Table of Content:

How to Link Aadhaar Card with UAN: A Step-by-step guide

Why is it mandatory to Link Aadhar with UAN

How can it secure your future?

Conclusion

How to Link Aadhaar Card with UAN: A Step-by-Step Guide

Aadhaar is a 12-digit unique identification number that the Indian government issues to the residents of India. The UAN (Universal Account Number) is a 12-digit number assigned to employees who contribute to the Employees’ Provident Fund (EPF). It is a unique identification number allotted to every employee enrolled in the EPF scheme. Linking Aadhaar with UAN is mandatory for EPF account holders.

Why Is It Mandatory to Link Aadhar With UAN?

Linking Aadhaar with UAN is mandatory per the latest EPFO regulations. According to these regulations, every EPF account holder must link their Aadhaar card with their UAN. Failing to do so may result in denied access to their EPF account or availing various EPF-related services.

How To Link Aadhar With UAN?

To link Aadhaar with UAN, one can follow the steps given below:

Step 1: Visit the official EPFO (Employees’ Provident Fund Organisation) website.

To get started, visit the EPFO website at http://www.epfindia.gov.in/. Once on the website, click the ‘Online Services tab and select the ‘e-KYC Portal option.

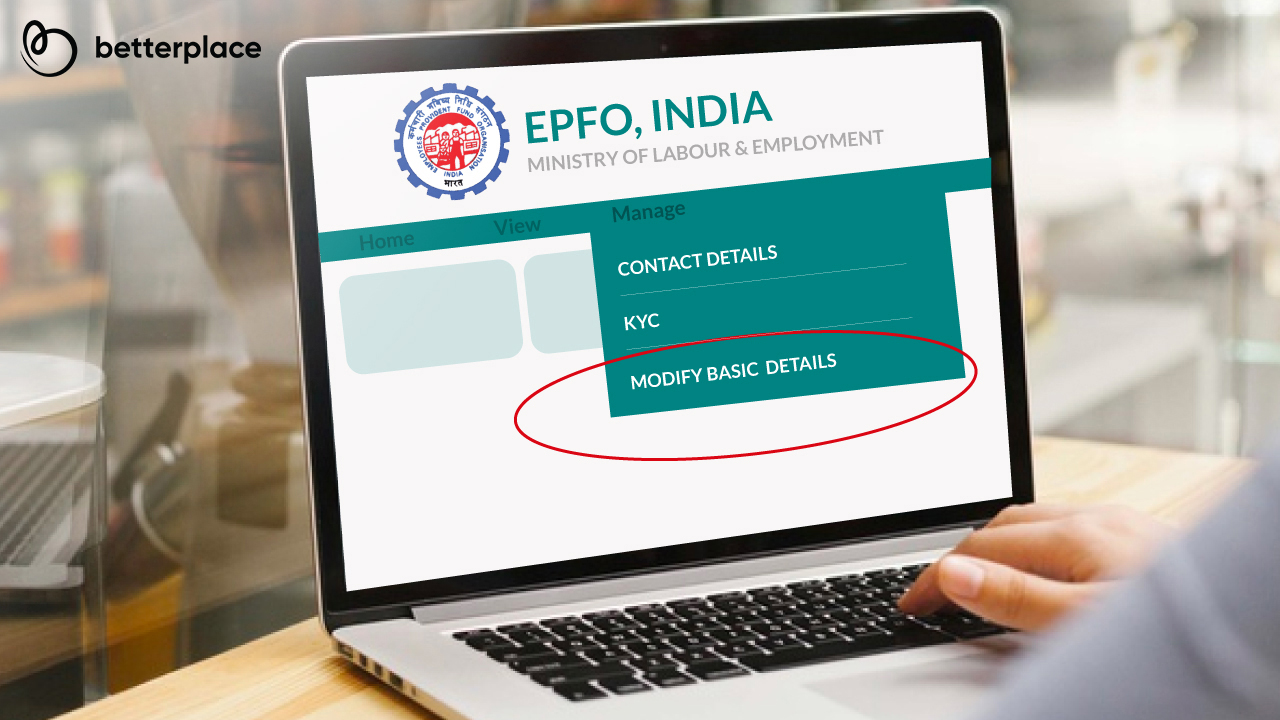

Step 2: Enter UAN and click on the ‘KYC’ option.

On the e-KYC portal, you will be prompted to enter the UAN and password. Once entered, click the ‘KYC’ option under the ‘Manage’ tab.

Step 3: Select ‘Aadhaar’ as the document type and enter the Aadhaar number.

Under the ‘Add KYC’ section, select ‘Aadhaar’ as the document type from the drop-down menu. Enter the Aadhaar number in the provided field and click the ‘Save’ button.

Step 4: Authenticate your Aadhaar details

Next, you will be prompted to authenticate the Aadhaar details. You can do this by clicking on the ‘Authenticate’ button, which will redirect you to the UIDAI (Unique Identification Authority of India) website.

On the UIDAI website, you will be prompted to enter your Aadhaar number, name, and security code. Once the required details are filled in, click the ‘Send OTP’ button. You will receive an OTP (One-Time Password) on your registered mobile number. Enter the numbers on the UIDAI website to authenticate the Aadhaar details.

Step 5: Submit your Aadhaar details for verification

Once the Aadhaar details have been authenticated, you must go back to the e-KYC portal and submit the Aadhaar details for verification. Lastly, click on the ‘Submit’ button to complete this process.

After submitting Aadhaar details for verification, the whole process may take some time to complete. Once the Aadhaar details have been verified, they will be updated in the user’s UAN account. After this, you will receive a confirmation message on your registered mobile number.

It is important to ensure that your name, date of birth, and gender on the Aadhaar card match the details in the UAN. If there is a mismatch, you must correct it before linking Aadhaar with UAN.

How Can it Secure Your Future?

Linking Aadhaar with UAN is essential to ensure a secure financial future. The Aadhaar card, being a unique identification number, helps streamline and simplify various financial processes. It includes EPF (Employees’ Provident Fund) and pension schemes. Linking Aadhaar with UAN makes it easier to authenticate and validate your identity. It also helps in avoiding fraudulent activities. The EPF account allows you to transfer money to the bank account automatically. Plus, it also enables you to get benefits from government programs. Therefore, linking the Aadhaar with UAN is paramount for every EPF account holder.

Final word

Linking the Aadhaar card with UAN is necessary for EPF account holders in India as it helps streamline and simplify various financial processes related to EPF and pension schemes. Aadhaar is a unique identification number issued by the Indian government to residents of India, and it serves as a tool for authenticating and validating identity. By linking Aadhaar with UAN, EPF account holders can avoid fraudulent activities and ensure a secure financial future.