Table of Contents:

- How does it work?

- Provident fund applicability

- When can an employee opt out of the provident fund?

- Provident fund opt out procedure

- The Benefit of opting out of Provident Fund for an Employee

Employee Provident Fund or EPF is the main scheme under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 that offers retirement as well as other benefits to the salaried class employees of the country.

How does it work?

This scheme is meant for building the retirement corpus for the employees and serves as a good investment option too. The employees can contribute 12% (up to 88%) of their PF wages towards Voluntary PF and the employer matches it with a contribution which is not more than 12%.

At the time of retirement, the employee is entitled to receive a pension and a lump sum amount which includes contributions over the years and the interest accrued thereon.

Provident fund applicability

Any organisation that has 20 or more employees is liable to maintain a provident fund account for its employees. There is no limit to the employees’ contribution to PF, he can contribute up to 100% of his Basic + DA (PF Wages) towards PF, but it must be a minimum of 12 per cent of the same.

However, if your employee draws a salary more than Rs.15,000 per month, then he/she can also choose to not contribute to the Provident Fund. This is possible only if he meets certain criteria.

For example, if a person moves overseas pursuing new employment there, then he is not obliged to contribute to EPF in India, and he can choose to opt out of PF. However, there are two other scenarios where he may need to contribute.

If the employee is deputed overseas to a country with which India has a bilateral Social Security Agreement, he can obtain a Certificate of Coverage (CoC) from EPF authorities and avail exemption from contribution towards host country Social Security Scheme.

There are 18 countries with which India has entered into an SSA, for all remaining countries, as long as the person receives a salary in India, he is obligated to contribute to both Indian EPF as well as to the host country’s Social Security Scheme.

When can an employee opt out of the provident fund?

An employee can opt out of the provident fund if the following criteria are met:

- If he/she is a first-time employee i.e., at the time of joining the first job

- The employee has his or her Basic + DA (PF Wages) more than Rs.15000/- per month

- At the time of changing a job, only when he/she does not have an existing PF account number

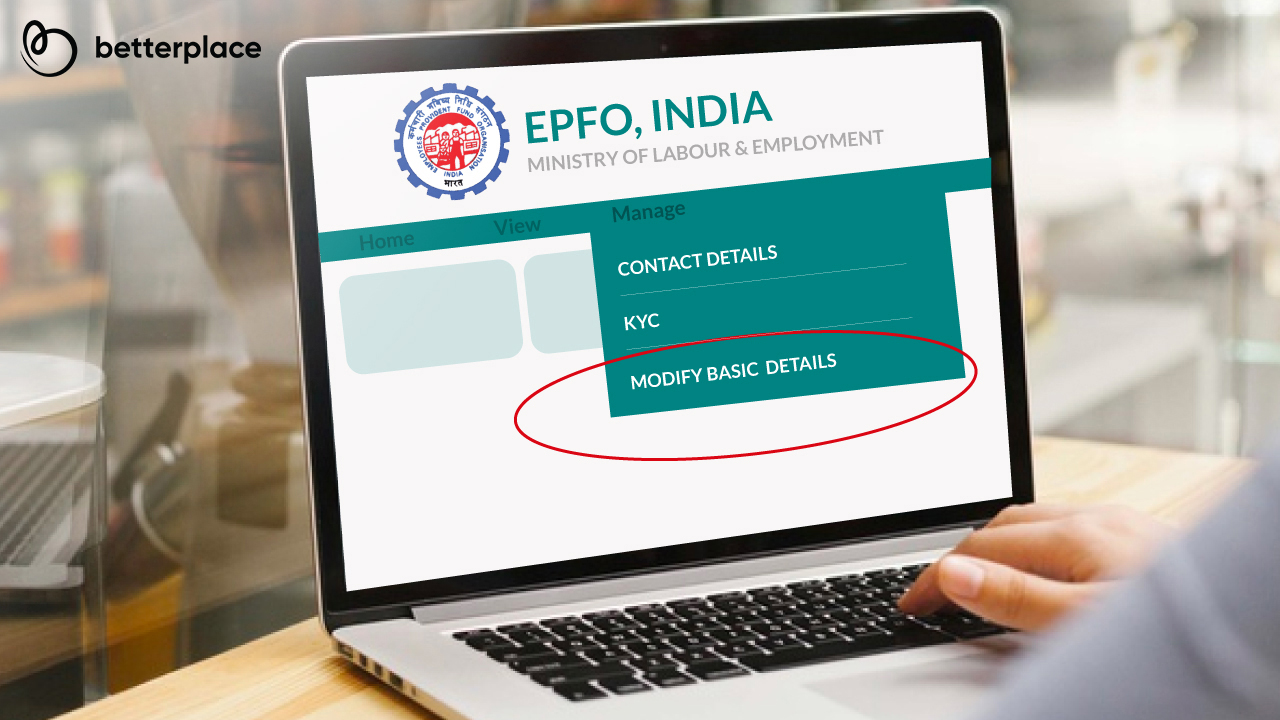

Provident fund opt out procedure

If an employee wants to opt out of PF, he can fill out Form 11 at the time of joining his first job. He will also have to present a letter addressing the employer stating that he wishes to opt out of the Provident Fund Scheme. However, the option to opt out will cease to exist in the event of making even a single contribution to PF.

The benefit of opting out of provident fund for an employee

Bigger take-home pay and Investment opportunity. Opting out of provident fund will result in more take-home pay, and hence more disposable income and investment opportunities that can potentially lead to greater returns.

While opting out of PF contributions will temporarily give you more disposable income, experts do not recommend this based on what an employee will lose by not opting for PF:

- Missing out on employer share of contribution.

- Missing out the interest on accumulated PF, which is 8.55% (2018- 2019) on the provident fund amount, which is significantly more than the interest rate of bank deposits.

- The contributions to PF are eligible for tax deductions under section Section 80C.

- The employee will miss out on the retirement pension under the Employees’ Pension Scheme (EPS).

- The employee will also miss out on the Insurance benefit (up to INR 6,00,000) that is covered under the EDLI Scheme — in case of accidental death during service before retirement — provided by EPFO. This benefit can also be availed by the employee’s nominee.

- The employee will not receive a lump sum amount on retirement.

- The employee will not have the option to take an emergency loan on the PF amount.

- Will not have the option of premature withdrawal of PF in case of unemployment or loss of income during medical emergencies.

FAQs on Opt-out option in PF

1. What if I choose not to participate in PF?

If we do not already possess PF bank details, we can choose to opt out of EPF. We could choose to not contribute to EPF if we have never contributed to it before. Individuals who prefer opting out of EPF payments will still get their entire income with no adjustments for provident funds.

2. Is it required to choose PF?

If we work for a company that hires more than 20 employees, we must participate in the EPF plan. If the company employs fewer than 20 employees, we can still enroll in the plan.

3. What is the procedure for opting out from EPS?

The EPS payment can be taken only after the individual has left the firm and before starting a new job. They can collect the EPS payment by submitting Form 10C to any EPFO site. To collect the EPS sum online, the worker should have a current UAN, as well as the KYC data, which must be connected to their UAN.

Related Articles on EPF