What is Service tax?

Service tax is applicable if the aggregate value of services is above ten lakhs in a financial year. Service providers must apply for service tax registration once the benefits of services reach nine lakhs in a year, within 30 days from the date of commencement of such a service.

Service tax is an indirect tax levied by the central government on the service provider for service transactions. It first came about in 1994 under the Finance act section 65, when it was applicable on a specific list of services but in the budget of the year 2012, the scope increased. It is now applicable to services like air-conditioned restaurants, inns, and hotels which provide short term accommodation, travel agents, cab services, etc.

In this article, we will take a look into some of the basics of service tax.

Who pays the Service tax – Though the service tax is levied on the service providers by the government, it is borne by the consumer of the service or the customer. The government charges this tax to companies on an accrual basis and to individual service providers on a cash basis.

When is the Service tax applicable – Service tax is applicable only if the aggregate value of services provided is above ten lakhs in a financial year. Service providers are required to apply for service tax registration once the benefits of services reach nine lakhs in a year, within 30 days from the date of commencement of such a service. The act under Section 65B (44) has a complete list of services that fall under the scope of service tax. There is also a “negative list” in section 66D of the Finance Act which lists non-taxable services. There is another “Special services” list which has all the services which are exempted from the service tax purview. This list was published in June 2012 under notification number 21/2012- ST. While levying the service tax, consideration is given if the region where service is rendered falls under taxable territory or not, like the State of Jammu and Kashmir is exempted from service taxes.

How to apply for service tax registration – In general service, tax is paid by the service provider to the government. For example, A CA provides his services and is liable to pay for the services provided along with other rules of filing returns. But in some cases, the service receiver might be required to pay the service tax directly to the government, and this is called “Reverse charge mechanism”. This came into effect from Section 68(2) of the Finance Act, 1994 to facilitate more tax compliance and tax revenues. There are a total of 15 services for which reverse charge mechanism holds, for ex: services by an insurance agent to anyone in the insurance business, services by a person who resides in a non-taxable territory and provides service to someone in the taxable zone, etc.

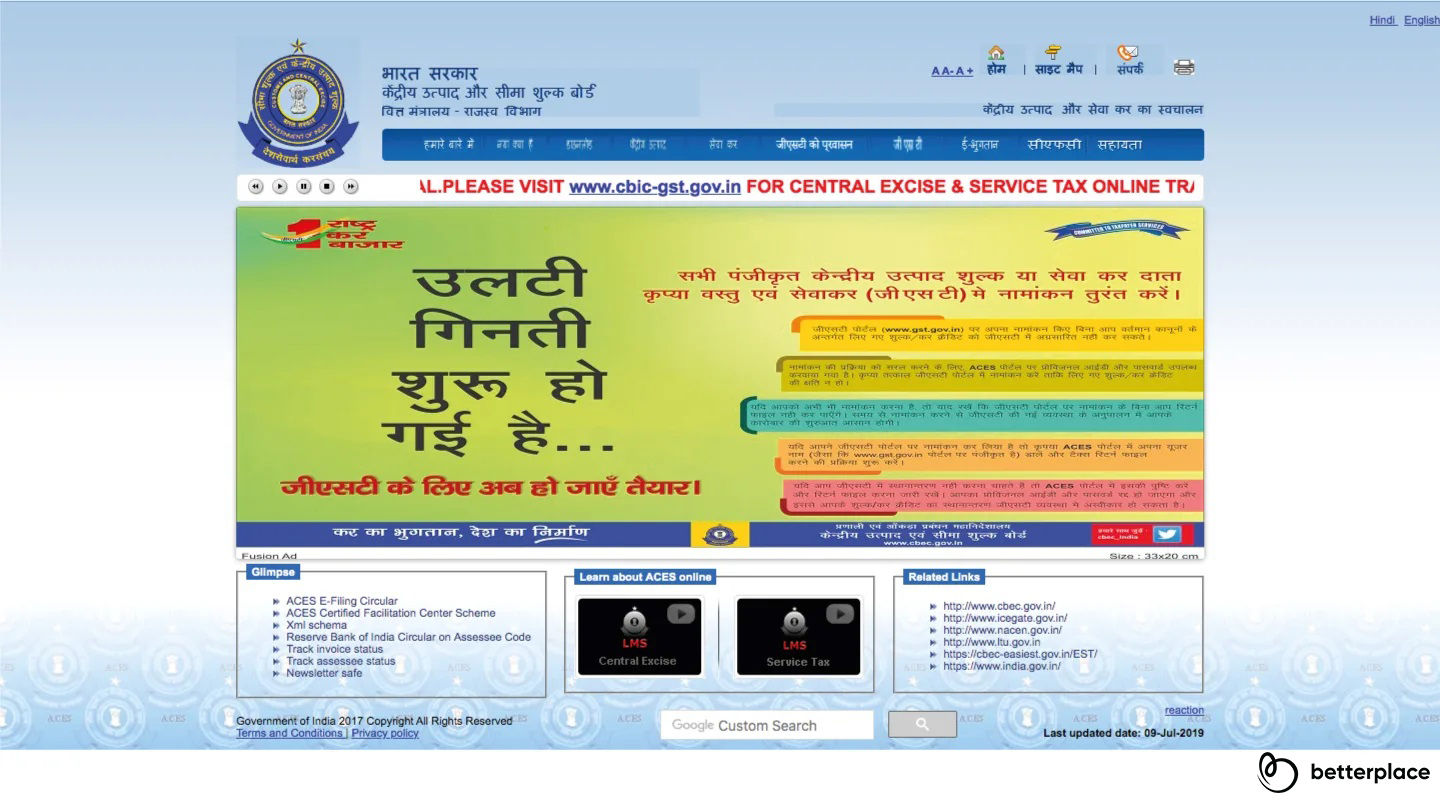

With the new digital India, the process of service tax registration has been made completely online. Below the process to register:

- Log on to ACES Govt. site

- Complete the registration form within 30 days of providing a taxable service.

- The government needs to review it, and registration is granted within two days.

- There is no need to provide documents at the time of registration. Documents can be submitted and verified after registration is complete.

Service Tax rates – Ever since its introduction, the service tax rates have changed a lot over the years as the government keeps revising them in financial budgets. In 2012 the rate was 12.36% which was increased to 14% in June 2015. Starting November 2015 the price became 14.5%, and in June 2016 the revised scale was 15%. The new Service tax rate includes 0.5% “Swachh Bharat” cess and 0.5% “Krishi Kalyan” cess.

In July 2017, the service tax was replaced by GST or goods and services tax.

Payment procedure of Service Tax – As per the new rule, all income taxpayers need to pay the Service tax online. If one needs to pay manually, they can make special requests for an exception. Payment has to be done quarterly by individuals, partnership or proprietary farms. The link for online payment is www.cbec-easiest.gov.in.

Service tax exemption – Small service providers can avail exemption of service taxes if their turnover is less than ten lakhs. You can still request for exemption even if your turnover is above ten lakhs. Few criteria under which Service tax can be exempted are:

- Any service which is offered to the UN or international organization.

- Any service which is offered to SEZ units (small economic zones)

- Taxable Services provided to diplomats or their family.

- A service which was provided before it was considered a taxable service, irrespective of when the payment happened.

Service tax Penalty – Below are a few situations when a Service tax penalty can be charged:

- If service tax was not registered within 30 days of a taxable service. The amount is INR 10,000 or INR 200 per day for the period default continued.

- If records and documents pertaining to Service tax are not maintained, then a penalty of up to INR 10,000 can be charged.

- Non-payment of Service Tax:

– If service tax is paid within 30 days of service notice, then no penalty charged.

– A 10% penalty is charged if a person fails to pay Service tax within the service notice period.

– If one provides proper reason along with valid documents for non-payment of service tax, then the penalty can be waived off.

A taxpayer must file for Service tax returns online on a half-yearly basis, from the time s/he started paying service taxes regularly.

Related Articles on Tax:

- A Start-up’s Guide on The Basics of Taxation

- All About Withholding Tax

- E-filing Income Tax

- Income Tax Returns Online

- Professional Tax Payment

- The Tax Credit Guide for Taxable Income, GST & 26AS

- All about the Indian Income Tax Department

- Taxable, Non-Taxable, and Partially Taxable Allowances of Your Salary

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space

Comments