What is Payroll Processing?

Payroll processing in HR is an elaborate process that involves a lot more than salary calculations. The process can be intimidating if you do not know how to go about it which is exactly why this handy guide will navigate you through the intricacies of payroll processing.

What is the meaning of Payroll Processing?

Payroll processing is an essential business function that involves arriving at the ‘net pay’ of the employees after the adjustment of necessary taxes and deductions. For efficient payroll management process, the payroll administrator needs to plan the payroll process step-by-step.

*Note

Net pay = Gross income – Gross deduction

Here,

Gross income/Salary = Regular Income + Allowances + One-time payment/ Benefit

Gross deduction = Regular deductions + Statutory deductions + One-time deductions

Challenges in the Payroll system and its One Step Solution:

What precisely are the payroll management obstacles? In this part, we’ll look at the problems that beset payroll management systems:

- There are several rules and procedures to follow, such as labour laws, federal rules, and legal compliance. Implementing these guidelines is not optional; it is required. However, non-compliance alone is not often a decision; many individuals simply do not grasp intricate rules. As a result, there are concerns with compliance and large fines.

- If we merely analyze the example of conformity, we can see that mistakes might occur owing to human factors. Errors often occur when the sole person is responsible for the payment of 30 people. These are common errors that occur during hand computations. Charges and fines are occasionally imposed as a result of these mistakes.

- Because cost accounting is so complicated, it is usual for HRM to postpone compensation. Time is required for manual methods, regulation, taxation, and anything else. Determining each employee’s paycheck manually can be exhausting, resulting in delays. Whenever these delays occur, employees become irritated, and your attrition rate rises.

Cost accounting for your SMEs isn’t a straightforward activity that can be performed in-house by a single individual. Payroll processing presents a number of problems that have an influence on your efficiency and adherence framework. As a consequence, noncompliance sanctions have grown commonplace. In the preceding post, we looked at solutions for payroll processing problems. These difficulties are simply overcome by using one payroll processing provider.

What does Payroll Processing encompass?

Here’s a list of tasks the payroll administrator needs to accomplish during payroll processing.

- Develop the organisation’s pay policy that includes flexible benefits, leave encashment policy, and more.

- Define payslip components – basic and variable pay, HRA, LTA, etc.

- Collect other payroll inputs from the transport service provider or the food/canteen vendor.

- Arrive at the net pay by calculating gross salary and deducting the statutory and non-statutory sums.

- Finally, release employee salary.

- File returns and deposit dues such as TDS, PF, and more, with respective authorities.

A step-by-step explanation of Payroll Processing in India

The entire payroll procedure is divided into 3 stages.

STAGE 1: Pre-Payroll Activities

-

Defining payroll policy

This is the first stage wherein you establish policies to bank on during the payroll process. To turn these policies into standards, they need to be approved by the management. Examples of such policies are – pay policy, attendance policy, leave and benefits policy, and more.

-

Gathering inputs

The next step is to gather inputs from various departments to ensure accurate calculation of payroll.

| DATA SOURCE | DATA EXAMPLE |

| Employees | Income tax declaration, facilities availed, and more. |

| HR team | Salary structure, eligibility for benefits, etc. |

| Finance team | Deduction for recoveries. etc. |

| Leave and attendance systems | Data from attendance systems, current work shift, etc. |

| General service providers | Transport service provider, canteen vendor, and more. |

All this data collection can seem overwhelming at first. You must, therefore, incorporate payroll software which comprises features such as leave and attendance management, ESS (Employee Self Service portal) and more to make it hassle-free.

-

Input validation

Once you’ve finished gathering all the required data, you need to verify its validity. Because a single mistake here can cause ruin the entire payroll process.

- Ensure that the list contains all the active employees and no records of inactive employees.

- Check that data adheres to the company policy.

- Ensure the data present in the right format.

Stage 2: Actual payroll process

-

Payroll calculation

Now that you have the verified data, its time to feed it into the payroll system. The result you get will be the net pay after the adjustment of necessary taxes and deductions. In this step, you recheck the process again to nullify chances of errors.

What is a Payroll System?

A payroll system is a software to automate the payroll process. These systems can be integrated with leave and attendance tracking systems and employee self-service portal and are used to keep track of employee’s working hours, calculate salaries, calculate taxes and deductions, print payslip, etc.

Payroll software, thus, minimises employers’ efforts so that they can focus on more pressing problems of the business.

Stage 3: Post-payroll process

-

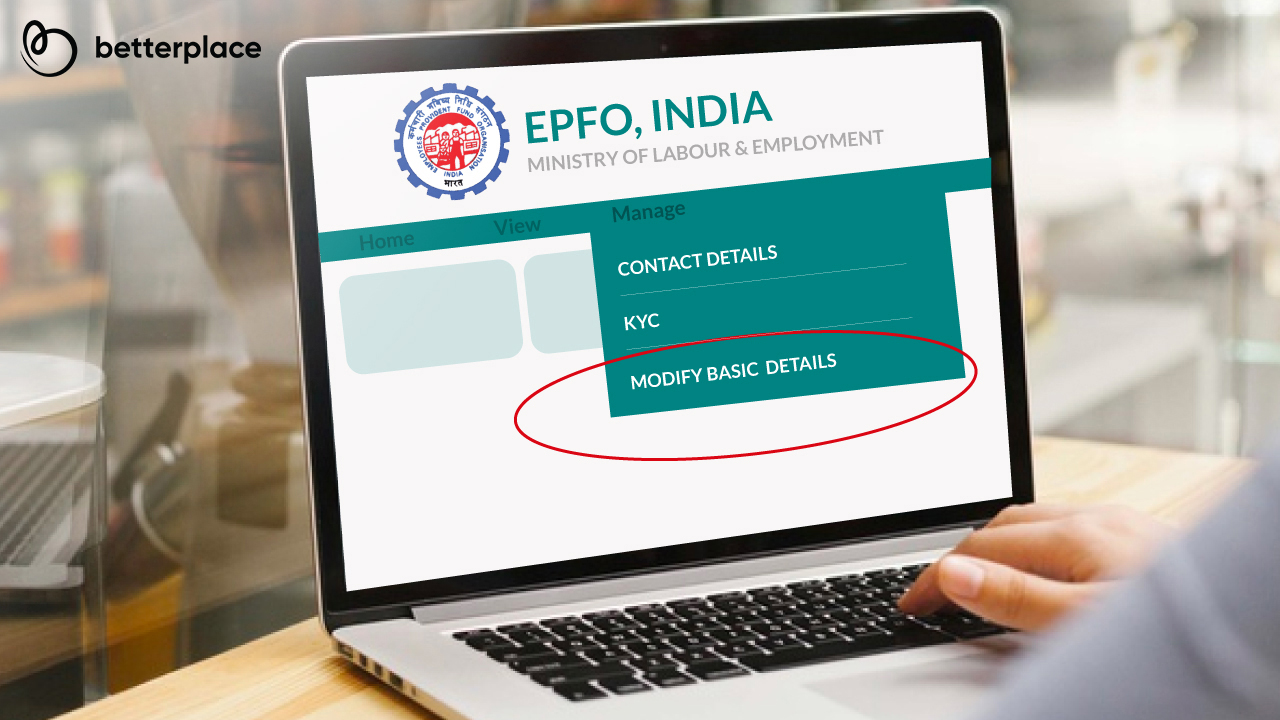

Statutory compliance

During the payroll processing, the payroll administrator needs to religiously adhere to the statutory compliances. Various statutory deductions – EPF, TDS, ESI – are deducted during payroll processing. These deductions are then paid to the respective authorities/government bodies.

-

Payroll accounting

Every organisation needs to maintain an accurate book of accounts. And the salary paid is one of its significant entries. Therefore, as a step of the payroll process, all salary data must be fed into the accounting or ERP system.

-

Payout

After all these steps, you can finally pay salaries via cash, cheque, or bank transfers. It is preferable to have salary accounts of employees for hassle-free transfers. For payment to salary accounts, you need to send salary bank account statements with particulars such as employee ID, account number, salary amount, etc., to the branch.

-

Reporting

The last step is to prepare accurate reports containing information such as department or location- wise employee cost. These reports are then sent to the finance department or the management team for further analysis.

These are what goes into the making of an efficient payroll process in India. Now that you know the procedure in detail, make sure to leverage the information and amplify your organization’s efficiency.

FAQ’S

1. What is the best frequency for payments to employees?

The frequency with which employers pay their employees can have a direct impact on the morale of the employees and, as a result, the success of the business. In general, employees are happiest when they are paid frequently, such as weekly. Retail companies, construction companies, and skilled labour businesses typically pay their employees weekly because this practice fosters loyalty and productivity among employees.

The only downside of paying weekly is that it costs more than paying monthly or bi-weekly. Government agencies and schools typically pay their employees once a month to save money and keep with their financial budgets. The only downside to monthly payroll processing is that it takes so long for employees to be paid.

2. Is paying employees by direct deposit a convenient and cost-effective way to pay employees?

Payment via direct deposit is an oft-used payment method. It is used by a majority of workers and is considered to be the most popular payment method. Business owners find this payment method convenient because it allows them to pay employees without having to hand them a physical check.

This payment method also makes business owners feel safer because they don’t need to worry about employees losing paychecks with sensitive information on them. Some states allow employers to implement mandatory direct deposit.

3. Is it legal for me to pay my employees in cash?

Employers who pay their employees in cash must take out taxes and deductions from the employee’s pre-tax wages before giving them their final take-home pay.

In addition, employers must keep accurate records of these transactions in case the government authorities or regulators wish to review them.

4. How long does it typically take companies to transfer payroll providers?

If your employees earn salaries with little fluctuation, and you conduct periodic payrolls, transferring the payroll to another system will be a relatively simple process.

Payroll administration is complex and time-consuming, especially when there are many pension schemes or employee benefits. This can make the transition from one payroll provider to another problematic, particularly if there have been many adjustments each month.

It may be necessary for a payroll provider to process one or two parallel pay-run files to ensure that any problems with the live transfer are identified and corrected. Payroll partners such as BetterPlace will assess your payroll at the start of our communications to decide whether parallel pay runs are necessary. Typically, most payroll providers in India do not charge for parallel pay runs in the majority of cases.

5. What are the dissimilarities between payroll and salary? Moreover, what are the essential aspects of payroll?

Salary refers to a regular payment of amounts of money, usually paid on a daily, weekly, monthly, or annual basis. Payroll is a system that allows businesses to process employees’ salaries. Salary and payroll are both crucial workplace activities.

As for the essential aspects of payroll, the following two are the most significant.

Accuracy is crucial when dealing with vital information. Maintaining the integrity of numbers and facts is critical in any industry, especially finance.

Any payroll system should comply with government rules and regulations relating to income tax, social security, payroll withholding and other matters. Failure to comply can result in large fines for the company as well as a host of other problems.

Related Articles:

What is Payroll Processing

Payroll Software Benefits

Advantages Of Open-Source Payroll Software

Payroll Administrator Duties

Paperless Payroll Process

Benefits Of Automated Payroll System

Top 6 Payroll Trends in 2023

Payroll Deductions