Table of Content

- What is Form 27EQ?

- What is Tax Collected at Source?

- Structure of Form 27EQ

- Due dates

- How to download TCS return Form 27EQ?

- Features of Form 27EQ

What is Form 27EQ?

Primarily for TCS returns, Form 27EQ is a quarterly certificate that contains details of the Tax Collected at Source or TCS under Section 206C of the Income Tax Act, 1961.

Under this section, the seller has to collect TCS from the buyer at the time of making the sale and furnish the quarterly TCS details while filing the TCS returns Form 27EQ every quarter before the due date to avoid penalty.

What is Tax Collected at Source?

The collection of direct tax or income tax collected by the seller while selling a product at the designated price is referred to as TCS or Tax Collected at the Source.

The difference between TDS and TCS

TDS is Tax Deducted at Source while making the payment. On the other hand, TCS is Tax Collected at Source while making the sales.

A question may arise in your minds when you read both the tax definitions together—does the seller collect TCS and the buyer or beneficiary deduct TDS simultaneously on the same transaction?

Your answer is no. Both TDS and TCS do not apply simultaneously to a single transaction. They apply to different transactions or events. And the provision of TCS is different from that of the TDS. The provisions of TCS come under Section 206C of the Income Tax Act, 1961.

Who must submit Form 27EQ for TDS return?

The entities that need to submit Form 27EQ TDS returns are as mentioned below:

- Corporate collectors and deductors

- Government collectors and deductors

Structure of Form 27EQ

Form 27EQ comprises of five sections, which are as follows:

Section 1

The following deductor information is required in this section:

- TAN Number

- PAN Number

- Financial Year

- Assessment Year

- Has the tax statement already been submitted for the given quarter? If so, then the provisional receipt number of the original request should be stated

Section 2

In this section, the below information about the deductor/collector needs to be provided:

- The deductor/collector’s name

- The division or branch of the collector, if applicable

- Residential and personal details of the collector, including:

-

- Physical address

- Email address

- Telephone number

Section 3

In this section, the below details of the individual who is responsible for the tax collection need to be mentioned:

- Name of the individual

- The full address of the individual

Section 4

In this section, the following details about the TCS collected and deposited with the government is required:

- Collection code

- Amount of TCS

- Surcharge amount

- Education cess amount

- Interest charged amount

- Other amounts if any

- Total tax deposit (the sum total of all the amounts mentioned above)

- Demand Draft or cheque number, if provided

- BSR code

- Date of depositing the TCS amount

- Whether the TCS has been deposited through book entry

- Challan serial number or transfer voucher number

Section 5

- This section contains the annexure to the Form 27EQ, wherein detailed information of the amount paid and the TCS has to be specified, along with relevant signatures.

Due dates

Due dates to file TCS returns:

| Quarter | Due date |

| 1st April to 30th June | 15th July |

| 1st July to 30th September | 15th October |

| 1st October to 31st December | 15th January |

| 1st January to 31st March | 15th May |

Due dates for filing TDS returns:

| Quarter | Due date |

| 1st April to 30th June | 31st July |

| 1st July to 30th September | 31st October |

| 1st October to 31st December | 31st January |

| 1st January to 31st March | 31st May |

How to download TCS return Form 27EQ?

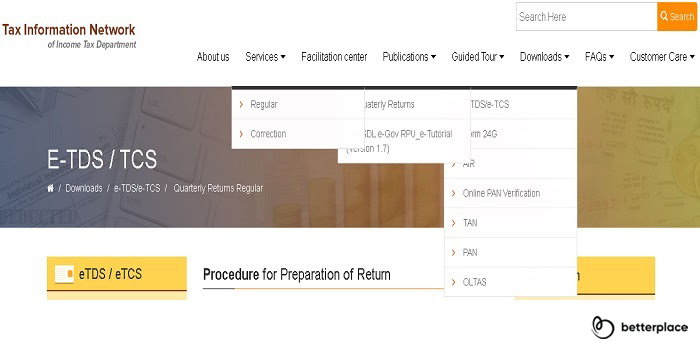

Step 1: Go to the NSDL official website.

Step 2: Go to the ‘Downloads’ tab on the Menu bar and select ‘E-TDS/E-TCS’ from the dropdown.

Step 3: Then, select the option ‘Quarterly Returns’ and click on ‘Regular’.

Step 4: A new page will open on your screen.

Step 5: Select the Form 27EQ out of the given options.

Features of Form 27EQ

The characteristics of Form 27EQ are as follows:

- Form 27EQ is a tax statement that contains details about the Tax Collected at Source and the deductions done by the payer.

- Form 27EQ comes under Section 206C of the Income Tax Act.

- The form should be filled and collected every quarter.

- The TAN details of the individual must be mentioned in Form 27EQ.

- Non-government employers have to provide their PAN details in Form 27EQ, while government employers need to mention ‘PANNOTREQD’ in Form 27EQ.

The most popular products that invite TCS are alcoholic liquor products for human consumption, among others. An individual taxpayer doesn’t have to worry about paying the TCS as the seller must collect the same and deposit it with the central government. Next, they have to file Form 27EQ quarterly to show the taxes collected and deposited with the government.

Related Articles