Highlights

- Check PF Balance through

- EPF balance of Private trusts/ Exempted Establishments

- EPF balance for inoperative EPF accounts

- How to Transfer Your EPF Balance into New Account

- Is PF e-Nomination Mandatory

- How to Submit an e-Nomination in EPFO

- EPF Interest Credited Into Your Account

- How to Check PF Balance Without Registered Mobile Number

- How To Check PF Balance From Your Home Without Internet

- Frequently Asked Questions

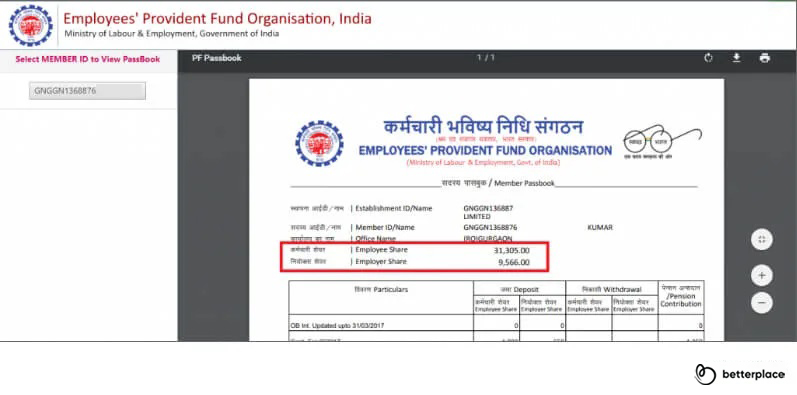

The EPF or Employee Provident Fund plays a vital role in the financial life of an employee. It is a retirement fund that is bolstered by an equal contribution every month from the employee and their employer. Every employee, who is an EPFO member, will be provided with an online EPF member passbook. This passbook shows the total amount deposited in the PF account of the employee and the monthly contribution details of both parties.

Latest Update

The interest rate applicable to the EPF contributions is 8.10% for FY 2022-23

For employees of a corporation, performing an EPF balance check has become easier. Now the employees don’t need to see the annual EPF statement shared by their employer to do their EPF balance check. They can do their EPF balance check online as well as offline:

Ways to Check your EPF Balance (Online)

Ways to Check your EPF Balance (Offline)

Let us look at these methods in detail.

PF Balance Check with UAN number on EPFO Web Portal

An employee, who is an EPFO member, can now get their EPF balance from the EPFO website. The employee can perform a PF balance check with their UAN number on the EPFO web portal.

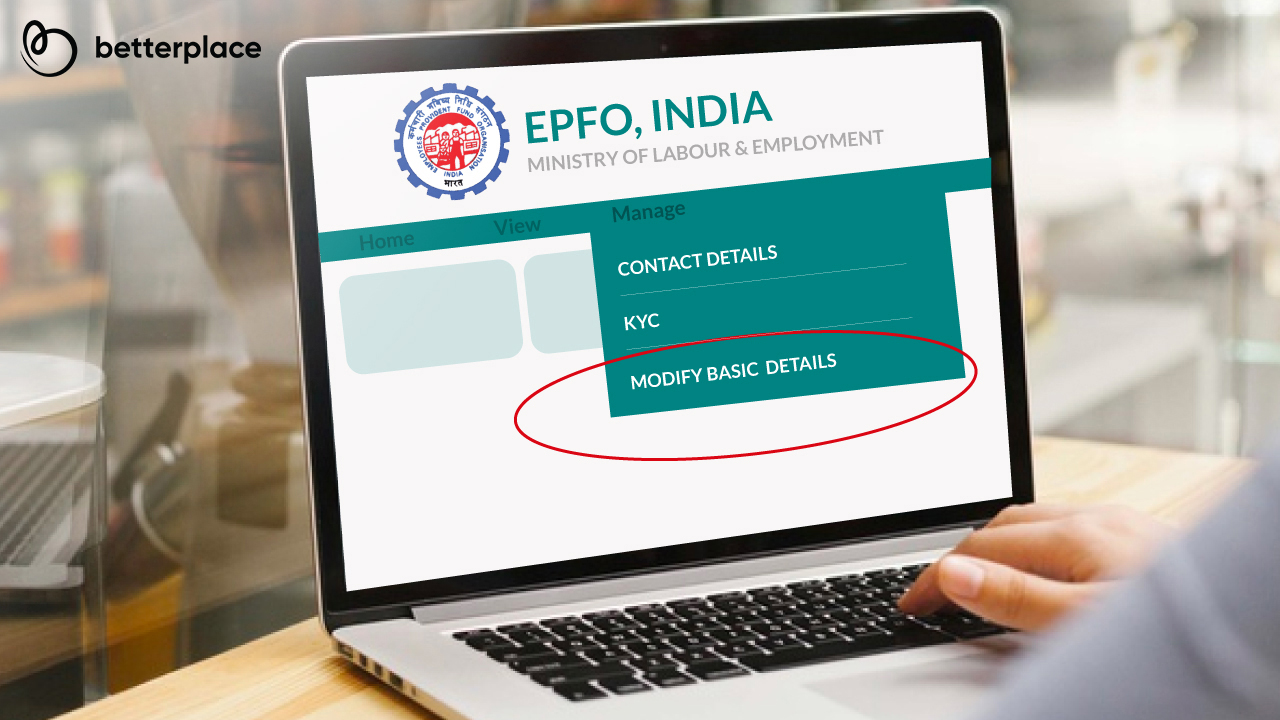

6 Steps to check PF Balance using UAN number on EPFO Web Portal:

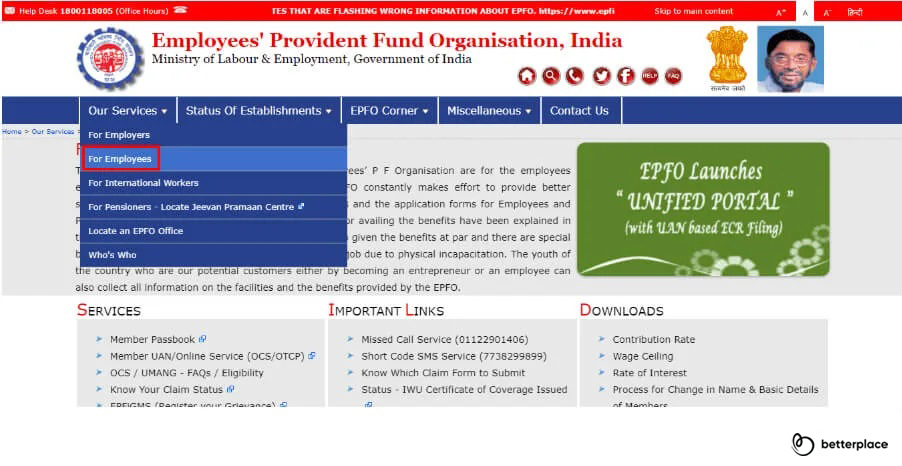

- Step 1: Go to the EPFO portal.

- Step 2: Go to “Our Services” on the menu bar and select “ For Employees”. A new page will open on your screen.

- Step 3: Then, go to the “Services” menu and select “Member Passbook”. A new login page will open on your screen.

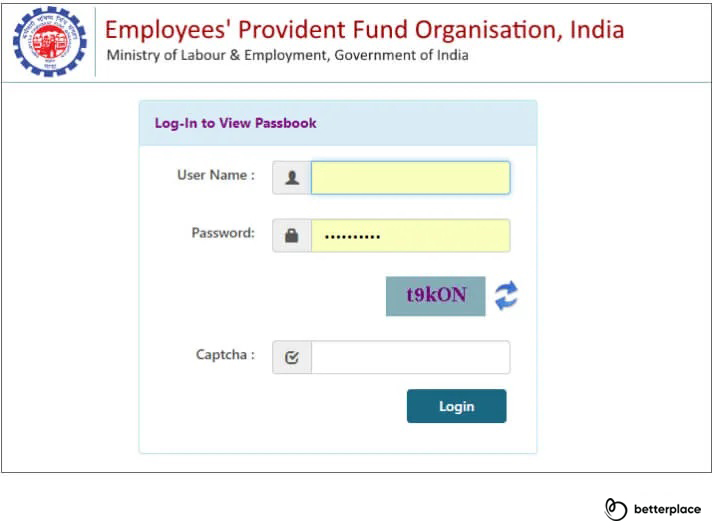

- Step 4: On the login page, enter your “UAN”, “Password” and the Captcha code for verification and hit Login. The UAN number is also commonly termed as EPF balance check number.

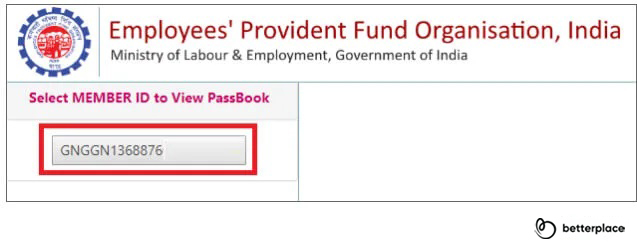

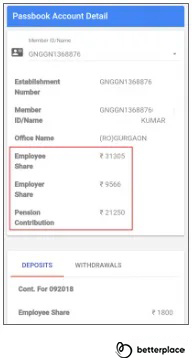

- Step 5: Once you have logged in, a new page will appear which will display all the Member IDs of every account linked to your UAN. So, if you have had different EPF accounts with any previous employer, they all will reflect on this page along with your current employer’s EPF account. It is important to note that you cannot do an EPF balance check without UAN number.

- Step 6: Select the relevant Member ID of the EPF account for which you wish to do an EPF balance check online. The applicable EPF member passbook will be displayed on your screen. You have the option for a UAN passbook download or EPF passbook download.

PF Balance Check Using UMANG App

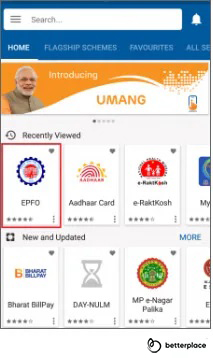

An EPFO member can also do their EPF balance check on mobile number with the help of the government centralised app, called ‘UMANG’ which is an acronym for Unified Mobile Application for New-age Governance. Through this app, the Government of India aims to provide all its government services under one roof.

In order to access the app and check the EPF balance on their phone, the EPFO member has to register their mobile number, which is linked to the UAN. You can check your EPF balance in the UMANG app in the simple steps mentioned below.

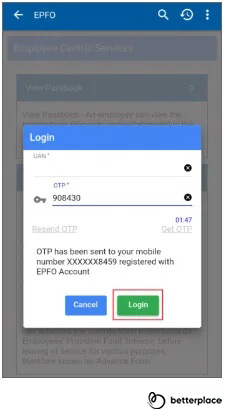

7 Steps to check PF Balance using UMANG App:

- Step 1: Install the UMANG app from the App Store/Play Store. Or click here to download the app.

- Step 2: Open the UMANG app and select “EPFO”.

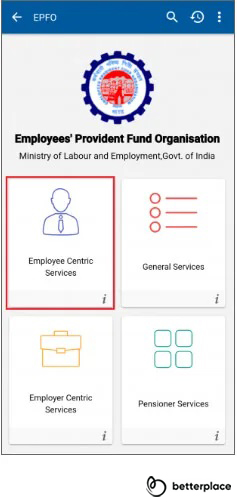

- Step 3: Choose the “Employee Centric Services” option.

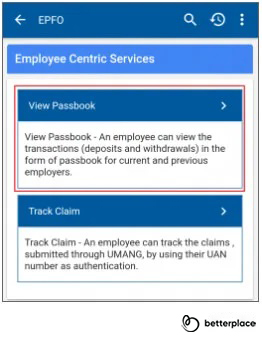

- Step 4: Select the “View Passbook” option to check the EPF balance.

- Step 5: Then, enter the UAN and select the “Get OTP” option. An OTP will be sent to your registered mobile number. Enter this number and select the “Login” option.

- Step 6: Choose the appropriate Member ID to view the relevant EPF balance.

- Step 7: Next, your EPF passbook will appear on your mobile, which will display your PF balance.

PF Balance Check by Sending an SMS

The EPFO member can now simply send an SMS to 7738299899 to check the EPF balance and last contribution amount. The SMS must be sent in the ‘EPFOHO UAN ENG’ format.

To elaborate, if the EPF balance UAN number is 123456, and the language of preference is English, then the SMS to be sent is “EPFOHO 123456 ENG”. Here the first three letters of the language form the language code. For English, it is ENG; for Hindi, it is HIN and so on.

Currently, the SMS facility allows for the below languages:

- Hindi

- English

- Marathi

- Bengali

- Gujrati

- Punjabi

- Kannada

- Telugu

- Tamil

- Malayalam

Note: The SMS facility is only available if the UAN is active and linked to the bank account, Aadhar and PAN. If the UAN is not linked, then the individual needs to first complete the KYC process before sending the SMS to know the balance.

PF Balance Check Through a Missed Call

The easiest method in which an EPF member can view their EPF balance is by simply giving a missed call to “011-22901406”. But the EPFO member must fulfil the below requirements in order to use the missed call facility:

- The EPFO member should possess an active UAN number.

- The mobile number of the EPFO member has to be registered with the UAN, and the member can give the missed call only from the registered mobile number.

- The UAN should be linked to other documents, such as Bank Account, Aadhaar and PAN.

How one can check their PF Balance without using a UAN?

Even if you don’t recall your UAN, you may quickly verify your EPF balance. You may check the balance by dialling 011-229014016 from your linked mobile phone. You are not necessary to supply the UAN code in this circumstance or you can check it on their website by following the steps mentioned below:

Step 1: Access the EPFO webpage at epfindia.gov.in.

Step 2: Select “Click Or tap here to see Your EPF Balance”.

Step 3: You’ll be sent to epfoservices.in/epfo. Select “Member Balance Information” from the drop-down menu.

Step 4: Choose your state and then click on the EPFO office link.

Step 5: Input your PF Account Number, name, and verified mobile phone number.

Step 6: Click “Submit” and your PF balance will be revealed.

Ways to check EPF balance of private trusts/ exempted establishments

If it is an exempted establishment or private trusts, then the EPF contribution is transferred to the trusts managed by the company, rather than getting transferred to the Employees’ Provident Fund Organisation. In this case, only the trust managed by the company can provide information about the PF balance of an employee. EPF accounts, managed by exempted establishments, do not contain a common method of PF balance checking with the EPFO. Further, the EPFO is in no way linked to such EPF accounts, and neither do they provide any EPF passbook check benefit for these EPF members.

As per the Employee Provident Fund and Miscellaneous Provisions Act, 1952, eligible employers or companies are given the liberty to manage their specific EPF schemes for the employees. Examples of exempted establishments are mainly large corporations, such as HDFC, Godrej, Infosys, TCS, Wipro, Nestle, so on and so forth. Such organisations have an in-house EPF trust. And hence, they don’t need to contribute their EPF corpus to the EPFO.

Such exempted establishments normally manage their EPF corpus with different trusts they own. However, the government expects these trusts to provide more returns in comparison to the funds managed by EPFO. The same EPF contribution rules apply to private trusts too.

The employees of exempted enablements can check out their PF balance in these four ways:

- Check payslip or PF slip: Employees of many such big establishments receive their salary slips from the company through internal emails. Their payslips contain their EPF balance. Few companies, however, provide EPF slip along with the salary slip. In this EPF slip, the employees would find their EPF balance and the monthly contribution.

- Check the employee portal of the company: Many such large corporations create and maintain their own company website for their employees. Their employees can sign in to the EPF section to check the EPF balance. TCS and Wipro are examples of such organisations which provide an online facility to their employees to check their EPF balance and get the EPF statement.

- Contact the HR department of the company: Employees can contact the HR department of their company. This is because they handle the EPF of the employees and are the right people to provide better details about EPF balance.

- Track your EPF contributions: An employee can also keep a record of the monthly contributions towards the EPF by regularly checking the salary slip and calculating their EPF balance. Employees can utilise the rate of interest as set by EPFO to calculate their EPF amount annually. Remember that a fixed amount( up to ₹1250/month) is contributed towards the employee’s EPS account.

Ways to check EPF balance for inoperative EPF accounts

As per the Government of India notification dated November 2016, dormant accounts will no longer be listed as inoperative. Instead, they will continue accruing interest like normal active accounts. EPFO had earlier stopped making interest payments to dormant EPF accounts since the year 2011. However, once the November 2016 amendment came into effect, every inoperative EPF account started accruing interest. The interest rate was 8.8% annually.

Earlier, EPF accounts went inoperative owing to two main reasons:

- The process of transferring the EPF account is tedious

- Employees prefer to open a new EPF account when they switch jobs

A gap in communication between the previous and the current employer of the individual largely contributes to such a situation. In such cases, if an employee is unable to find any details of old inoperative EPF accounts, those individuals can contact the EPFO helpdesk to get their EPF balance in old accounts transferred to their currently active accounts.

How to Transfer Your EPF Balance into New Account?

In India, an Employee Provident Fund (EPF) account can be transferred from one account to another, even if it’s an older account. This can be done when an employee changes jobs or switches to a new EPFO office.

The transfer process ensures that the employee’s savings remain protected and continue to earn interest, regardless of the change in employment.

As an employee, you can transfer your EPF account to a current one through the following process:

Step 1: Log in to your EPF account using your UAN and password.

Step 2: Navigate to the “One Member – One EPF Account (Transfer Request)” option in the “Online Services” section.

Step 3: Click “Get Details” to view the PF account details of your previous employment.

Step 4: Choose either your previous or present employer for attesting the claim form, depending on the availability of a signatory with a DSC.

Step 5: Obtain an OTP by clicking “Get OTP” and entering it into the provided space.

Self-attest and submit the generated, filled-out PF transfer request form in PDF format to your selected employer.

Step 6: Wait for your employer to approve the transfer digitally and track the process with the generated tracking ID.

Step 7: Please note that in some cases, you may need to download and submit the Transfer Claim Form (Form 13) to your employer to complete the EPF transfer process.

Please note that in some cases, you may need to download and submit the Transfer Claim Form (Form 13) to your employer to complete the EPF transfer process.

Is PF e-Nomination Mandatory?

The e-Nomination process for the Provident Fund (PF) account is not mandatory. However, it is advisable to nominate a person who will receive the amount in case of death or permanent disability. The e-Nomination process is an electronic way to nominate someone for your PF account and is easier and quicker than the traditional paper-based process.

How to Submit an e-Nomination in EPFO?

To help ensure the proper distribution of subscrivers’ Provident Fund (PF) savings in the event of their untimely passing, the Indian government has provided EPF account holders with the option to nominate someone to receive their benefits. Here’s the step-by-step process for e-nominating:

Step 1: Login to your EPF account using your UAN and password.

Step 2: Navigate to the e-Nomination section under the Online Services tab.

Step 3: Fill out the required information, including the name, age, and relationship of the nominee.

Step 4: Review the information and submit the form.

Step 5: The nominated person’s details will be updated in your EPF account.

It’s important to regularly review and update e-nomination to ensure that the beneficiaries are accurately reflected.

EPF Interest Credited Into Your Account?

The Employees’ Provident Fund (EPF) is a popular savings scheme for salaried individuals in India. Checking the EPF balance is an important aspect of monitoring one’s savings. It also helps ensure their contributions are accurately reflected in the fund.

Employees can check their EPF balance online through the EPFO portal by logging in with their Universal Account Number (UAN) and password. Another option is to check the balance via the Umang App, which is available for download on both Android and iOS devices.

Additionally, employees can check their EPF balance through missed calls and SMS services. By giving a missed call or sending an SMS to a designated number, they can receive their EPF balance on their registered mobile number.

In case of any discrepancy in the EPF balance, employees can raise a grievance on the EPFO portal, which the concerned authorities will resolve.

How to Check PF Balance Without Registered Mobile Number

Employees contributing to the Employee Provident Fund (EPF) can easily check their PF balance online. However, some employees may need help checking their balance due to a change in their registered mobile numbers. Here’s how one can check their PF balance without a registered mobile number:

- Visit the EPFO portal: Go to the EPFO portal and click on the ‘For Employees’ option.

- Enter your details: Enter your UAN (Universal Account Number), password, and the captcha code. One can generate a code in case one forgets the password. In such cases, click on the ‘Forgot Password’ link.

- Select ‘Member ID’: Once you log in, select the ‘Member ID’ option to view your PF balance.

- Check your balance: Your PF balance will be displayed on the screen.

In case of difficulties, while checking the balance online, one can also check the balance by sending an SMS to 7738299899. Type’ EPFOHO UAN ENG’ in the message and send it to the given number.

The message can be received in multiple languages. All you need to do is replace ENG with the first three letters of the preferred language. For example, one can type ‘EPFOHO UAN HIN’ to get updates in Hindi. This feature is accessible in many languages, including English, Hindi, Punjabi, Gujarati, Marathi, Kannada, Telugu, Tamil, Malayalam, and Bengali.

Tracking PF Money: How To Check PF Balance From Your Home Without Internet?

Monitoring your provident fund (PF) balance is essential to ensure the effective management of your earnings. Traditionally, this involved visiting the provident fund office or accessing an online portal. However, technological progress has revolutionized the accessibility of this information, making it more convenient than ever before. Even without an internet connection at home, various alternative methods exist to check your PF balance.

In this article, we will delve into techniques for tracking your PF funds in the absence of internet access.

1. Missed Call Service:

One of the simplest ways to check your PF balance without an internet connection is through the missed call service. Each regional provident fund office has a dedicated toll-free number for this purpose. You can find the specific number for your region on the official website of the Employees’ Provident Fund Organization (EPFO). Dial the number from your registered mobile number, and after a few rings, the call will automatically disconnect. You will receive an SMS containing your PF balance details shortly afterwards.

2. SMS Service:

Similar to the missed call service, you can also use the SMS service provided by the EPFO to check your PF balance. Send an SMS in the prescribed format to the designated number, which can be found on the EPFO website. The message should contain specific details such as your Universal Account Number (UAN), followed by a predefined code. You will receive an SMS response within a few moments with your PF balance information.

3. UMANG App:

The Unified Mobile Application for New-age Governance (UMANG) is a government initiative that provides a wide range of services, including checking your PF balance. While this method does require an internet connection for the initial setup, once configured, you can access your PF balance offline. Install the UMANG app on your smartphone, register with your mobile number, and link your UAN to the app. After the initial setup, you can view your PF balance without internet connectivity.

4. EPFO Offline Services:

Sometimes, when internet access is unavailable, the EPFO provides offline services for checking your PF balance. You can visit the nearest EPFO office and request an account statement. Fill out the necessary forms and submit them along with your identification documents. The EPFO officials will process your request, and you will receive a printed account statement containing your PF balance.

Keeping track of your PF balance is essential for financial planning and ensuring the security of your savings. Utilizing these offline methods allows you to easily monitor your PF balance from the comfort of your home, even without an internet connection.

Frequently asked questions on EPF

1) Can an employee check their EPF balance in their previous company?

Yes. An individual can check out their final EPF balance in their previous company. The individual has to sign in to the EPFO portal with the help of their UAN (Universal Account Number) and Password, and then select the appropriate Member ID to view the EPF balance of their previous company. All different member IDs that appear on the web portal are linked to the individual’s EPF accounts from their different previous employers.

2) Can you check your EPF balance with the help of the PAN number?

No. The EPF balance cannot be checked with the help of the PAN number. To check EPF balance, you need a UAN. However, to enjoy various services and benefits of EPFO, you need to feed the PAN details into your EPF account.

3) Can you check EPF balance with Aadhaar number?

You cannot check your EPF balance by using your Aadhaar number. You can check your EPF balance online by only using your UAN.

4) Can you check your EPF balance via an SMS without linking UAN to your mobile number?

The SMS facility is available only on the registered mobile number. So, you must get your mobile number registered with your UAN to check your EPF balance via SMS. This is because information about EPF balance is messaged only to registered mobile numbers.

5) Can you check your EPF balance by giving a missed call from an unregistered number?

No. To check your EPF balance, the number from which the missed call is made has to be registered with your UAN. Therefore, you must mandatorily link your 10-digit mobile number with your UAN to avail the missed call service.

6) Can you check your EPF member balance by using your PF number?

You will need your UAN details to log in and check your EPF balance online. Thus, PF number isn’t required to check EPF balance. The information collated above is all you need to know about checking EPF balance online and EPFO balance inquiry. It is better to keep the same EPF account number, even if you change the jobs, as it will be easy for EPF calculations.

7) How to download EPFO ‘m-sewa’ app?

Earlier, EPFO had provided the ‘m-sewa app’ to all the members to check the balance and other details. The facility is now discontinued. However, you can check the EPF balance using UMANG (Unified Mobile APP for New Governance). The UMANG app can be downloaded from play store or app store and from the UMANG official website.

8) How to avail a loan against my PF balance?

You can avail a loan against your EPF balance based on the years of your service. You have to submit Form 31, which will show your EPF account number, salary and other details, to your employer and the employer should apply for the loan directly to EPFO along with other relevant documents.

9) Can I withdraw my complete PF balance at one go?

You can withdraw your PF corpus completely after two months of unemployment. Also, you can withdraw up to 75% of your EPF corpus after one month of unemployment. Tax exemption on PF withdrawal is valid only after 5 continuous years of EPF membership.

10) How to download EPF balance details?

You can download the EPF account statement, which will have EPF balance details as well as other information, using the e-passbook facility available on the EPFO website. You need to register with EPFO to view and download the balance statement. Here are the steps to download your EPF passbook/statement.

- Login to the membership portal using your mobile number.

- Click on ‘download e-passbook’.

- Select PF office from the list.

- Enter the company PF code.

- Enter your PF account number.

- Complete the PIN verification using the registered mobile number.

- You will get your e-passbook on the page after 3 working days.

- You can download the statement afterwards.