A Detailed Look at the ITR 1 Form

ITR 1 form, also commonly termed as ‘Sahaj’ meaning ‘easy’, is the form used by most taxpayers while filing income tax returns. ITR 1 form is generally used by salaried taxpayers and can only be filed online through the e-filing portal.

Table of Content

Every Indian resident, whose total annual income is more than the tax exemption limit, must pay income tax and file income tax returns to the Government of India. To simplify the tax collection process, the taxpayers are categorised into different groups and sections depending on their income and its source. Similarly, there are different types of ITR (Income Tax Return) forms for each category of taxpayers.

ITR 1 form, also commonly termed as ‘Sahaj’ meaning ‘easy’, is the form used by most taxpayers while filing income tax returns. ITR 1 form is generally used by salaried taxpayers and can only be filed online through the e-filing portal.

How to file ITR 1

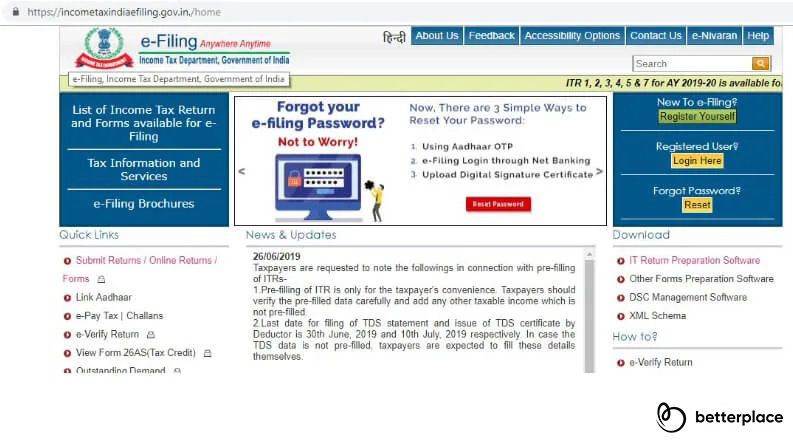

Step1: Go to the e-filing portal.

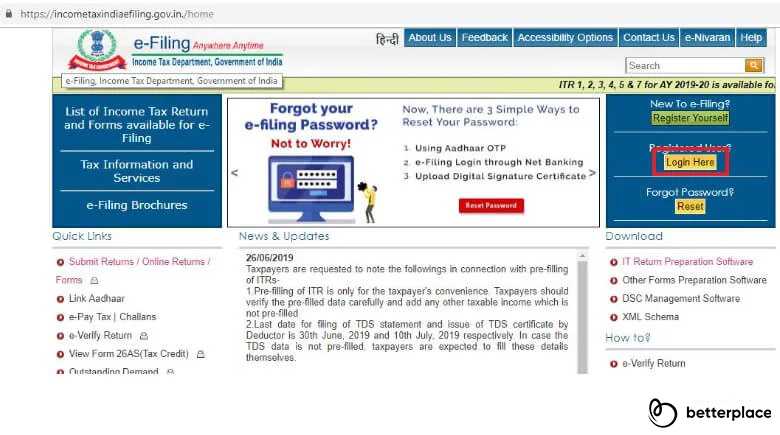

Step 2: If you already have an account, then log in by entering your details. If you are new to the e-filing website, then you must register yourself with the e-filing portal by clicking on ‘Register Yourself’.

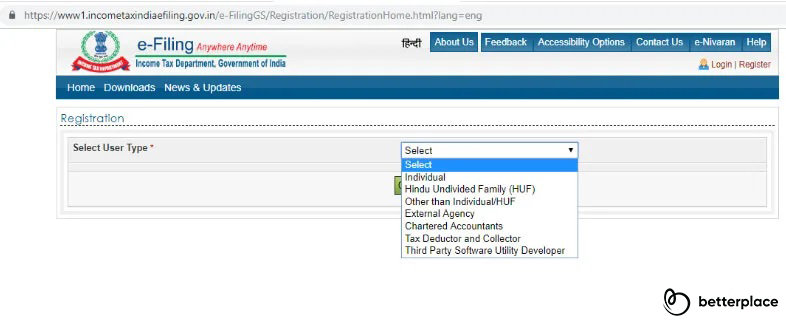

Step 3: To register with the Income Tax Department website, select the appropriate User Type from the dropdown.

The options available under this category include Individual, HUF or Hindu Undivided Family, External Agency, Other than HUF/Individual, Tax Deductor and Collector, Chartered Accountants, Third-Party Software Utility Developer.

After selecting this option, provide your permanent address and current address details. Then, enter the Captcha verification code and click on ‘Submit’.

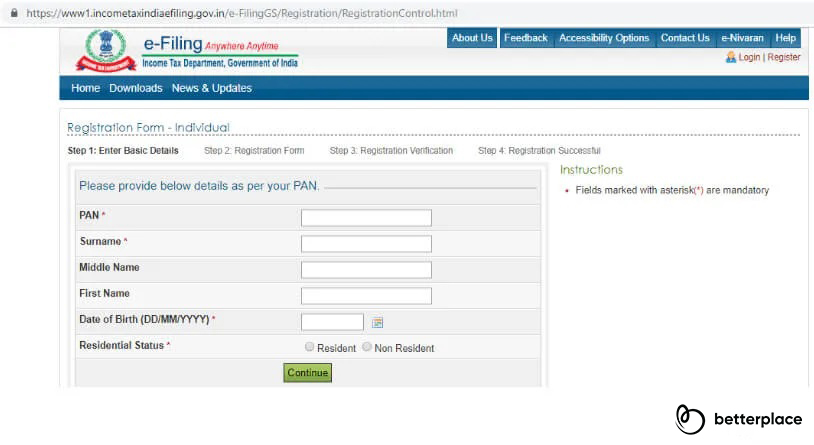

Step 4: After you click on ‘Submit’, a new page will open. On this page, input all your basic details.

Enter your Name, your PAN details, Date of Birth. Your PAN number will become your User ID. Also, provide your email address and mobile number.

Step 5: The next step is to complete PAN verification. The system will verify your PAN with the database. After successful verification, your contact details and your transaction ID will get displayed on your screen.

Step 6: After the PAN verification, you need to activate your account. The Income Tax Department will send you an activation link to your registered email address. Open the email and click on the link to complete the registration process and activate your account.

Who can file ITR 1 for the assessment year 2020-21?

ITR 1 is a single-page form that needs to be filed by individuals whose annual income is below ₹50 lakhs. The sources of income include:

- Salary and/or pension income

- Income or earnings from One House Property (barring the cases wherein the losses from the previous year is carried forward)

- Income or earnings from Other Sources (barring the winnings from horse races and lottery)

It is possible for the taxpayer to file for clubbed ITR returns by including the income of the spouse or the minor, as long as their income or earnings falls within the specifications mentioned above.

Who is not eligible to file ITR 1 for the assessment year 2020-21?

Any taxpayer, who meets the following criteria, cannot file ITR 1 form for the AY 2020-2021:

- If the annual income or earnings of the individual is more than ₹50 lakhs

- If the individual is the director of a firm or company, and they hold or have held unlisted equity stocks during the mentioned financial year

- Non-Residents and Residents not ordinarily resident (RNOR)

Further, individuals earning their income from the following sources cannot file ITR 1 Form for income tax returns:

- Gambling, horse races, lottery, etc.

- More than One House Property

- Long-term and short-term capital gains that are taxable

- Profession and business

- Income from agriculture exceeding ₹5000

- A resident individual who has assets and financial investment in a firm or entity that is outside of India, or has the signing authority of any account situated outside India

- An individual seeking relief from double taxation as per Section 90/90A/91, relief on foreign tax paid

Steps to download ITR 1 form

By following the simple steps mentioned below, the individual can do the ITR 1 form download:

- Step 1: Go to the e-filing website of the Income Tax Department.

- Step 2: In the download section, select ‘Offline Utilities’ and click on ‘Income Tax Return Preparation Utilities’.

- Step 3: Select the appropriate ‘Assessment Year’.

- Step 4: Click on ‘Excel Utility’ to fill in the details manually in the ITR 1 form. Then, download the file.

- Step 5: Open the file and start filling in all the details.

ITR 1 form structure

The ITR 1 form is divided into nine major segments:

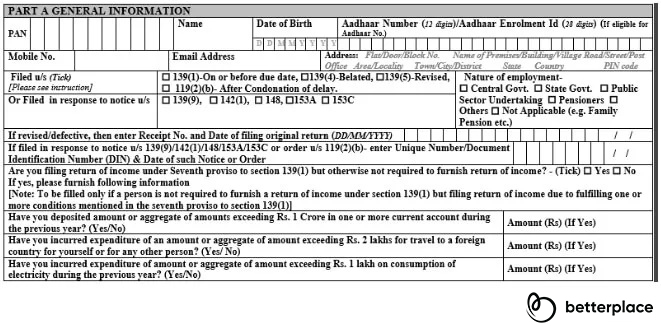

Part A: General Information

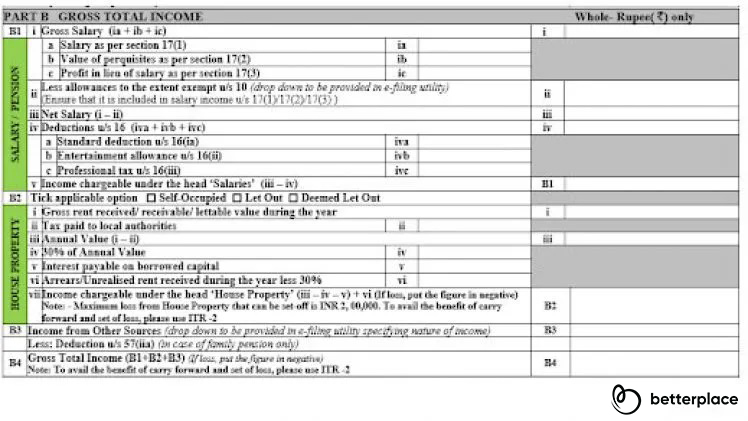

Part B: Gross Total Income

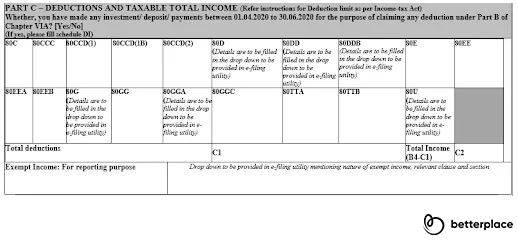

Part C: Deduction and Total Taxable Income

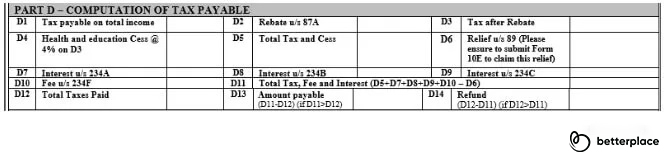

Part D: Computation of Tax Payable

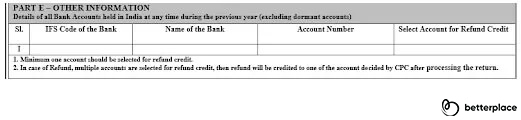

Part E: Other Information

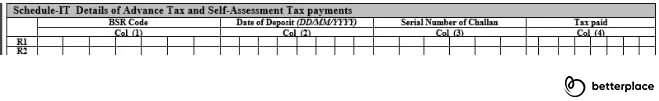

Schedule IT: Details of Advance Tax and Self Assessment Tax Payments

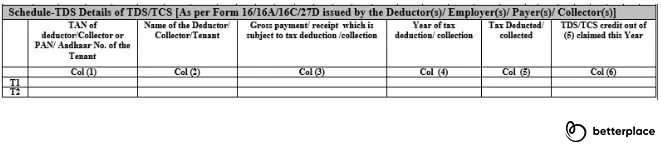

Schedule TDS: Details of TDS/TCS

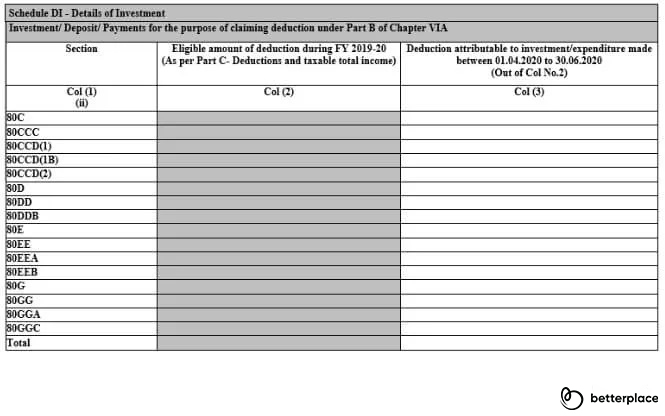

Schedule DI: Details of investment

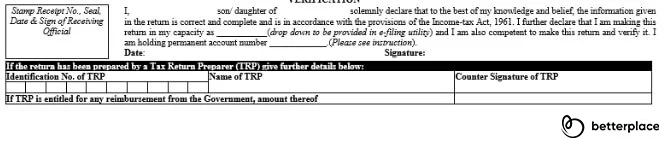

Verification

Different ways of filing ITR 1 form

The ITR 1 form can be submitted in the following two ways:

Offline Method

The following type of individuals mentioned below can file their ITR returns in physical paper format:

- An individual who is more than 80 years of in the preceding financial year

- An HUF or individual whose total annual income or earnings is lower than ₹5 lakhs and should not have claimed for ITR refunds in their income tax returns file

In the offline method, the ITR return is submitted physically on paper. The Assessing Officer will issue the acknowledgement after the physical submission of the ITR form.

Online Method

- You enter the data in the online form and submit it electronically. Then, submit the verification form or ITR-V Form to CPC, Bengaluru.

- File your ITR returns online with the digital signature and e-verify the ITR-V via EVC, Aadhaar OTP, Net banking.

If the ITR 1 form is submitted electronically, an acknowledgement will be mailed to the registered email address. The individual can also download this acknowledgement from the Income Tax Department website. The individual has to sign the acknowledgement and post it via regular mail to the CPC Office of the Income Tax Department in Bengaluru within 120 days of ITR 1 filing.

If the ITR 1 form is submitted with the digital signature, then the individual can e-verify their returns.

Last date for filing ITR 1 in 2020

An individual should submit their filed ITR 1 form on or before 31st July of the given assessment year for taxes paid in the previous financial year. For example, if the individual files ITR 1 form for taxes paid during the FY 2019-2020, then the assessment year will be 2020-21. Thus, the last date for submission of ITR 1 form would be 31st July 2020.

Note: Due to the COVID-19 pandemic and the resultant nationwide lockdown, the Government of India has extended the last date of filing ITR 1 form till 30th November 2020 for the FY 2019-2020.

Penalty on late filing of ITR returns

According to the revised rules, the Section 234F of the Income Tax Act notifies that if the individual fails to file their ITR returns before the last date of 31st July, then they are liable to pay the penalty of maximum ₹10,000. However, if the total annual income of the taxpayer is less than ₹5 lakhs, then the applicable penalty amount is ₹1000.

| Date of e-Filing | Penalty for total annual income below ₹5,00,000 | Penalty for total annual income above ₹5,00,000 |

| 31st July 2020 | 0 | 0 |

| Between 1st August 2020 to 31st December 2020 | ₹1000 | ₹5000 |

| Between 1st January 2021 to 31st March 2021 | ₹1000 | ₹10,000 |

Documents required for ITR 1 form submission

- Form 16: If the individual was employed by more than one employer during the given financial year, they are required to keep the Form 16 from all their employers.

- Form 16A: If the individual receives any pension or interest income for different institutions or banks, then those entities would issue the Form 16A or a TDS certificate.

- Form 26AS: The individual can download Form 26AS from the TRACES portal. Form 26AS contains comprehensive details about all tax deductions done on behalf of the taxpayer and deposited against their PAN number by all deductors in the given financial year. The individual must verify the TDS details specified in Form 16/16A and check whether it equals with the TDS amount shown in Form 26AS.

- Bank passbook and statement: These documents are required to provide accurate details about the interest received on bank deposits. The taxpayer is also required to provide the bank details in the returns form.

- PAN Card

- Documents supporting exemptions or investments: If the individual has made certain investments or falls under a certain exemption under relevant sections, they must provide the relevant details while filing the income tax returns application.

Here is all the information you need to know about ITR 1 form. If you are yet to file your ITR returns, do it before the last day.

Frequently Asked Questions

- If your income is more than ₹50 lakhs this year, which form should you file?

If the annual income of the individual is more than ₹50 lakhs, then they can file ITR 2, ITR 3, or ITR 4 forms based on their income source. If the individual is salaried and has a salary income of more than ₹50 lakhs annually, they should then file the ITR 2 form. If the income is from profession or business, the individual must file the ITR 3 form. If it is presumptive income under the relevant section of the Income Tax Act, then the individual must file the ITR 4 form. - Do you need to show exempt LTCG while filing ITR 1?

The individual must show their exempt LTCG status in ITR 1, provided they are exempted as per Section 10(38). If the LTCG is taxable, then the individual may use other applicable forms. Also, ITR returns should be filed compulsorily if the LTCG amount is more than ₹2.5 lakhs, even if their annual earnings are below the taxable limit. - Can you file ITR 1 with exempted agricultural earnings?

Yes. The individual can file ITR 1 if their income from agriculture is less than ₹5000. If the income is higher than ₹5000, then they must file ITR 2 form. - How to furnish bank account details in ITR 1 form?

All the current and savings account details held during the given financial year should be provided while filing the ITR 1 form. However, dormant account details, which are non-operational for three years, are not mandatory. The bank account number of the individual must be in the CBS or Core Banking Solution System. The individual should provide the bank details in Part E of the ITR 1 form. - Do you also include income from dividends on mutual funds?

Yes, the individual should show their income from dividends from mutual funds in Part D section of the ITR 1 form.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space

Comments