7 Common Misconceptions About Payroll

A payroll outsourcing firm takes away the payroll burden from you. They insulate the process with expertise, cut-down costs, and nullify the risk of errors and non-compliance.

You cannot afford to go wrong with payroll.

Why?

For starters, the cost of mismanaged payroll begins with harsh fines and penalties and ultimately leads to ruining the entire business.

- As per research payroll problems affect 54% of the workforce.

- 40% of SME owners believe that managing payroll and related taxes are the worst and most time-consuming part of owning a business.

The issue, however, is not payroll but the misconceptions hovering around it that create problems and harm businesses.

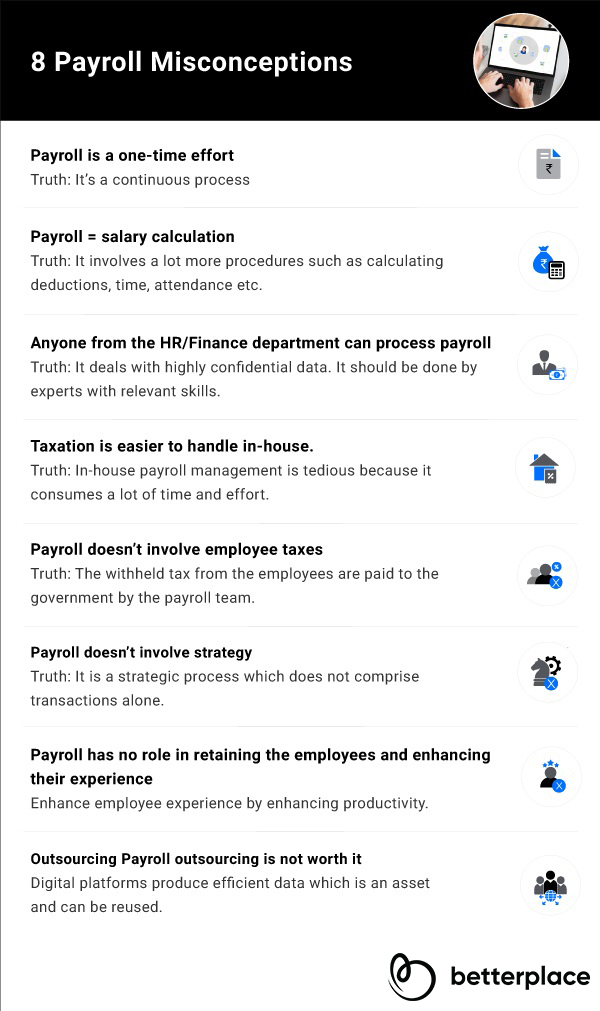

Here are 7 payroll misconceptions and truths behind them

Payroll is a one-time effort

This cannot be farther from the truth. Setting up a framework for payroll is a continuous process — it doesn’t end with setting up payroll software.

The process needs regular evaluation and periodic updates. And that’s precisely how you maximize its efficiency.

- You need to continuously eliminate repetitive tasks, find error-prone areas, and identify time-consuming parts using payroll software.

- Changes in the work atmosphere, compliance standards, and technological developments also contribute towards making payroll an ongoing process.

Remember to frequently audit your payroll software and the entire process.

Payroll = salary calculation

Payroll is often misconstrued as a process of paying employees for their work jobs. The reality, however, is different.

- Payroll cannot exclusively fit under HR. It involves accounting procedures too.

- The payroll process involves salary calculation as per the leave policy but that’s just a part of it. It also deals with time and attendance, deducting TDS and contribution for PF, ESI, PT, & all that’s applicable.

Payroll is thus much more than salary calculation.

Anyone from the HR/Finance department can process payroll

Payroll deals with highly confidential employee data so it mustn’t be handled by just about anyone.

- Assign payroll responsibly to experts who have the necessary skills.

- Make sure they know to handle sensitive information besides knowing about taxations and its statutory aspects.

- Always have a confidentiality agreement in place to maintain the security of your payroll data.

All about tax

- Taxation is easier to handle in-house.

Companies that outsource the entire payroll process often handle taxation in-house to save costs. However, by not handing over the process to experts, they end up increasing the cost manifold through non-compliance and heavy penalties.

- Payroll doesn’t involve employee taxes.

This is misleading. Employers must fairly withhold payroll taxes from employee’s gross salaries. The payroll team then — on behalf of the employees — pays it to the government.

Payroll doesn’t involve strategy

That’s a lie.

Payroll doesn’t comprise transactions alone. There are various strategic activities that go into making an efficient payroll process.

- Payroll components are thoroughly reviewed to ensure that your payroll synchronizes with the industry standards, benefits employees, and gives you a competitive edge.

- Ensure that your payroll and organizational goals are on the same lines.

Payroll has no role in retaining the employees and enhancing their experience

Employees have both monetary and non-monetary motivating factors. And both affect their experience.

An efficient payroll system with accurate payments, payslips issuance, ESS portals increases employee’s trust in the organization. This inculcates a transparent culture, reduces employee turnover, and enhances their experience.

Outsourcing Payroll outsourcing is not worth it

A common misconception is that it is easier and cheaper to handle payroll in-house.

Reality – Here are the ingredients to handle payroll in-house

You’ll need

- Time and money to upgrade and maintain your payroll software.

- An in-house IT team.

- IT Hardware support, time and again.

- Extra time and cost to train employees, for payroll administration and taxation, and to keep up with the compliances.

- High risk of errors and non-compliant procedures.

- Cost of fines and penalties if you go wrong.

Does it look like it’s easier or cheaper to deal with the aforementioned?

The truth is, a payroll outsourcing firm takes away the payroll burden from you. They insulate the process with expertise, cut-down costs, and nullify the risk of errors and non-compliance.

Conclusion

Now you know the common misconceptions that trap you and ruin your business. The next step is to understand their corresponding truths and take one step at a time to eliminate them by leveraging the latest processes and technologies.

Subscribe For Newsletter

Subscribe to get the latest news and happenings around recruitment space

Comments