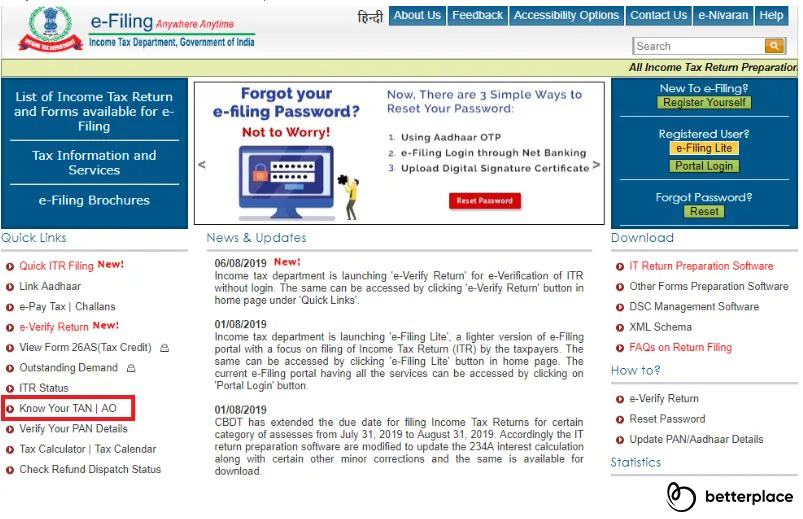

Step 2: From the “Quick Links” on the left-hand side of the page, select “AO” from the “Know your TAN|AO” option.

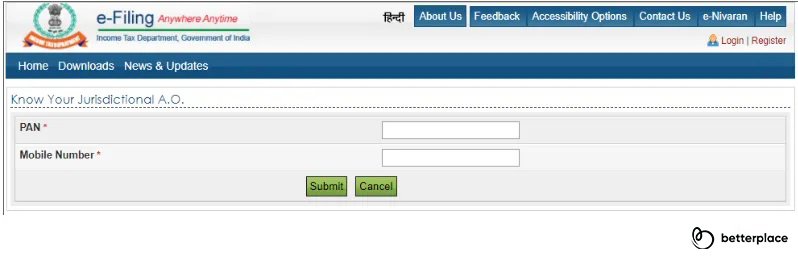

Step 3: A new webpage will open. Enter your “PAN” and “Mobile Number” and then click on “Submit”.

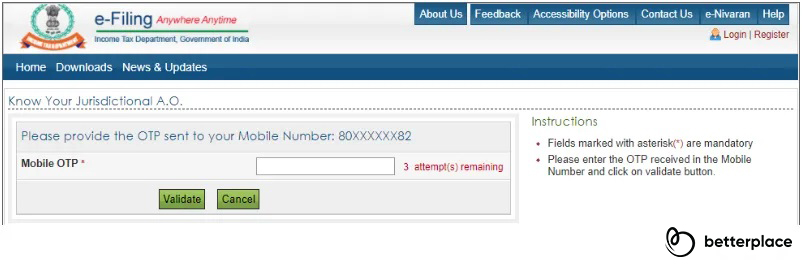

Step 4: You will receive an OTP on your registered mobile number. Enter the OTP os the given filed and click on “Submit”.

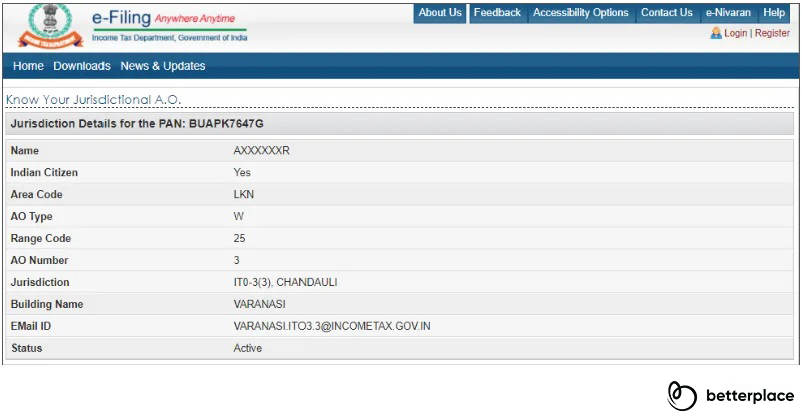

Step 5: After you click on “Submit”, a pew page will open, displaying your AO jurisdiction for your PAN number.

Option 2:

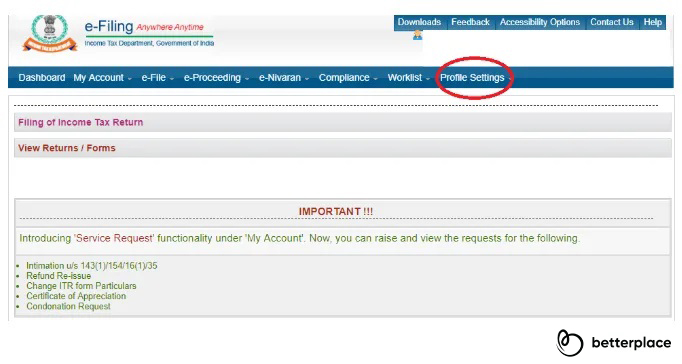

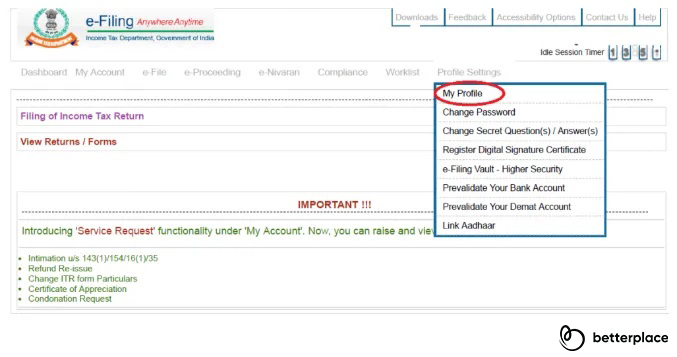

Sign in to the official E-filing website with your Login ID and password. Then, go to Profile Settings, which is on the Menu tab and select ‘My Profile’ from the drop-down.

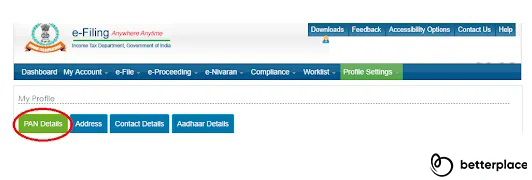

Then, click on ‘PAN Details’

Once you click, these details will get displayed on your screen:

- PAN

- Name

- Date of Birth

- Gender

- Category

- Address

- Status

- Citizenship status

- Jurisdiction details

-

- Area Code

- AO Type

- Range code

- AO Number

- Jurisdiction

- Building Name

- Email ID

Do make sure that you know your GST jurisdiction and quote it correctly in all the places.

With the help of these simple steps, you will be able to know your jurisdiction income tax. Do note that PAN jurisdiction and income tax jurisdiction are exactly the same. So you don’t need to worry if someone asks you about PAN card jurisdiction and TAN jurisdiction, as they are all interchangeable terms. Also, it helps to know your jurisdictional AO (Assessing Officer), so that you can approach them with any grievances.