Table of contents

Required documents and information

Step by step transfer procedure for PF transfer online

Under the EPF scheme, a part of the employee’s salary is reserved for the provident fund. An employee can contribute a minimum of 12% of the Basic or even more towards the PF fund, unlike an employer who cannot contribute more than 12% of the basic salary of the employee towards EPF.

This PF amount, along with interest helps an employee get a lump sum amount during retirement. The process for PF Transfer is seamless and straightforward with UAN (Universal Account Number). The Employees Provident Fund Organisation (EPFO) has made provision for employees to transfer EPF from the previous employer to a new employer with ease.https://www.betterplace.co.in/blog/universal-account-number/

An employee has the option to get the claim attested either by the current employer or the previous employer in the online PF transfer. Once the employee submits the PF transfer form online, the employer will verify, approve and submit the request online through the portal.

Why transfer PF?

An employee need not close the EPF account with the previous employer while switching job, instead can transfer the PF account to the new employer. PF fund is regarded as a safe long-term investment for employees which is backed by the Government of India.

Therefore, if an employee is working and wishes to continue working by switching jobs, then it is recommended to make EPF transfer than withdrawing as the PF amount remains as ideal savings for retirement. You can raise your grievances online through a tool called Grievance Management System.

Required documents to submit an EPF transfer online

The information or the documents an employee should keep ready to submit an EPF transfer online include:

- Revised Form 13

- Valid Identity Proof (Aadhar, PAN or Driving License)

- Old and current details of the PF account

- The registered mobile number provided at the EPFO website should be active.

- An active UAN in the UAN portal

- An approved e-KYC from the employer

- Current employer’s details

- Establishment Number

- PF Account Number

- Bank account details of the salary account

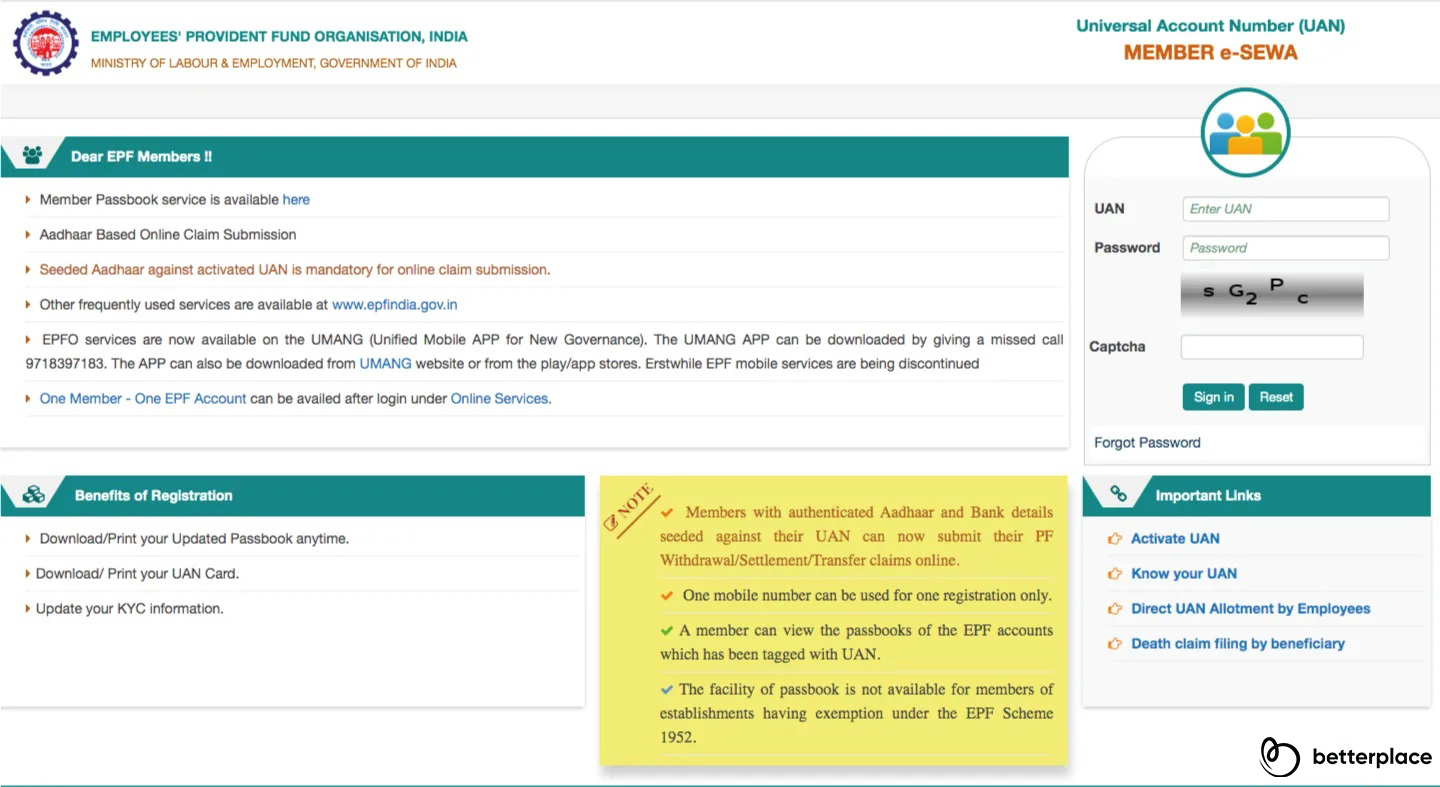

An employee needs to meet the above requirements to proceed with an online claim submission in the EPFO portal. If not then an employee can visit the e-SEWA portal which is managed by the EPFO to seed the KYC and other details required.

Forms Required for EPF Transfer

Although PF transfers were previously available online through the ‘Online Transfer Claim Portal,’ with what was the advent of UAN, the transference procedure has been updated and relocated to what is the ‘Unified Portal.’ Nevertheless, to perform a digital PF transfer, complete these required arrangements:

- The user must have established his UAN using the site of UAN, the cell phone which is used for registration must likewise be active.

- Employee’s bank account and bank IFSC code must be established against the UAN. Seeding Aadhar number and PAN against UAN is not required for submitting transfer claims.

- The e-KYC should have already been approved by the employer.

- The former and present boss should have authorized signatories in EPFO who are digitally registered.

- An employee’s PF account number from both past and present occupation must be put into the EPFO dataset.

- Just one transfer request can be accepted against the prior member ID.

- Personal information and PF account details displayed in EPFO ought to be accurate.

Step-by-step procedure for EPF Transfer through EPFO Portal

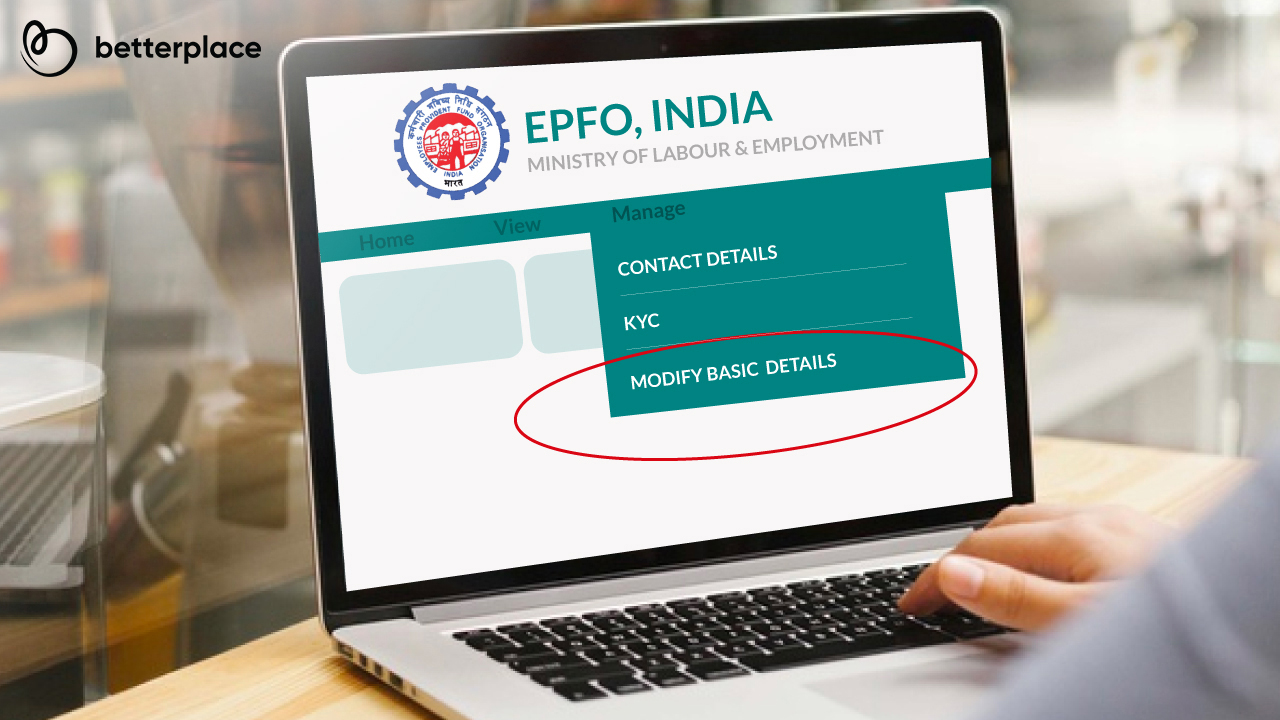

Follow the simple steps below to transfer the PF fund quickly:

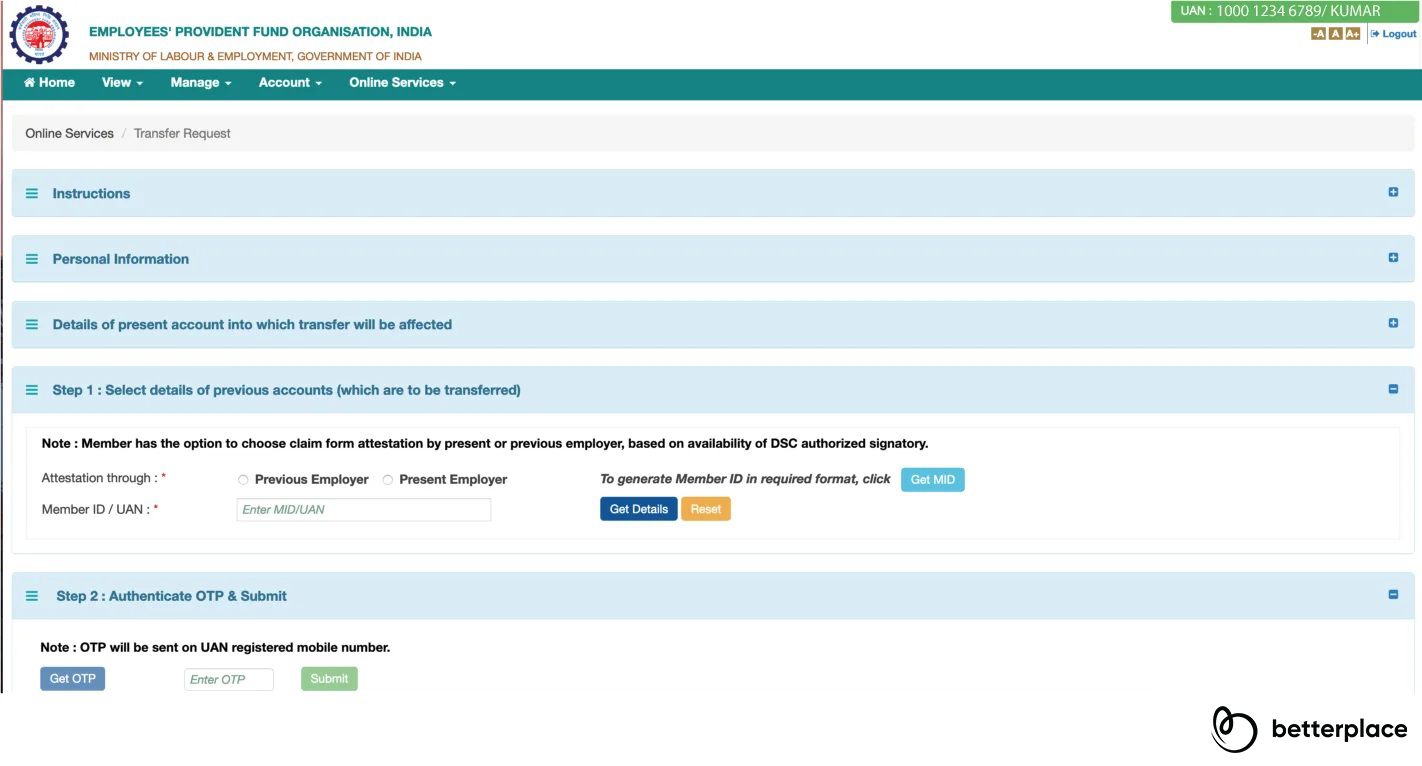

- Login to the EPFO portal online using your UAN and password.

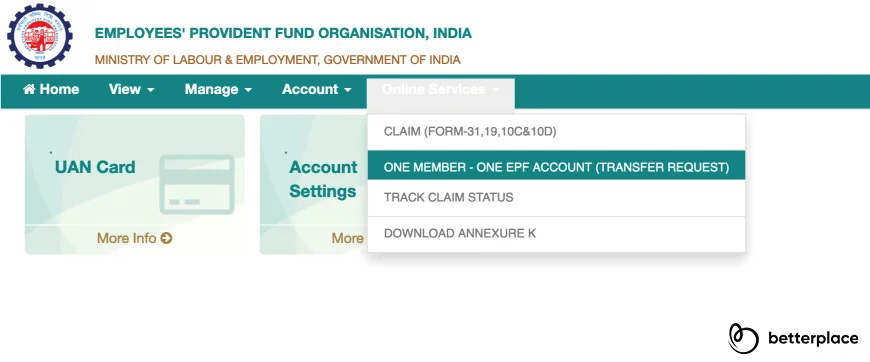

- Under the main menu of the home page, click on the ‘online services’ tab and select the option ‘Transfer request.

- Now you see a page open with your personal details.

- Verify that your EPF number, date of joining, date of birth and other details are correct, otherwise, your claim will not be processed.

- Once you verify your personal details, you need to submit the transfer request for attestation by selecting the previous employer or the current employer option.

- Your PF account details of the previous employer would appear on clicking the ‘get details’ tab.

- Once you fill in the details of your employer and click on submit, an OTP will be generated to your registered mobile number.

- Once you receive the OTP, complete the authentication by typing the OTP received in the space provided and click on the ‘submit’ button.

- Now a self-attested copy of your online PF transfer request can be submitted to the employer you have selected within 10 days of submitting the request in the portal.

- Your employer will also get the notification of the PF transfer request online.

- After verifying the details of the employee, the employer approves the EPF transfer request digitally to the EPFO portal, which will then process the claim.

- Once it is approved, you can find the PF transferred to your new account with the current employer.

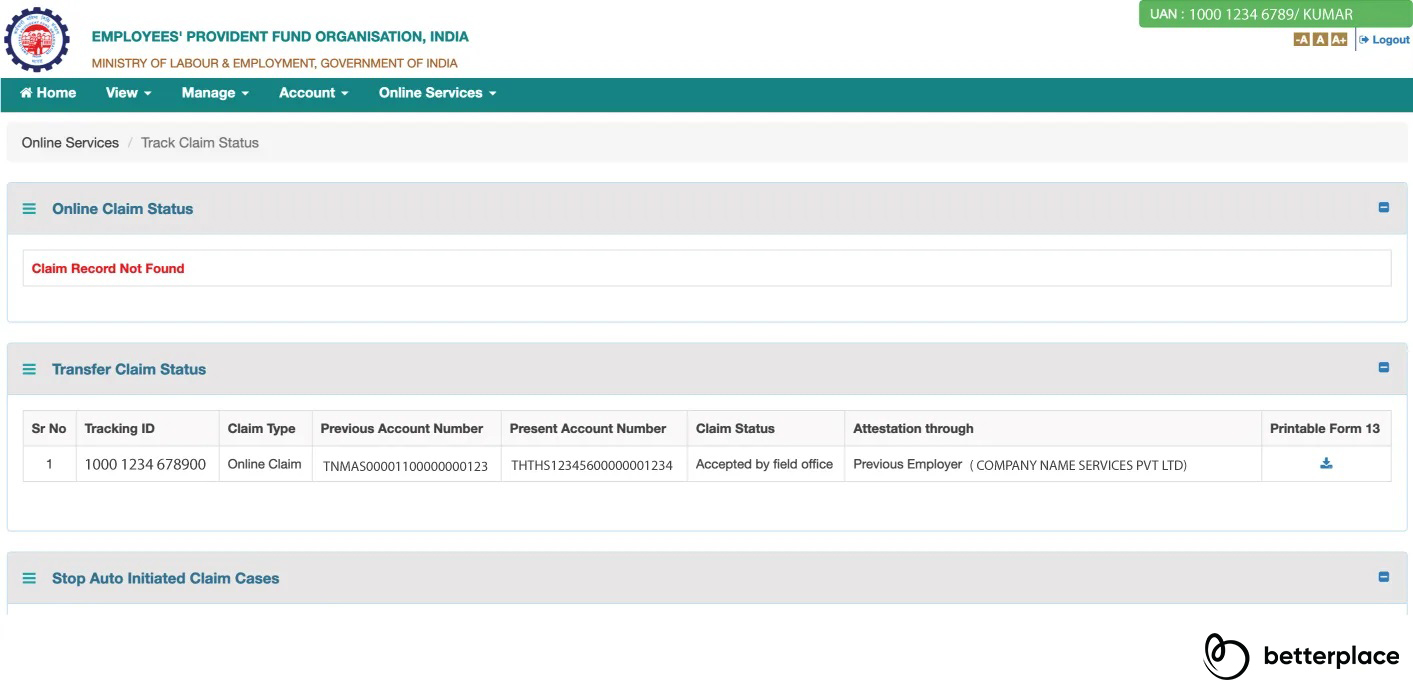

- You can also track the status of your PF transfer online by clicking on the Track claim status tab under the online services dropdown on the EPFO website using your EPFO member login ID.

How To Check The Status Of PF Transfer?

Employee Provident Fund (EPF) is a government-backed scheme that ensures employee retirement benefits across India. It is a form of savings for employees where a certain amount of their salary is contributed towards the fund. Employees can transfer their EPF balance from their previous employer to the new one when they switch jobs. Checking the status of your PF transfer is essential to ensure a smooth transfer process.

Here are the steps to check the status of your PF transfer:

- Visit the Employees’ Provident Fund Organisation (EPFO) official website at www.epfindia.gov.in.

- Click on the ‘Our Services’ tab and select ‘For Employees’ from the drop-down menu.

- Select ‘Member Passbook’ under the ‘Services’ option.

- Enter your UAN (Universal Account Number) and password to log in to your account.

- Click the ‘View’ button next to the ‘Passbook’ option.

- You will see all the transactions related to your EPF account, including your current transfer status.

- If the transfer status shows as ‘Accepted by the employer,’ your previous employer has initiated the transfer process. If it shows ‘Accepted by EPFO,’ it means that the EPFO has approved the transfer, and the amount will be credited to your new account soon.

If you face any issues with the transfer process, you can raise a grievance on the EPFO website or contact their customer service helpline for assistance.

What’S The Tax Liability For Taking Out Funds From Two PF Accounts?

The tax liability for taking out funds from two Provident Fund (PF) accounts would depend on several factors, such as the amount withdrawn, the period of service, and the tax laws in the country where the accounts are held.

If an individual withdraws funds from two different PF accounts, the total amount withdrawn from both accounts will be added together to determine if it exceeds the tax-free limit. Withdrawals from a PF account after five years of continuous service are tax-free. However, if an individual has worked for less than five years, the amount withdrawn will be taxed.

Furthermore, if the combined amount of withdrawal exceeds the tax-free limit, the excess amount may be subject to tax.

Individuals should submit Form 15G/15H to their PF accounts’ respective authorities if their total income falls below the taxable limit. This will help in avoiding tax deductions on the PF withdrawals

Conclusion:

In any employee’s mid-career, switching jobs between PF registered companies is a usual thing, but to keep an employee’s PF secure choosing to transfer the PF is wiser than withdrawing. Another important note with a tax point of view is that withdrawing PF funds within five years of employment attracts tax.

Your UAN account serves as an umbrella to consolidate all the PF funds lying in different member IDs of your previous jobs into one. The EPFO portal saves you from running to different places to get your own money.

FAQs

1) Is there a way to know the status of my PF transfer, advance or settlement that has been submitted to the EPF office?

Yes. Members can redirect to the EPFO passbook page, log in with their UAN and password and get all the information regarding the status.

2) Is the EPFO member intimated about the PF transfer affected?

Members can request a copy of the Transfer Certificate (Annexure-K) — issued to the transferee PF Trust or the Regional P.F. Commissioner/P.F. Trust — giving full details of the transfer from the EPF office.

3) Does a member have to be enrolled under EPFO all over again in the case of a transfer between one establishment to another?

The EPFO has to be enrolled as a member under the new employer or establishment and to get the PF funds from the old employer.

4) How are PF funds paid to the EPFO member if accumulations from the past are not transferred on cancellation of exemption?

It is the duty of the local Regional Provident Fund Commissioner (RPFC) to ensure the transfer of cash and securities. The RPFC will also arrange a transfer of the PF dues to the EPFO member.

5) Is there a provision for the transfer of a member’s PF account in case there is a change in establishment?

When changing employers, a member must always get the PF account transferred from the previous employer to the current employer by submitting Form 13(R). Alternatively, the member can also request for a transfer online by logging into the EPFO portal with a valid UAN and password.

Related Articles on EPF