Table of Contents

As per the provisions of Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 establishments with 20 or more employees must mandatorily register with the Employee Provident Fund Organization (EPFO). Under the Employee Provident Fund (EPF) scheme, an employee is required to pay a minimum of 12% of basic wages towards the scheme. The employer is also required to make an equal contribution to the employee’s account, but not exceeding 12%.

Universal Account Number (UAN) is a twelve-digit number assigned to every member of the EPFO, that helps an employee to obtain and manage information related to their EPF account. An employee may have multiple Member Identification Numbers (Member ID) when they change employer, but the UAN remains the same.

Documents Required for UAN Activation

The mandatory documents required for UAN registration and authentication:

- Bank account information including the IFSC code, account number, and branch name.

- The PAN Card: Your PAN must be connected to the UAN.

- The Aadhaar Card: Because the mobile number and bank account are connected to your Aadhaar card, it’s required to be provided in order to obtain a UAN.

- Some other ID or residence evidence that might be necessary.

UAN generation Through the UAN Portal

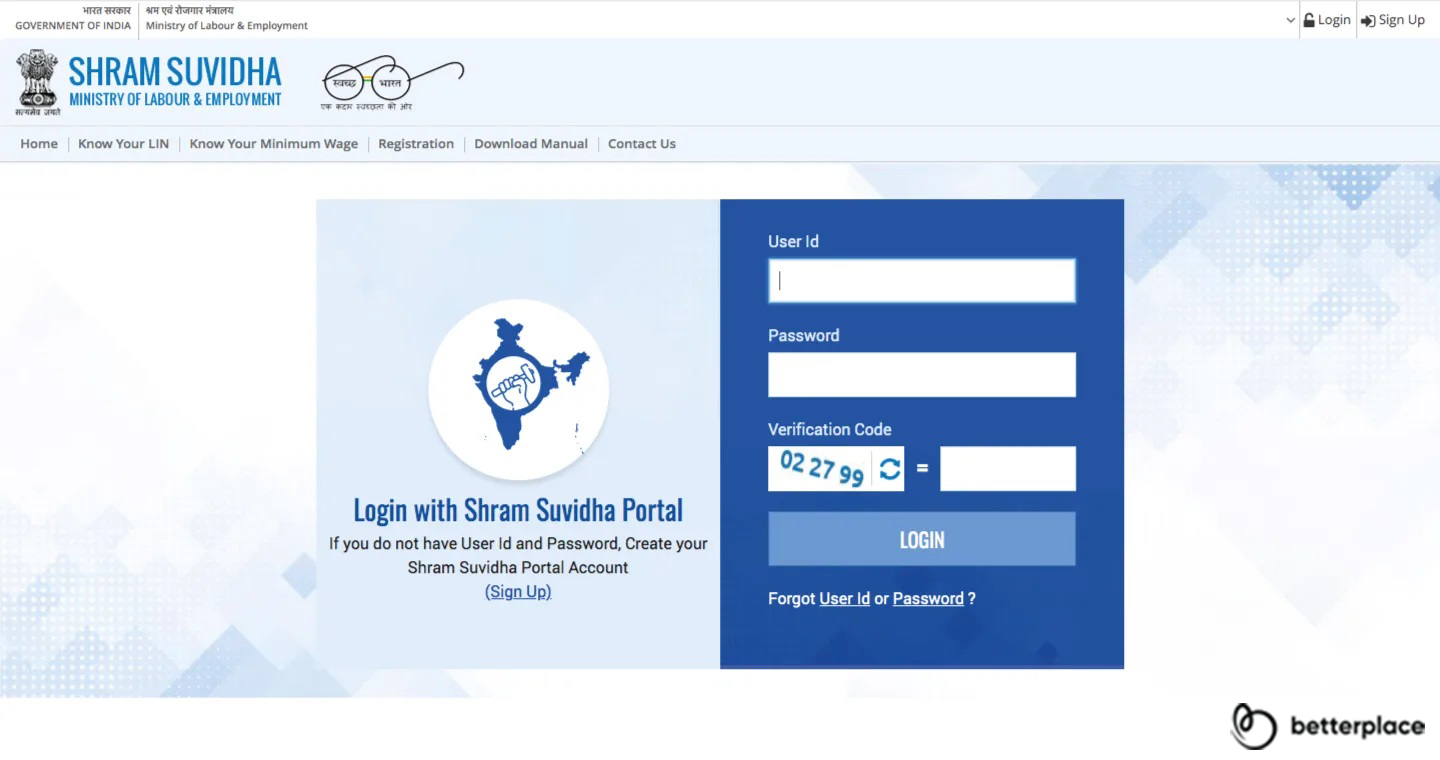

EPFO assigns a unique UAN to every employee at the time of initial registration to the EPF Scheme by the employer. It can quickly be done on the EPFO employer portal, provided the employer has registered the establishment through Shram Suvidha Portal. To register an employee for UAN, the employer has to perform the following steps:

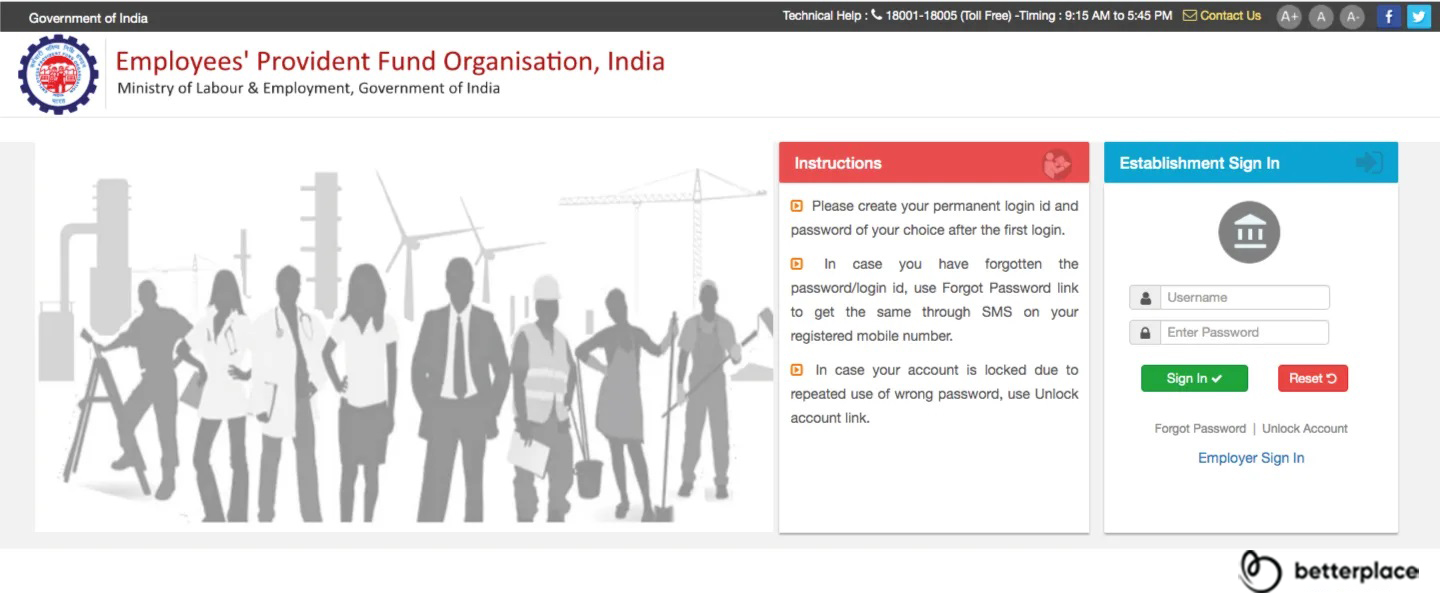

1. Visit Government of India EPFO Homepage.

2. Sign in to Establishment using establishment ID and password.

3. Click on “Register Individual” tab in the “Member” section.

4. Enter the employee’s details such as PAN, Aadhaar, bank details, etc.

5. Approve all details in the “Approval” section.

A new UAN will be generated for the employee which can be easily linked to the PF account. To avoid duplication, the employer needs to ensure that valid documents such as identity proof, address proof, bank details, and Permanent Account Number (PAN) are collected for registration during the employee onboarding, both in the form of soft copy and hard copy for future reference. In case an employee already has a UAN, they just have to let the new employer know of their existing UAN.

It is the duty of the employer to inform the employees of their UAN number. But in case they do not, an employee can obtain their UAN with their Member ID, PAN, Adhaar from the EPFO portal by following the steps below:

1. Visit Member Home.

2. Click on the link “know your UAN status”.

3. Enter the required details (PAN or Aadhar or Member ID).

4. Click on “Get Authorization Pin” to get an OTP on the registered mobile number.

5. Enter OTP to receive SMS that will include the UAN and its status.

UAN Activation Through the UAN Portal

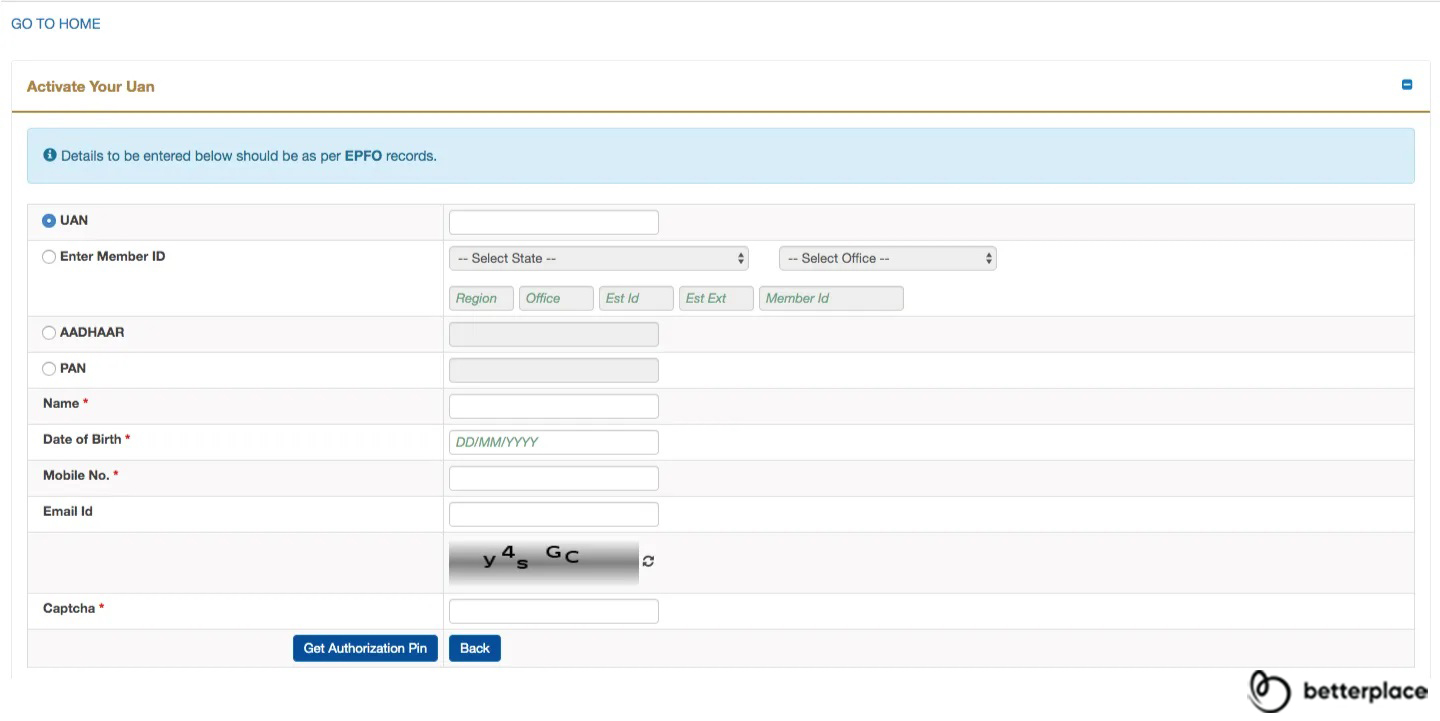

An employee can perform UAN activation at the UAN member portal by following the steps below:

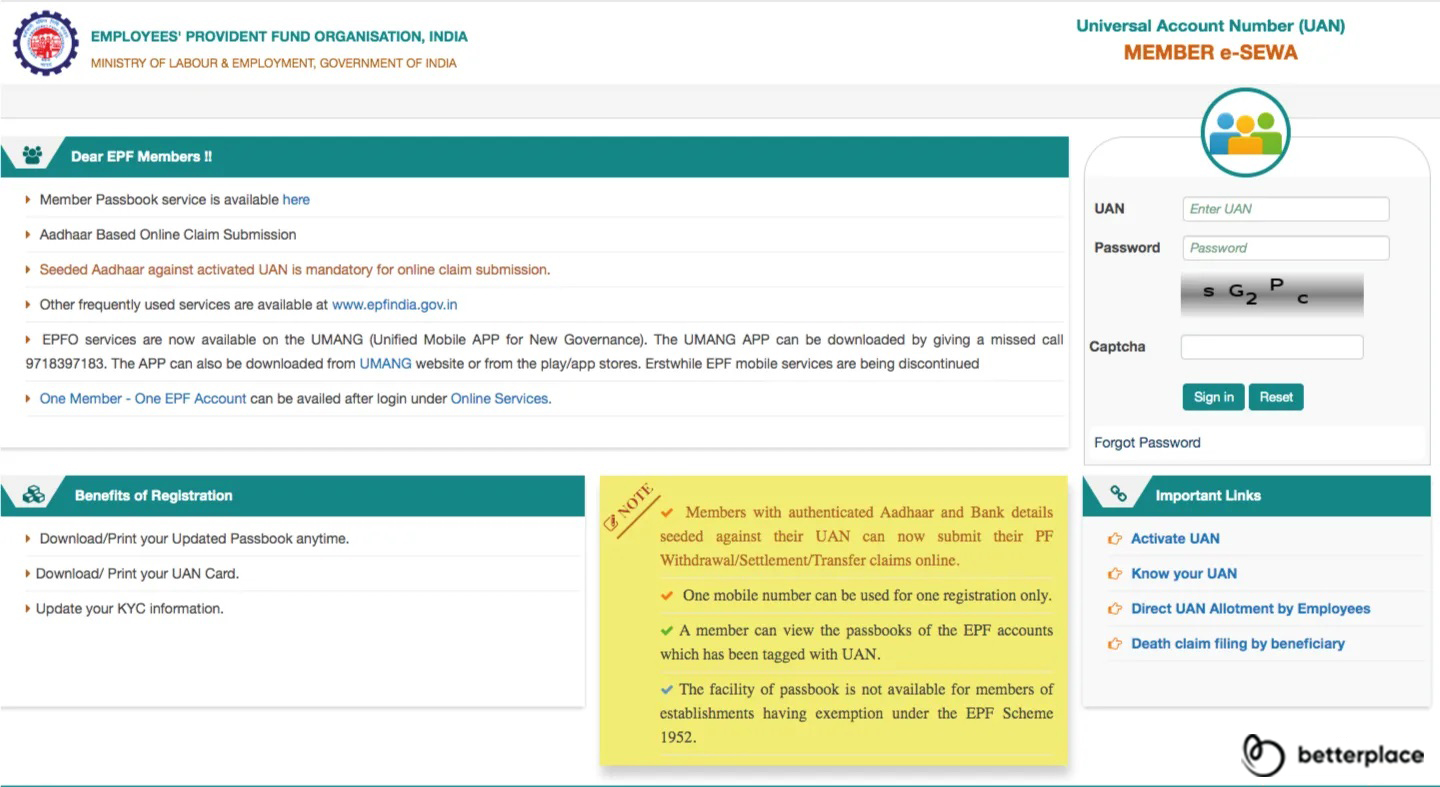

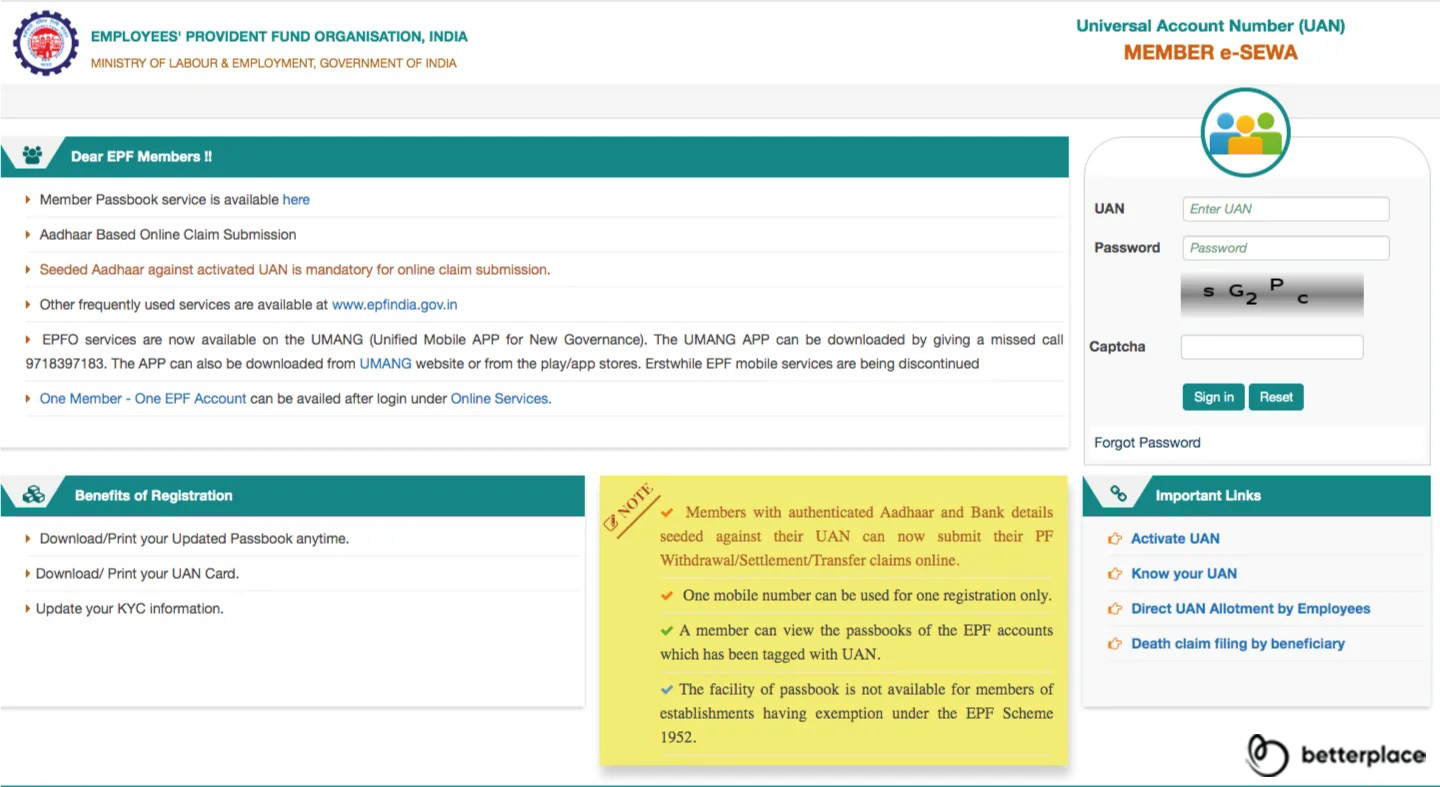

1. Visit the UAN eSewa portal.

2. Click on the link “Activate UAN”.

3. Enter the required details (PAN or Aadhar or Member ID).

4. Click on “Get Authorization Pin” to get an OTP to the registered mobile number.

5. Enter OTP and click on Activate UAN to make UAN active.

Once the UAN activation process is completed, the member will receive a password in their registered mobile number which can be changed as per their choice.

Using the UAN as user id and password a member can log in to MEMBER e- SEWA to avail the EPF passbook service. The UAN passbook service lets the member keep track and manage their EPF balance from the comfort of their home.

Linking Aadhaar to UAN

Online procedure:

1. Visit Member Home

2. Sign in to the MEMBER e-SEWA using UAN and password

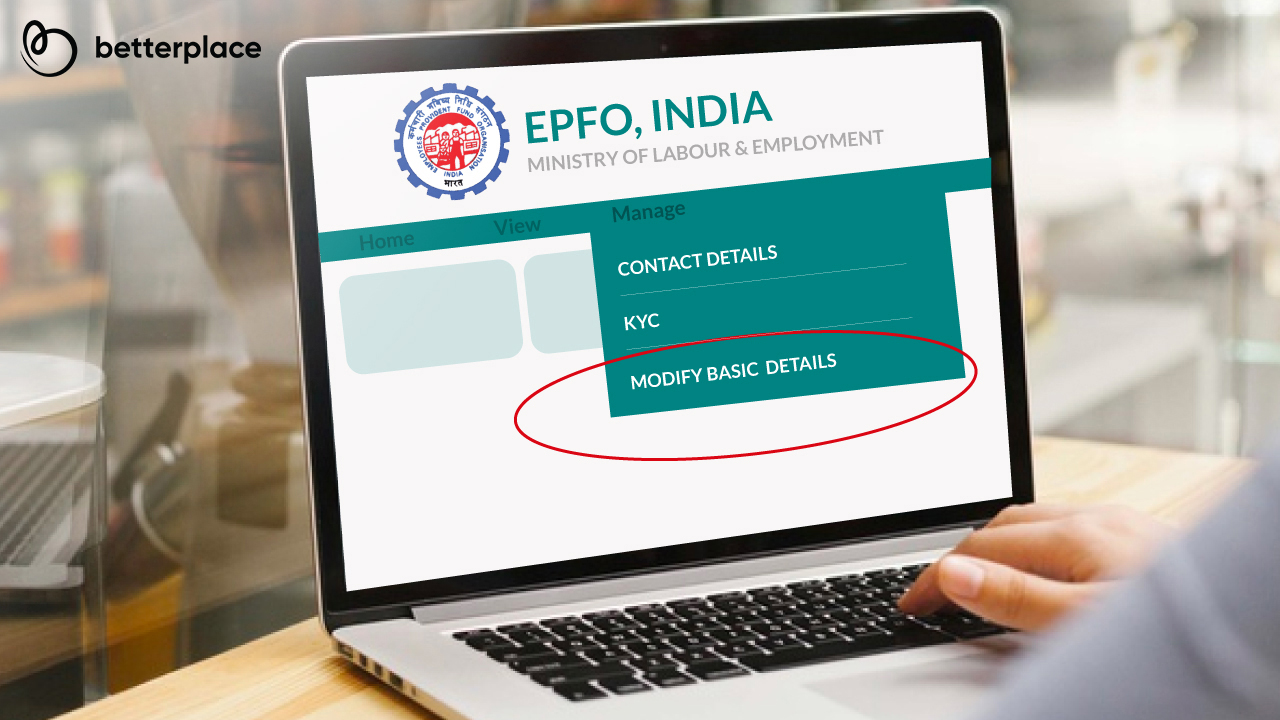

3. Select “KYC” under the “Manage” tab

4. Select the option for “‘Aadhaar’”

5. Enter the required details (name and Aadhaar Number)

5. Click “Save”

The process of Aadhaar link is completed when “verified” status is shown next to the Aadhaar number.

Additional reading: How To Link Aadhaar Card With UAN

Offline procedure:

The offline procedure of linking Aadhaar to UAN is by visiting any of the EPFO’s branches or Aadhaar CSE (Common Service Centre). There, the member needs to submit a request form with a self-attested copy of their Aadhaar card. Upon verification, it will be done which shall be confirmed by a notification to the registered mobile number.

EPFO has come a long way since its inception in 1952. It has taken various steps along the way from providing a social security service to making EPF claim settlement easier, and UAN is one such significant step.

8 Key Features of Universal Account Number (UAN)

The UAN for EPF serves as a one-of-a-kind identifier for all EPF members, allowing them to keep track of their EPF contributions, withdrawals, and transfer requests with ease. Here are the most noteworthy advantages of using UAN:

Single Window Access: Members can access their EPF account through a single-point window, avoiding the need to remember multiple account numbers.

Convenient Mobile Access: With the UAN Member Portal’s mobile application, members can view their EPF account details from anywhere, at any time.

Up-to-date Passbook: Members can view their transaction history through the UAN Member Portal’s instant passbook access.

Streamlined E-Nomination: Members can nominate a person to receive their EPF balance in the event of their death through the UAN Member Portal.

Seamless Transfer Process: Transferring EPF accounts from one organization to another is made easy with UAN, without the need for physical form submissions.

Real-time Claim Status: Members can check the status of their EPF withdrawals, transfers, and other claims through the UAN Member Portal.

Secure Online Contributions: Members can make secure online contributions to their EPF account through the UAN Member Portal.

SMS Alerts for Transactions: The UAN Member Portal sends SMS alerts for contributions, withdrawals, and other transactions, keeping members informed and up-to-date.

These UAN features make managing EPF accounts an effortless and efficient process for members.

Top 8 Benefits of Universal Account Number (UAN)

The Universal Account Number (UAN) for the Employees Provident Fund (EPF) is a revolutionary tool that offers a wealth of benefits to its members. Here are some of the top perks of using UAN:

One-Stop Access: Members can access all their EPF information from a single point, eliminating the need to remember multiple account numbers.

On-the-Go: The UAN Member Portal provides a mobile application that allows members to access their EPF account from anywhere, at any time.

Transparency: With the UAN Member Portal, members have instant access to their passbook, providing a clear view of all EPF transactions.

Peace of Mind: UAN gives members the option to nominate a person for their EPF account, ensuring that their savings will go to their intended recipient in the event of their death.

Hassle-Free Transfers: Members can transfer their EPF accounts from one organization to another without any inconvenience, thanks to UAN.

Real-Time Status: The UAN Member Portal provides members with an easy way to check the status of their EPF withdrawal, transfer, and other claims.

Online Convenience: Members can make online contributions to their EPF account with just a few clicks through the UAN Member Portal.

Instant Notifications: UAN sends SMS alerts for various transactions, such as contributions and withdrawals, so members always stay informed.

In conclusion, UAN brings a wealth of advantages to EPF members, making it a more convenient and efficient way to manage their accounts.

What is The Importance of Having a Universal Account Number (UAN)?

Having a Universal Account Number (UAN) for the Employees Provident Fund (EPF) is essential for various reasons. Here are some of the most significant ones:

Easy Access: UAN gives EPF members a single place to access their accounts, eliminating the need to remember multiple numbers and reducing stress.

Smooth Transfers: When you have a UAN, moving your EPF account from one company to another becomes a breeze, without the need for physical forms.

Centralized Control: The UAN platform lets you manage your EPF account from one place, making it easy to keep track of contributions and withdrawals.

Record Keeping Simplified: The UAN Member Portal provides quick access to your passbook, allowing you to keep a complete record of your EPF transactions in one place.

Peace of Mind: With e-nomination through UAN, you can ensure that your EPF balance goes to your nominated person in case of death.

Easy Contributions: UAN makes it simple to make online contributions to your EPF account, saving you time and effort.

Instant Updates: The UAN Member Portal sends SMS alerts for various transactions, including contributions and withdrawals, keeping you informed all the time.

In short, having a UAN gives EPF members control over their accounts and makes managing their EPF funds easier. With a centralized platform for EPF management, UAN helps members keep track of their savings and plan for the future.

How To Find/Check UAN Number?

The Universal Account Number (UAN) is a unique identification number issued by the Employee Provident Fund Organization (EPFO) to employees. It is a vital component in accessing employee provident fund (EPF) accounts, and it is essential to have an active UAN to avail of various benefits related to the EPF.

To find your UAN, you can visit the EPFO portal or check your salary slip or provident fund statement. On the EPFO portal, you can click on the ‘Know Your UAN Status’ option and enter your basic details like your name, date of birth, and mobile number to retrieve your UAN. Alternatively, you can also generate your UAN number online by following a few simple steps on the EPFO portal.

Once you have obtained your UAN, you can activate it on the EPFO portal and link it to your Aadhaar and bank account details.

FAQ’s

1. You can activate your UAN again if you change jobs?

Since UAN is a unique identification number that can be used only once, it need not be activated again any time you switch jobs.

2. Why is there a need to provide all the previous member IDs in the Universal Account Number?

The purpose of a Universal Account Number is to consolidate all the Member Identification Numbers that have been issued to an individual employee. This consolidates the information about all the schemes under which an employer has made contributions on behalf of an employee, making it easier for the employee to check all his/her accounts.

As per the new proposed changes, employees would need to disclose their previous Member ID or UAN in Form-11.

3. Can employees on contract register for the UAN and avail online facilities?

Employers with 20 or more permanent employees are required to generate Universal Account Numbers for employees making ₹ 15,000 a month or more from the sixth of the following month onward. In addition, both full-time and contract employees can sign up for UAN online after their employers have activated the account number.

4. Is the application for UAN registration free of charge?

The Universal Account Number (UAN) is free to activate, and there is no fee of any kind associated with it.

5. Is it the employer or some government authority that assigns UAN?

The Employees’ Provident Fund Organization (EPFO) distributes Universal Account Number (UAN) to an employee when he or she enrolls with the EPF.

6. You can use your UAN to transfer funds even if you do not link Aadhaar with it?

You cannot transfer funds or claim pension fund withdrawal unless your Aadhaar number is linked with your UAN. You must seed your Aadhaar number with your UAN.

7. For any online claims, is UAN mandatory?

For any kind of online claims associated with PF or pension, you need a valid UAN.

8. Is it possible to get more than just one UAN?

Only one UAN is assigned to each individual. It can be used by the employee while they are a part of any other eligible employer.

9. For an employee who is a PF subscriber, is the PAN linked with the UAN?

Yes, UAN has to be mandatorily linked with PAN. Moreover, a subscriber must also ensure that Aadhaar is also linked.

10. Are employers allowed to withhold employee provident fund (EPF) balances upon firing an employee or terminating a contract?

No, this cannot be done because EPF accounts are linked to UANs, which are transferable between eligible and registered employers.

11. What is a PF account number and a universal account number?

For withdrawals of EPF funds, a PF number is required. This comprises all PF information and details concerning the affected employee’s transactions with the organisation.

UAN stands for Universal Account Number. The UAN comprises information concerning all the Member Ids of an employee. A UAN is eligible throughout an employee’s lifetime and will remain a permanent number. If an employee switches jobs, the UAN will remain the same.

12. Can an employee have more than one UAN assigned under a single name?

Employees can only have one User Account Number (UAN) under a single name. It is transferable across eligible employers.

13. Can UAN be activated via a mobile app or through SMS?

You cannot activate your UAN through SMS at the moment. The only currently available method of activation is by registering online on the EPFO member portal, or through the Umang app.

14. Can personal details be updated for UAN? What is the process?

After updating their details in the universal account number portal, employees will receive an acknowledgement message with a unique verification code that they must enter before any update is made.

15. Can UAN activation be done offline?

To avail EPFO’s online services, employees have to register for UAN, the universal account number. This can be done only online.

Employees must provide updated information on their employment to their employers, which employers must confirm and submit to the concerned officers. After confirmation, the information will be available in the UAN portal.