How to Link Pan Card and Aadhaar Card

PAN Aadhaar linking is mandatory for all taxpayers. As per a GOI notification, from 1st April 2019, it is mandatory to link Aadhaar to ITR as well as provide the Aadhaar number while filing the ITR, unless exempted. Henceforth, a taxpayer cannot file their income tax returns without doing a PAN Aadhaar link.

- Various methods to link PAN card with Aadhaar –

As per the ruling of The Honourable Supreme Court of India, PAN Aadhaar link has become mandatory for all Indian taxpayers. This decision was a part of the verdict about the constitutional legality of Aadhaar, its usage in ITR and other verification purposes. The Supreme court, in its verdict, said that filling the Aadhaar number is mandatory while filing income tax returns. Thus, it has become crucial to do PAN card link to Aadhaar in addition to Aadhaar card link with mobile number. Nowadays, the Aadhaar number is required while applying for a new PAN card itself.

According to the notification by CBDT (Central Board of Direct Taxes), dated 30th December 2019, the final date for PAN Aadhaar link was extended by three months, i.e. till 31st March 2020. Thus, every Indian taxpayer has to link PAN with Aadhaar. If any individual fails to do a PAN Aadhaar link, their PAN number will stop being operational from 1st April 2020.

Through the notification dated 13th February 2020, the Government of India has clarified what would happen next when the PAN is deemed non-operational. As per the notification, the PAN card of those taxpayers, who link Aadhaar with PAN after 31st March 2020, would become operational from the day the taxpayer does the Aadhaar card link.

Also, from 1st April 2019, it is mandatory to link Aadhaar to ITR as well as provide the Aadhaar number while filing the ITR, unless exempted. Henceforth, a taxpayer cannot file their income tax returns without doing a PAN Aadhaar link.

While there are other ways to link mobile number to Aadhaar card online, to understand how to do a PAN Aadhaar link online, read the two ways outlined below:

Taxpayers registered with the e-filing portal

- If an individual is still able to file income tax returns, then there are chances that their PAN number has been already linked to their Aadhaar number. This happens if the Aadhaar number has been mentioned previously by the individual while filing their income tax returns for the preceding assessment year. Sometimes, the Income Tax Department links the PAN number with the Aadhaar number if the details are available with them.

- The individual can check whether their Aadhaar number is linked to their PAN number by going to the e-filing portal of the Income Tax Department.

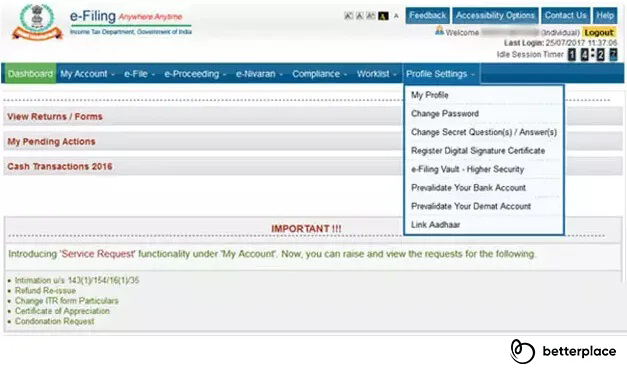

- Sign in to the portal by entering the PAN number as User ID, followed by the Password and Birth Date. After you enter the details, click on “Login”. Your account will open. Then, go to the “Profile Settings” tab and choose the last button “Link Aadhaar”.

- If the Aadhaar number is already linked, then a message will be displayed on the screen as “Your PAN is already linked to Aadhaar number XXXX”.

- If the PAN number is not connected to the Aadhaar, then a new page will appear on the screen, which will contain the form where the individual needs to enter the details, such as gender, birth date and name as mentioned in the PAN records. After filling the form, enter the Aadhaar number. Then, you will be asked to fill a verification code that appears on the screen. Once you fill it, click on the “Submit” button.

- After submission, a message will display on the screen conveying that the submission was a success.

For non-registered individuals

- If an individual is not registered with the e-filing portal, they can still visit the page on the portal for linking their Aadhaar to PAN online. Alternatively, you can visit the Income Tax Department website, but you will be directed to the e-filing portal.

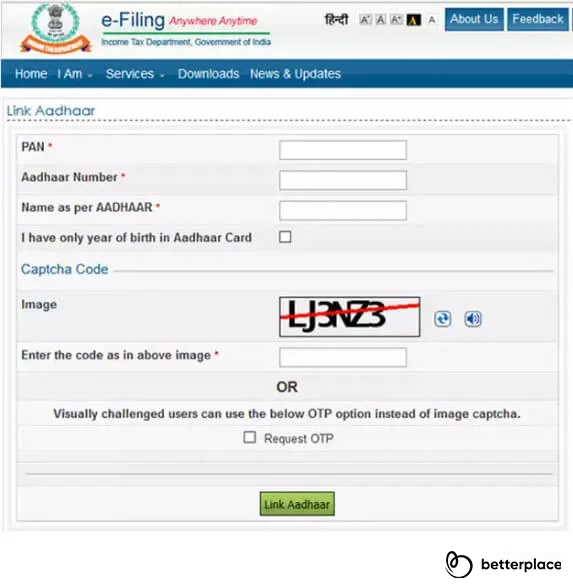

- Click on the “Link Aadhaar” button on the official portal. A form would appear on your screen. Fill in the following details:

- PAN number

- Aadhaar number

- Name as per Aadhaar

- If the Aadhaar card contains only the birth year, then the individual should also tick the checkbox “I have only year of birth in Aadhaar card”.

- Enter the Captcha code and click on the “Submit” button. On successful submission, you will see a message displayed on the screen showing that Aadhaar number and PAN number are successfully linked.

SMS method

If an individual is not able to link Aadhaar and PAN on the e-filing portal of the Income Tax Department, then they can use the additional ways of linking Aadhaar and PAN. In a notification dated 29th June 2017, the Central Board of Direct Taxes has mentioned additional methods of linking Aadhaar and PAN apart from the online method

Now an individual can link Aadhaar and PAN by sending an SMS to NSDL e-Governance Infrastructure Limited or UTIITSL (UTI Infrastructure Technology And Services Limited) by following the below steps:

- The individual needs to send an SMS to the numbers 56161 or 567678 in a specific format.

- The format is: UIDPAN<SPACE><12 digit Aadhaar><SPACE><10 digit PAN>.

- UTIITSL and NSDL will not charge for the text message. However, the mobile network operator will levy the applicable charges.

Important points to remember

- If the taxpayer links Aadhaar and PAN through the online method, then an Aadhaar OTP gets generated if the name of the taxpayer on the Aadhaar card doesn’t match with that on the PAN card but the gender and birth date match. The OTP is delivered to the registered mobile number on the Aadhaar card. The taxpayer has to enter the OTP and perform the process of PAN and Aadhaar link.

- If there is still a mismatch between the Aadhaar and PAN data, then the taxpayer has to correct the details and then try to link Aadhaar and PAN.

With the help of the simple steps mentioned above, you can link your Aadhar and PAN numbers online with the Income Tax Department e-filing portal. Remember, Aadhaar and PAN numbers must be linked with the Income Tax Department to file the income tax returns form and to claim for income tax refunds successfully.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space