Table of Contents:

- What is EPS

- Eligibility criteria for EPS

- Different EPS and EPF pension types

- EPS Pension forms details

- Process to check EPS balance

- Calculation and Withdrawal of EPS

- Employee Pension Scheme (EPS): FAQs

Latest News about EPS

Employee Pension Scheme – Additional 1.16% To Come From Employer’s Contribution

In recent news about the Employee Pension Scheme, it has been announced that the employer will contribute an additional 1.16% towards the scheme. This development has come as a relief for many employees, as it will result in a higher contribution towards their pension savings.

The Employee Pension Scheme (EPS) is a retirement savings scheme the Indian government introduced for employees in the organized sector. Under the EPS, both the employee and the employer make contributions toward the employee’s retirement savings.

The employer’s contribution towards the EPS was earlier fixed at 8.33% of the employee’s basic salary, subject to a maximum of Rs.1,250 monthly. However, with the recent announcement, the employer’s contribution towards the EPS will now increase to 9.49% of the employee’s basic salary, subject to a maximum of Rs.1,800 per month.

The additional contribution will result in higher retirement savings for employees, which will be especially beneficial for those who may need to make adequate savings toward their retirement. The move is also expected to encourage more employees to opt for the EPS scheme, as it offers a secure and reliable retirement-saving way.

What is EPS (Employees’ Pension Scheme)?

The EPS (EPS full form – Employee pension scheme) is a scheme by the Employee’s Provident Fund Organization (EPFO), which aims at social security. This scheme is for the pension of the employees working in the organized sector, after their retirement at 58 years.

The advantages or benefits of this scheme are only to be availed if the employee has served for a minimum of (continuous or non-continuous) 10 years. EPS pension was made available from 1995 and later retained for existing and newly joined EPF employees since.

Eligibility criteria for EPS

To avail the benefits of pension under the Employees’ Pension Scheme, your employees should meet the following eligibility conditions. The individual should:

- Be an EPFO member

- Complete 10 years of active service along with equal years of active contribution towards the EPF pension Scheme

- Be 58 years or above

- Have attained at least 50 years of age to withdraw from the EPS pension at a lower rate

- Delay withdrawing the pension for by 2 years, i.e., till he or she is 60 years, to become eligible to get EPS pension at a rate of 4% annually

Different EPS and EPF pension types

As per the EPS pension scheme, an employer can provide different kinds of pensions to the employees. Here are some pension types:

Widow pension

Also known as Vridha pension, wherein, a widow of the deceased EPFO member is eligible for this pension. The pension is paid to the widow until her death or remarriage. In case of more than one widow, the pension value is paid to the oldest widow.

The amount for a monthly payout of the widow pension is calculated according to Table C of the Employees Pension Scheme 1995. As on date, the minimum pension amount has been increased to INR 1,000.

Child pension

Under child pension, If the EPS member is deceased, their surviving children become applicable to receive a monthly pension from the pension contribution in EPF. This is in addition to the widow pension to the deceased’s wife. The monthly payouts will be applicable until the child turns 25 years old. The pension can be paid to a maximum of two children and the payable amount is 25% of the widow pension amount.

Orphan pension

If the EPFO member dies and does not have any surviving widow, then his children are entitled to receive a pension under the orphan EPF pension scheme. Under this, the orphan or orphans receive 75% of the widow pension monthly.

Reduced pension

An EPF pension scheme member can withdraw early pension if he or she has attained the age of 50 but is less than 58 years old, and, if they have made an active pension contribution in EPF for 10 years or more. In such cases, the pension value is reduced to a rate of 4% per year until the employee reaches the age of 58 years.

For example: if an EPF pension member, who is 56 years of age, wishes to withdraw reduced pension monthly, then he or she will get the payouts at the rate of 92% of the original pension amount. It is calculated as 100% – (2*4) = 92%.

EPS Pension forms details

An EPFO member of the survivor has to fill various EPS forms depending on their eligibility criteria to avail the benefits of the Employees’ Pension Scheme.

To obtain the Employee Pension Scheme (EPS) benefits in India, various forms may be necessary depending on the conditions and mode of withdrawal. These documents initiate the withdrawal process, supply required information, and confirm the employee’s eligibility.

The following are the most commonly required forms for EPS withdrawal:

Form 10C

The Employees’ Provident Fund (EPF) is a retirement benefit as per the EPFO Act 1995, wherein, the member invests part of his salary every month and the employer makes an equal pension contribution in PF towards his/her EPS pension account. When a member switches jobs, he/she can transfer the EPF amount to a new account or withdraw the amount by submitting an EPS scheme certificate and filling the necessary EPS form. EPS Form 10C, however, can be used to withdraw the accumulated pension amount after a continuous service of 180 days and before the completion of 10 years of active service.

Form 13 (Transfer Claim Form)

Used when transferring EPS funds to another EPFO office upon job or location change

Form 13-V (Bank Mandate Form)

Supplies necessary details for direct EPS amount deposit to the employee’s bank account.

Form 10D

Form 10D is the general form that a member needs to fill to withdraw monthly pension after the age of 50 years. This EPS form can also be filled to withdraw monthly child pension and widow pension too.

Form 2 (Life Certificate Form)

Verifies the employee’s life and eligibility for receiving pension benefits.

Life certificate

Life certificate has to be submitted in November every year by the member or the beneficiary of the pension to certify that he or she is still alive. This form should be submitted in person by the beneficiary to the branch manager of the bank with the active pension account details.

Non-remarriage certificate

This form is a declaration that the widow/widower of the pensioner has not remarried. This declaration has to be submitted every year in November by the widowed individual. The widow will have to furnish this certificate once at the time of the commencement of the pension.

It’s crucial to keep in mind that these forms may differ depending on the EPFO office and to check with the local office for the most recent information on forms required for withdrawing EPS funds.

Pension benefits under EPS

Eligible EPS pension members can avail the benefits of the pension according to the age from which they start the withdrawals. For different cases, the value of the pension is also different.

Pension at 58 years

The member is eligible for the benefits of pension after his/her retirement, that is, after 58 years of age. However, for this, they should have compulsorily made an active pension contribution in EPF for 10 years, at least, before their retirement to avail the pension benefits. Post-retirement, the EPS pension scheme certificate gets generated. This certificate is required to fill up form 10D to withdraw the pension monthly.

Pension on discontinuing service without fulfilling the criteria

If the member discontinues service or is unable to stay in duty for 10 years prior to 58 years of age, he/she could withdraw the entire amount once they attain 58 years of age by furnishing form 10C.

Pension on absolute disablement

If the EPFO member becomes completely and permanently disabled, then he/she is qualified to receive monthly pensions, irrespective of them not having served the minimum service period required to get monthly pensions. Their employer must deposit EPF minimum pension funds into their EPF account for a minimum of 1 month for them to become eligible for this pension.

A member can avail the pension benefits monthly from the very date of disablement and get paid for his/her lifetime. But, the member has to take a medical test to ascertain that he/she is not fit for the work that they were doing before getting disabled.

Pension if the member is deceased

The family of the EPFO member becomes eligible to receive the EPS pension (or, EPF pension) in the below-mentioned cases:

- If the EPFO member dies after the commencement of monthly pension.

- If the EPFO member dies before the age of 58 but has completed the 10 minimum years of active service contribution.

- If the member dies in the service duration and the company or employer has deposited pension funds in the members EPF account for a minimum of 1 month.

What happens to the EPS amount in case of a change in jobs?

Previously, while switching employment, you had to submit out two forms:

- Form 11 to certify that you are a member of Employees’ Provident Fund (EPF) schemes.

- Form 13 to have your PF balance moved from the previous company to the current one.

If you have an existing Universal Account Number (UAN) and your Aadhaar is validated for KYC in the EPF database, a composite Form 11 can now fulfil both functions. Everyone else must still complete Forms 11 and 13.

How Does Employee Pension Scheme Work?

Employees’ Pension Scheme (EPS), often called EPF Pension, is a social security scheme administered by the Employees’ Provident Fund Organisation (EPFO). The system provides for a pension after retiring at age 58 for employees who work in the organized sector. Nevertheless, the scheme’s perks are only available if the worker has worked for the company for at least 10 years (the service doesn’t have to be continuous).

EPS was introduced in 1995, and it enabled both new and existing EPF members to participate. Both of the contracting parties contribute 12% of the employee’s wage to the EPF. Every month, the employee’s complete part is given to the EPF, 8.33% of the employer’s portion is donated to the Employees’ Pension Scheme (EPS), and 3.67% is contributed to the EPF.

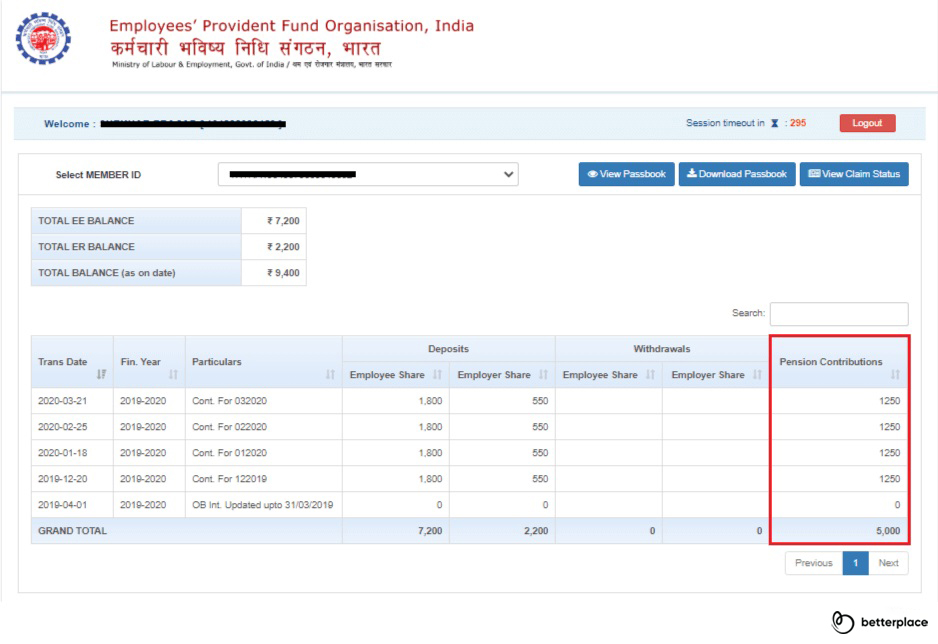

The process to check EPS balance

Here are the steps that’ll help you check your EPS balance.

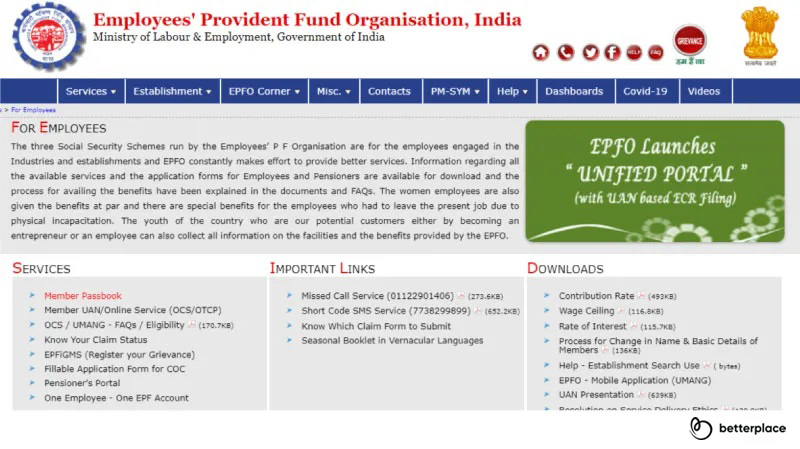

Step 1: Visit the official EPFO portal

Step 2: Under the “Services” dropdown menu in the top left corner click on “For Employees”

Step 3: Then click on “Member Passbook” under Services

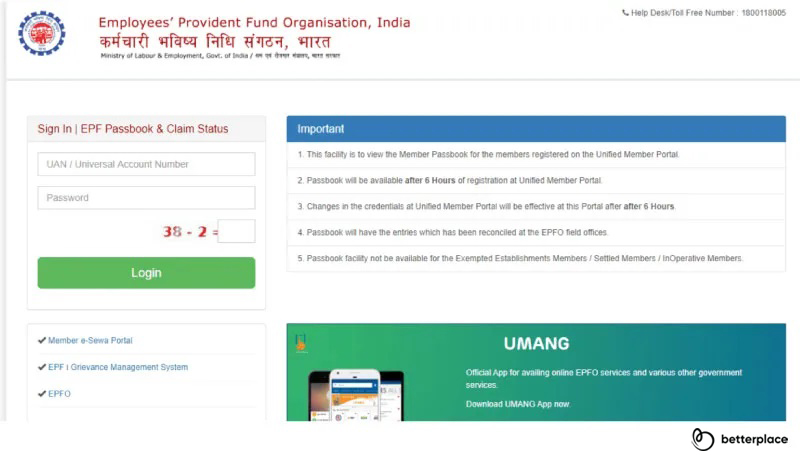

Step 4: On the member passbook portal click on the “Login” button after entering your UAN, password, and solving captcha.

Step 5: “Select Member Id” from the dropdown and click on the “View Passbook” button on the right to display all the pension contributions by the employer till date and the total EPS balance. Alternatively, you can download a PDF version of the same by clicking on the “Download Passbook” button.

Calculation of EPS

The monthly EPS or pension amount an employee receives after retirement is based on the pensionable service and pensionable salary. It is calculated as per the following formula:

Member’ Monthly Salary = (Pensionable Salary*Pensionable Service)/70

Pensionable Salary: The average monthly salary received by an individual in the last 60 months, before he/she decides to exit the Employees’ Pension Scheme.

Pensionable Service: It is the service period — or the duration of employment — of an individual. It is calculated as the total of service periods under different employers. In the event of a job switch, the individual must obtain an EPS Scheme certificate and hand it over to the new employer.

As mentioned earlier, this pension fund can be withdrawn prematurely, but only after the employee has served a term of ten non-continuous years of service. This fund is taxable, and various tax benefits can be availed on the consolidated amount.

The two scenarios of EPS withdrawals

There are two cases under which you can withdraw your pension amount.

- For service exceeding 10 years

In this case, an individual can withdraw pension fund by filling Form 10C.

- For service not exceeding 10 years

There are a couple of points to remember for such a case:

- The pension fund can be withdrawn on the EPFO portal via Form 10C.

- The percentage of pension amount that can be withdrawn depends on the number of years of service.

- The individual’s UAN must be linked with KYC on the portal.

For this case, service cannot be more than 10 years. For this too there are different scenarios. If an individual is still in service and hasn’t completed 10 years, EPS amount cannot be withdrawn. The pension amount can only be encashed during the interval between the exit from one service and the beginning of a new service.

Terms & Conditions of EPS:

- The employee must be an EPFO member (Employees Provident Fund Organization).

- One must have completed 10 years of service and be over the age of 50 to receive an early pension under EPS. To be eligible for a normal pension, you should be at least 58 years of age.

- In the event that a pension is not paid for two years before reaching the age of 60, the compensation will be increased by 4% every year.

- An individual is only eligible for the Employee Pension Scheme if he or she has served for at least 10 years.

Difference between EPF and EPS:

The provident fund scheme encourages individuals to save for their retirement. According to the scheme, both the employers and employees of a business contribute to the employee’s provident fund account. The contribution accumulates until the individual’s whole working time, after which the employee can take a lump-sum payment with interest.

Employees who are EPFO members and have invested in the EPS account are eligible for a pension under the pension system. When such an employee dies, the pension is continued to be paid to the nominee. Employees make no contributions to the EPS account. The employer contributes 8.33% of the employee’s salary (basic plus dearness stipend). After the age of 58, the employee receives a pension from such a system.

Features of the EPS

- EPS is an initiative of the Indian government, therefore, the returns are guaranteed; investing in this scheme does not involve any risks. The amount to be returned is fixed and there will be no changes.

- For employees earning Rs 15,000/- or less each month, it is mandatory to enrol in the scheme.

- In case of the EPFO member’s widower/widow getting remarried, the pension amount is to be left to the children who will be categorised as “orphans”.

- Employees enrolled in the EPF pension scheme are automatically enlisted in the EPS scheme.

- Rs 1000/- is the minimum pension amount that the individual will receive.

Contribution Towards EPS

The Employee Pension Scheme (EPS) in India is a component of the Employees’ Provident Fund and Miscellaneous Provisions Act of 1952, offering pension benefits to workers.

Both employers and employees are required to contribute 12% towards the EPF scheme with the employer contributing 8.33% of the worker’s basic salary and dearness allowance towards PF and the remaining 3.67% towards EPS.

On the other hand, the employee contributes 12% of the same (Basic + DA) towards PF. These contributions are deposited into the Employees’ Provident Fund (EPF) account, with the pension portion being transferred to the EPS account.

Employers are responsible for collecting the employee’s contribution and making their own, while employees are in charge of ensuring their contributions are being made and keeping track of their EPF balance.

EPS Withdrawal

Before withdrawing from the Employee Pension Scheme (EPS) in India, it is critical to be aware of a few key considerations.

Firstly, to be eligible to receive the EPS funds, it is typically necessary to have retired at the age of 58 or to have completed 10 years of service, whichever comes later. Secondly, it is essential to understand the circumstances under which the EPS funds may be withdrawn, such as termination of employment, resigning after a decade of service, or passing away.

The steps involved in withdrawing EPS funds (offline) include:

- Obtaining the EPS withdrawal form from the EPFO office or downloading it from the official website.

- Filling out the form with accurate information and submitting it to the EPFO office along with the required documentation.

- The EPFO will verify the details and, if everything is in order, will proceed with processing the withdrawal request.

- The EPS funds will then be transferred directly to the employee’s bank account.

It is important to keep in mind that the withdrawal process may take several weeks to complete. Thus, it is advisable to start the process well ahead of time to ensure a smooth and timely payout.

In order to retrieve the Employee Pension Scheme (EPS) funds through an online process, one must take the following steps:

- Access the Employees’ Provident Fund Organisation (EPFO) official website at https://www.epfindia.gov.in/.

- Sign into the Member Portal using the Universal Account Number (UAN) and password.

- Proceed to the ‘Online Services’ area and select the ‘Claim (Form-31, 19 & 10C)’ option.

- Fill out the EPS withdrawal form on the website, supplying all required information and uploading the necessary documents.

- Submit the form and monitor the status of the request online.

- Once approved, the EPS funds will be directly deposited into your bank account.

It is crucial to keep in mind that in order to use the online process, the UAN must be connected to a bank account and the KYC details must be up-to-date. Additionally, make sure that the EPF account has been linked to the UAN prior to attempting to withdraw EPS funds online.

Is an EPF or EPS Account Transferable?

The transfer of an Employee Provident Fund (EPF) or Employee Pension Scheme (EPS) account is possible in India, allowing for the seamless transition of savings from one EPFO office to another when an individual changes jobs or location. The purpose of this process is to maintain the security of the employee’s funds and maintain their earning potential.

There are two methods available for transferring EPF/EPS accounts in India, both online and offline.

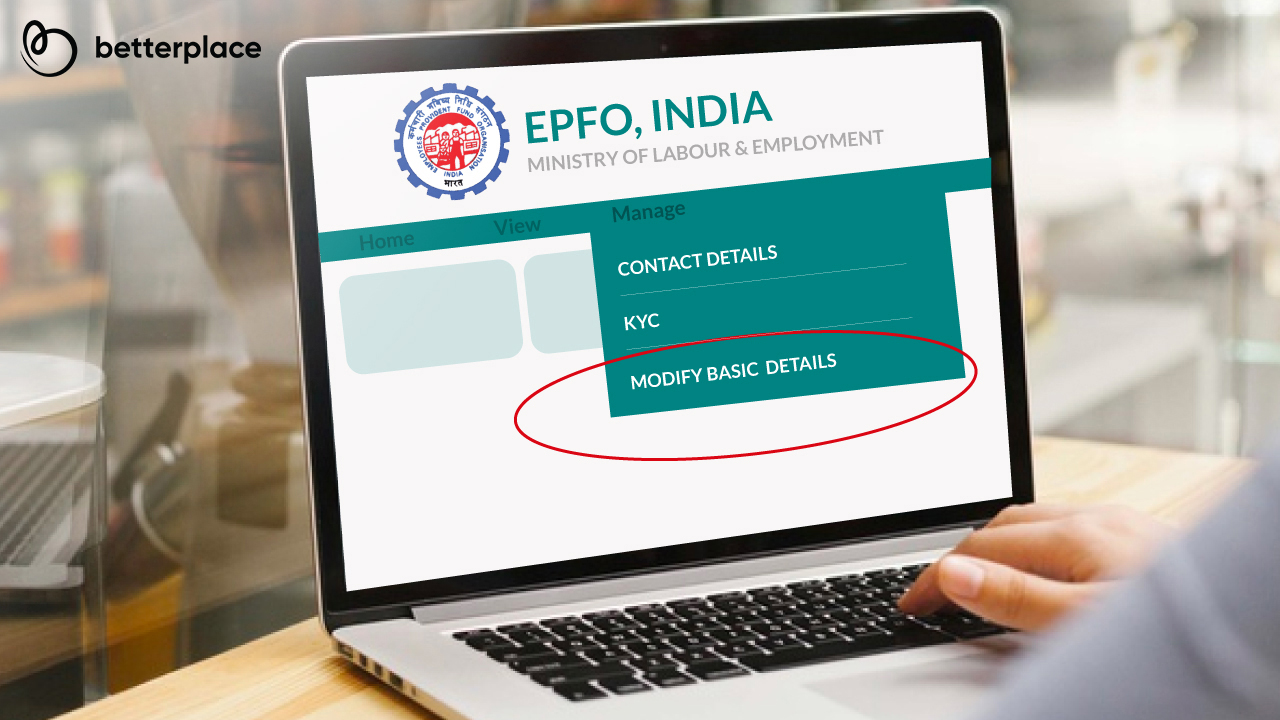

For an online transfer, the following steps should be taken:

- Access the Employees’ Provident Fund Organisation (EPFO) official website – https://www.epfindia.gov.in/

- Log in to the Member Portal using a Universal Account Number (UAN) and password.

- Navigate to the “Online Services” section and select the “Transfer Your EPF Balance” option.

- Complete the transfer request form online, providing all necessary information.

- Submit the form and monitor the status of the request.

For an offline transfer, the process involves:

Acquire the Transfer Claim Form (Form 13) either from the EPFO office or by downloading it from the EPFO website.

Fill out the form accurately with complete information.

Submit the form, along with required documents such as a previous EPF passbook, to the new EPFO office.

The new EPFO office will verify the details and process the transfer request if everything is in order.

It’s important to keep in mind that the EPF/EPS transfer process may take several weeks, so early planning is recommended. Additionally, the employee should confirm that their UAN is linked to their bank account and KYC details are up to date.

In conclusion

Employees Pension Scheme and Employees Provident Fund are two great instruments to deposit and save your money for a better future. These tools also help you save taxes on the interest earned. A few important points to remember are:

- The employer makes all the contributions to the Employees Pension Scheme account.

- The employer contributes 8.33% of the employee’s pay towards the EPS, which includes the basic and the dearness allowances.

- The employer has to contribute the amount in the first 15 days of the month.

- All applicable costs of the contribution must be borne by the employer.

- To avail the pension benefits, the individual should be in active service for a minimum of 10 years, which also includes the same number of years of active contribution towards the EPS.

- If an individual has not finished 10 years but has completed a minimum of 6 months of service, he or she could withdraw the EPS pension amount if they are unemployed for 2 or more months.

- As per the EPS pension scheme, the retirement age is fixed at 58 years.

- The employee is no longer a member of the pension fund when the employee starts availing reduced EPS pension benefits or after reaching the individual’s lifetime of 58 years.

For more information on anything related to EPF pension and EPF pension, subscribe to our blogs as we will share the latest EPFO pension news regularly.

Employee Pension Scheme (EPS): FAQs

1) What is the maximum EPS contribution?

EPS is calculated as 8.33% of basic. There is an INR 15,000 the basic salary so the maximum EPS contribution by the employer will not exceed INR 1,249.5.

2) For a case where both parents have passed away is the dependent child entitled to the pension?

Pension is paid to the dependent child as an orphan pension which is 75% of the pension that would’ve been paid to parents.

3) How is EPS transferred online?

With the help of the Composite Claim Form. An individual must apply for EPF transfer during a job change via the EPFO portal.

4) Is the employee holding the EPS account the only beneficiary?

No. In the absence of the employee, the amount can be claimed by dependants.

5) Who falls under the the ‘dependants’ category for pension benefits?

In the absence of the individual holding the EPS account, the spouse or children can claim the amount. For a case with no spouse/children, the amount can be claimed by the nominee declared by the individual. For no nominee, pension amount will go to the individual’s parents.

6) How is the pension amount derived under the Widow Pension Scheme? Will the Ministry increase the amount?

The pension amount is derived on the basis of the pension wage at the time of the demise of an employee and the tenure of employment. Furthermore, the change can hinge on the proposals made by the ministry.

7) Will a subscriber’s service tenure be counted as 10 years if he has completed, for example, 9 years and 7 months of service?

Yes, since the subscriber has exceeded 9.5 years of service, it will be considered as 10 years. In other words, he/she will be eligible for pension upon attaining 58 years of age.

8) What is the process for elderly and the sick pensioners who are physically unable to process/submit documents?

EPS pensioners can also submit Digital Life Certificate(DLC) via the UMANG app. To facilitate the process, India Post Payments Bank has recently launched the doorstep Digital Life Certificate service for pensioners. They can submit an online request to avail doorstep DLC service on payment of a nominal fee.

9) Is it mandatory to transfer PF amount under different PF accounts to the current (active) PF account to get pension?

Yes. In order to avail pension benefits, the subscriber must apply for an online transfer of the funds from previous employers’ PF accounts to the current employer’s PF account.

10) What are the various benefits a spouse is entitled to receive in the event of the subscriber’s (PF account holder) demise?

If the subscriber passed away during service, the nominee will get the settlement of PF dues with interest, EDLI benefits, and widow pension. To avail the said benefit, the spouse (nominee) needs to contact the establishment where their spouse worked.

Related Articles